INITIAL ESCROW ACCOUNT DISCLOSURE STATEMENT Files Consumerfinance Form

Understanding the Initial Escrow Account Disclosure Statement

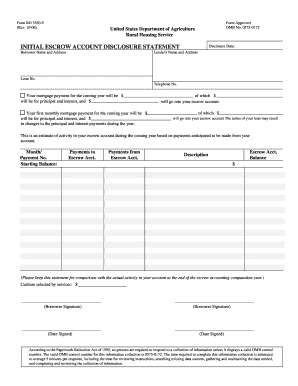

The initial escrow account disclosure statement is a crucial document that outlines the terms and conditions of an escrow account. This statement provides borrowers with essential information regarding the amounts to be deposited into the escrow account, the purpose of these funds, and the estimated disbursements for property taxes and insurance premiums. It is a legal requirement for lenders to provide this disclosure to ensure transparency and compliance with federal regulations.

Steps to Complete the Initial Escrow Account Disclosure Statement

Completing the initial escrow account disclosure statement involves several steps to ensure accuracy and compliance. First, gather all necessary information, including property details, loan terms, and estimated costs for taxes and insurance. Next, accurately calculate the monthly escrow payment based on these estimates. Finally, review the completed statement for accuracy before submitting it to the lender. Utilizing electronic tools can streamline this process, making it easier to fill out and sign the document securely.

Key Elements of the Initial Escrow Account Disclosure Statement

The initial escrow account disclosure statement includes several key elements that are essential for understanding the escrow arrangement. These elements typically consist of:

- Escrow Account Balance: The initial amount required to fund the escrow account.

- Monthly Payments: The estimated monthly contribution to the escrow account.

- Projected Disbursements: An outline of expected payments for property taxes and insurance.

- Account Management: Details on how the escrow account will be managed and any applicable fees.

Legal Use of the Initial Escrow Account Disclosure Statement

The initial escrow account disclosure statement serves a legal purpose by ensuring that borrowers are informed about their escrow accounts. Compliance with the Real Estate Settlement Procedures Act (RESPA) mandates that lenders provide this disclosure to protect consumers from unexpected costs and to promote fair lending practices. Failure to provide this statement can result in penalties for the lender and may affect the borrower's rights.

Examples of Using the Initial Escrow Account Disclosure Statement

Examples of the initial escrow account disclosure statement's use can vary based on individual circumstances. For instance, a first-time homebuyer may receive this statement as part of their mortgage closing process, detailing how much they need to pay into the escrow account each month. Additionally, homeowners refinancing their mortgage may also receive an updated disclosure statement reflecting changes in their escrow payments based on new property tax assessments or insurance rates.

Obtaining the Initial Escrow Account Disclosure Statement

To obtain the initial escrow account disclosure statement, borrowers typically receive it from their lender during the mortgage application process. It is essential to review this document carefully upon receipt. If a borrower does not receive the statement, they should contact their lender directly to request it. Keeping a copy of this disclosure is important for future reference, especially when reviewing escrow account activity or addressing any discrepancies.

Quick guide on how to complete initial escrow account disclosure statement files consumerfinance

Effortlessly Prepare INITIAL ESCROW ACCOUNT DISCLOSURE STATEMENT Files Consumerfinance on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage INITIAL ESCROW ACCOUNT DISCLOSURE STATEMENT Files Consumerfinance on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign INITIAL ESCROW ACCOUNT DISCLOSURE STATEMENT Files Consumerfinance with Ease

- Locate INITIAL ESCROW ACCOUNT DISCLOSURE STATEMENT Files Consumerfinance and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes necessitating new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign INITIAL ESCROW ACCOUNT DISCLOSURE STATEMENT Files Consumerfinance and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the initial escrow account disclosure statement files consumerfinance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an escrow account disclosure statement?

An escrow account disclosure statement is a document that outlines the terms and conditions of an escrow account, detailing how funds are held and disbursed. This statement ensures transparency between parties involved in a transaction, highlighting fees and the timeframe for fund release. Understanding this statement is crucial for effective financial planning.

-

How can airSlate SignNow help with escrow account disclosure statements?

airSlate SignNow allows you to easily create, send, and eSign escrow account disclosure statements in a secure digital format. Its user-friendly interface simplifies document management and ensures compliance with regulatory requirements. This solution helps streamline your workflow and minimizes the risks associated with paper-based documents.

-

What features does airSlate SignNow offer for escrow account disclosure statements?

airSlate SignNow provides features such as customizable templates, in-app signing, and secure sharing for escrow account disclosure statements. These features enhance efficiency by allowing users to prepare documents quickly and execute transactions seamlessly. Additionally, the platform ensures that documents are legally binding and securely stored.

-

Is airSlate SignNow cost-effective for managing escrow account disclosure statements?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing escrow account disclosure statements. Offering flexible pricing plans, businesses can choose a package that fits their needs without compromising quality. This affordability enables organizations of all sizes to streamline their document processes efficiently.

-

Can I integrate airSlate SignNow with other tools for escrow account disclosure statements?

Absolutely! airSlate SignNow integrates seamlessly with a variety of other software tools, enhancing the management of escrow account disclosure statements. This integration allows for smoother workflows by connecting your existing systems, such as CRM and accounting software, to provide a cohesive user experience.

-

What are the benefits of using airSlate SignNow for escrow account disclosure statements?

Using airSlate SignNow for escrow account disclosure statements can enhance efficiency, reduce errors, and improve compliance. With electronic signatures, documents can be executed faster, which expedites the entire transaction process. Additionally, the digital format allows for better tracking and storage of documents, optimizing overall business operations.

-

Is airSlate SignNow secure for handling escrow account disclosure statements?

Yes, airSlate SignNow employs advanced security measures to protect the confidentiality and integrity of your escrow account disclosure statements. With features like data encryption and secure cloud storage, businesses can trust that their sensitive information remains safe from unauthorized access. Ensuring compliance with industry standards is a top priority.

Get more for INITIAL ESCROW ACCOUNT DISCLOSURE STATEMENT Files Consumerfinance

- Ti 006 549448741 form

- California insurance identification card form

- Card application form de 36

- Rental agreement for a temporary substitute vehicle bluebird auto rental 200 mineral springs drive dover nj 07801 973 989 2423 form

- Utv rental agreement form

- Cancel license get form

- Vs 35 form

- Mv 907a pdf 347255647 form

Find out other INITIAL ESCROW ACCOUNT DISCLOSURE STATEMENT Files Consumerfinance

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document