Other Important Tax Filing Tips 2023

Key elements of the 2016 140 tax form

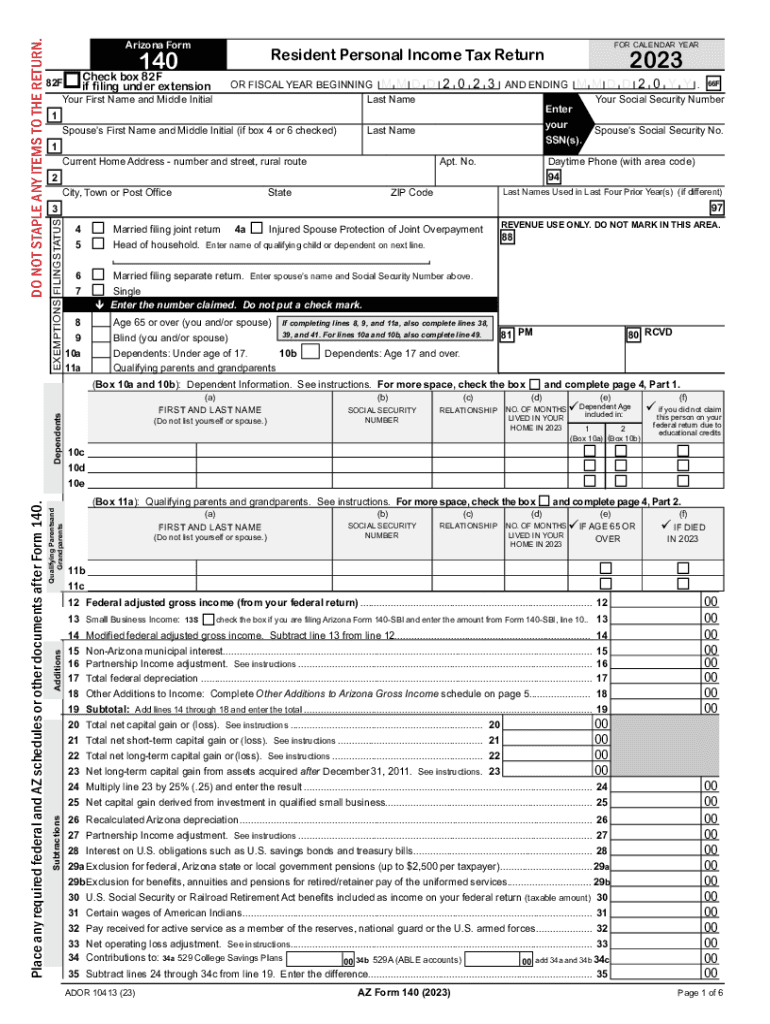

The 2016 140 tax form, also known as the Arizona Form 140, is essential for individual income tax filing in Arizona. This form is used by residents to report their income, claim deductions, and calculate their tax liability. Key elements of the form include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Filing Status: Taxpayers must indicate their filing status, such as single, married filing jointly, or head of household.

- Income Reporting: All sources of income must be reported, including wages, interest, and dividends.

- Deductions and Credits: Taxpayers can claim various deductions and credits, which reduce their taxable income.

- Tax Calculation: The form includes a section for calculating the total tax owed based on the reported income and applicable rates.

Steps to complete the 2016 140 tax form

Completing the 2016 140 tax form involves several steps to ensure accuracy and compliance. Follow these steps for a smooth filing process:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in your personal information accurately at the top of the form.

- Select your filing status and report your total income in the designated section.

- Claim any deductions or credits you are eligible for, ensuring you have documentation to support your claims.

- Calculate your total tax liability using the provided tax tables.

- Review the completed form for accuracy before signing and dating it.

Filing deadlines for the 2016 140 tax form

The filing deadline for the 2016 140 tax form typically aligns with the federal tax deadline. For most taxpayers, this date is April 15 of the following year. However, if April 15 falls on a weekend or holiday, the deadline is extended to the next business day. It is important to file on time to avoid penalties and interest on any taxes owed.

Required documents for the 2016 140 tax form

To complete the 2016 140 tax form accurately, you will need several documents. These include:

- W-2 Forms: Issued by employers to report wages and taxes withheld.

- 1099 Forms: For reporting income from self-employment, interest, dividends, and other sources.

- Receipts: For any deductible expenses, such as medical expenses or charitable contributions.

- Previous Tax Returns: To reference prior year information and carry forward any losses.

Penalties for non-compliance with the 2016 140 tax form

Failure to file the 2016 140 tax form on time or inaccuracies in reporting can result in penalties. Common penalties include:

- Late Filing Penalty: A percentage of the unpaid tax amount for each month the return is late.

- Accuracy-Related Penalty: Charged if the IRS finds substantial errors in the tax return.

- Interest on Unpaid Taxes: Accrues on any taxes owed that are not paid by the deadline.

Form submission methods for the 2016 140 tax form

Taxpayers have several options for submitting the 2016 140 tax form. These methods include:

- Online Filing: Many taxpayers choose to file electronically using tax preparation software.

- Mail: The completed form can be mailed to the appropriate Arizona Department of Revenue address.

- In-Person: Taxpayers may also submit their forms in person at designated state tax offices.

Quick guide on how to complete other important tax filing tips

Easily Prepare Other Important Tax Filing Tips on Any Device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents rapidly without delays. Handle Other Important Tax Filing Tips on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Other Important Tax Filing Tips Effortlessly

- Obtain Other Important Tax Filing Tips and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Other Important Tax Filing Tips and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct other important tax filing tips

Create this form in 5 minutes!

How to create an eSignature for the other important tax filing tips

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona 140 in the context of airSlate SignNow?

Arizona 140 refers to a specific feature within airSlate SignNow that enhances document management and eSigning processes. This feature is designed to streamline workflows for businesses, ensuring that documentation is handled efficiently and securely.

-

How does airSlate SignNow pricing work for Arizona 140?

The pricing for Arizona 140 within airSlate SignNow is competitive and designed to meet the needs of various businesses. By offering flexible subscription plans, companies can choose the level of service that best fits their budget and volume of transactions.

-

What are the key features of Arizona 140 in airSlate SignNow?

Key features of Arizona 140 include customizable templates, real-time collaboration, and advanced security measures. These features are aimed at simplifying the eSigning experience while maintaining compliance with legal standards.

-

What benefits can businesses expect from using Arizona 140?

Businesses using Arizona 140 can expect increased efficiency, reduced turnaround times for document review and approval, and enhanced customer satisfaction. The streamlined eSigning process allows companies to focus on their core activities rather than administrative burdens.

-

Can Arizona 140 integrate with other software applications?

Yes, Arizona 140 is designed to integrate seamlessly with various software applications, enhancing the overall functionality of airSlate SignNow. This integration capability allows businesses to leverage their existing tools and systems for a more cohesive workflow.

-

Is Arizona 140 suitable for small businesses?

Absolutely, Arizona 140 is an excellent choice for small businesses looking for an efficient eSigning solution. Its user-friendly interface and cost-effective pricing make it accessible and beneficial for organizations of all sizes.

-

What types of documents can I send using Arizona 140?

You can send a wide variety of documents using Arizona 140, including contracts, agreements, and forms. The versatility of airSlate SignNow ensures that whatever documentation you need to handle, it can be done quickly and securely.

Get more for Other Important Tax Filing Tips

Find out other Other Important Tax Filing Tips

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament