Doj 488 Form

What is the Doj 488 Form

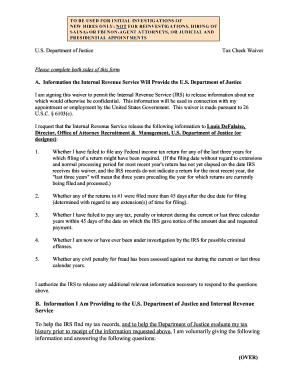

The Doj 488 Form is a document used primarily for reporting specific information related to criminal justice and law enforcement activities. This form is essential for individuals or organizations that must comply with legal requirements when engaging in activities that involve sensitive data or interactions with law enforcement agencies. Understanding its purpose is crucial for ensuring compliance and maintaining transparency in operations.

How to use the Doj 488 Form

Using the Doj 488 Form involves several key steps to ensure that all necessary information is accurately reported. First, gather all relevant data required for the form, including personal identification details and any necessary supporting documentation. Next, carefully fill out each section of the form, ensuring that all information is complete and accurate. Once completed, review the form for any errors or omissions before submission. Proper usage of this form helps ensure compliance with legal standards and facilitates effective communication with law enforcement agencies.

Steps to complete the Doj 488 Form

Completing the Doj 488 Form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary information, including identification and relevant case details.

- Fill out the form clearly, ensuring all fields are completed as required.

- Review the completed form for accuracy, checking for any missing information.

- Sign and date the form where indicated to validate the information provided.

- Submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal use of the Doj 488 Form

The legal use of the Doj 488 Form is governed by various regulations that dictate how information should be reported and handled. It is crucial to use this form in accordance with federal and state laws to avoid potential legal repercussions. Properly completing and submitting the form ensures that the information is recognized as valid and can be used in legal contexts, such as investigations or background checks.

Key elements of the Doj 488 Form

Several key elements are essential for the Doj 488 Form to be considered complete and valid. These include:

- Personal identification information of the individual or organization submitting the form.

- Details of the specific incident or activity being reported.

- Signature of the individual completing the form, affirming the accuracy of the information.

- Date of submission to establish a timeline for the report.

Form Submission Methods

The Doj 488 Form can be submitted through various methods, allowing flexibility for users. Common submission methods include:

- Online submission through designated government portals, ensuring a quick and efficient process.

- Mailing the completed form to the appropriate agency, which may require additional time for processing.

- In-person submission at designated offices, providing an opportunity for immediate confirmation of receipt.

Quick guide on how to complete doj 488 form

Effortlessly prepare Doj 488 Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and safely store it online. airSlate SignNow provides all the tools needed to create, alter, and electronically sign your documents swiftly without delays. Handle Doj 488 Form on any device with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Doj 488 Form without hassle

- Find Doj 488 Form and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click the Done button to save your changes.

- Select how you prefer to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Doj 488 Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the doj 488 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Doj 488 Form?

The Doj 488 Form is a crucial document required for certain legal and compliance processes. It is typically used to fulfill specific requirements set by legal authorities. Understanding how to properly fill out the Doj 488 Form can streamline your submission process.

-

How can airSlate SignNow assist with the Doj 488 Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Doj 488 Form. Our solution ensures that your documents are securely managed and legally binding. With features designed for quick access and collaboration, you can expedite your submission process.

-

What is the pricing structure for using airSlate SignNow to manage the Doj 488 Form?

Our pricing for airSlate SignNow is transparent and cost-effective, catering to various business needs. You can choose from multiple plans based on your document management requirements, including those for the Doj 488 Form. We offer a free trial so you can explore the features before committing.

-

Are there any features specifically for the Doj 488 Form in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for the Doj 488 Form, such as template creation, easy editing, and secure electronic signatures. These features simplify the process of completing and sending the form. Users can also save time with automated workflows.

-

Is airSlate SignNow compliant with regulations for the Doj 488 Form?

Absolutely! airSlate SignNow is compliant with various legal and regulatory standards necessary for handling documents like the Doj 488 Form. Our platform employs top-notch security measures to ensure your data remains protected throughout the signing process.

-

Can I integrate airSlate SignNow with other tools for managing the Doj 488 Form?

Yes, airSlate SignNow offers seamless integrations with various applications to enhance your workflow involving the Doj 488 Form. You can easily connect our platform with CRM systems, cloud storage, and other tools you use. This flexibility helps streamline your document management process.

-

What are the benefits of using airSlate SignNow for the Doj 488 Form?

Using airSlate SignNow for the Doj 488 Form offers numerous benefits, including time savings, enhanced security, and an intuitive user interface. With electronic signatures, you eliminate paperwork and reduce processing time. Our platform also allows for easy collaboration among multiple stakeholders.

Get more for Doj 488 Form

- Letter writing complaint how to write a complaint letter infoplease form

- Zip codes enclosing other zip codesgeonet the esri community form

- As you know a hearing on our motion for relief from automatic stay and abandonment form

- We would like to take the deposition of form

- Can a ltd insurance company claim overpayment if claimant is form

- Enclosed herewith please find a proposed order granting s form

- Sample letter to the court clerk form

- How to address a letter to a judge youtube form

Find out other Doj 488 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors