Qualifying Parentsand 2021

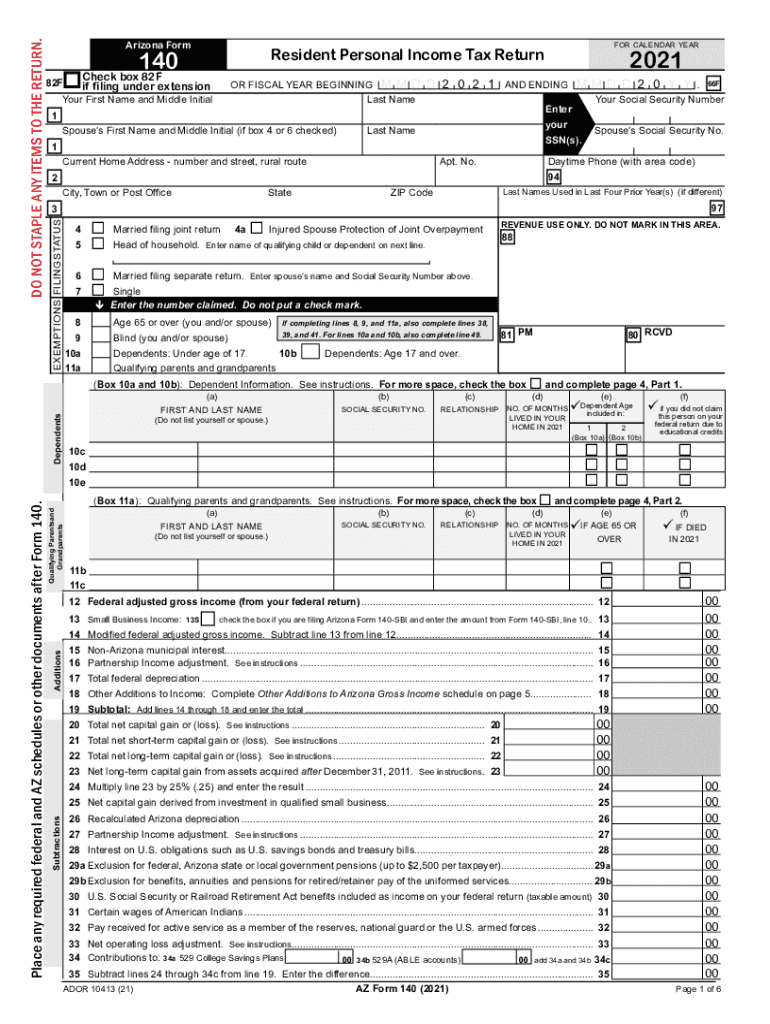

Understanding the Arizona Form 140 Tax

The Arizona Form 140 tax is the primary income tax return form used by residents of Arizona. This form is essential for reporting individual income, calculating tax liability, and claiming any applicable credits or deductions. It is designed for single individuals, married couples filing jointly, and heads of household. The Arizona 140 tax form requires detailed information about income sources, deductions, and personal exemptions to ensure accurate tax reporting.

Steps to Complete the Arizona Form 140

Completing the Arizona Form 140 involves several key steps to ensure accuracy and compliance:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the form.

- Claim deductions and credits applicable to your situation, such as standard deductions or itemized deductions.

- Calculate your total tax liability and any payments made throughout the year.

- Review the completed form for accuracy before submission.

Required Documents for Filing

To successfully file the Arizona Form 140, you will need to provide several documents that support your income and deductions:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Receipts for deductible expenses, including medical expenses and charitable contributions.

- Any relevant tax documents from previous years that may affect your current filing.

Filing Deadlines for Arizona Form 140

The deadline for filing the Arizona Form 140 typically aligns with the federal tax return deadline. Generally, this means you must submit your form by April 15 of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to be aware of these dates to avoid penalties and interest on late payments.

Form Submission Methods

You can submit the Arizona Form 140 through various methods to suit your preferences:

- Online: E-filing through approved tax software is a convenient option for many taxpayers.

- Mail: You can print the completed form and send it to the Arizona Department of Revenue.

- In-Person: Submitting the form directly at designated state tax offices is also an option.

Penalties for Non-Compliance

Failing to file the Arizona Form 140 on time or providing inaccurate information can lead to penalties. Common penalties include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, which accrues daily until the balance is settled.

- Potential legal action for severe cases of tax evasion or fraud.

Quick guide on how to complete qualifying parentsand

Complete Qualifying Parentsand effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Qualifying Parentsand on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Qualifying Parentsand with ease

- Obtain Qualifying Parentsand and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools provided specifically for that function by airSlate SignNow.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your alterations.

- Select how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors necessitating new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Qualifying Parentsand to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct qualifying parentsand

Create this form in 5 minutes!

How to create an eSignature for the qualifying parentsand

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is Arizona Form 140 tax?

Arizona Form 140 tax is the primary income tax form used by residents of Arizona to report their personal income and calculate state tax liability. This form is essential for accurately filing your taxes and ensuring compliance with Arizona's tax regulations. With airSlate SignNow, you can easily sign and submit your Arizona Form 140 tax electronically, streamlining the filing process.

-

How does airSlate SignNow help with Arizona Form 140 tax filing?

AirSlate SignNow simplifies the process of managing and eSigning documents, including the Arizona Form 140 tax. Our platform allows you to securely send and receive tax forms, ensuring quick and efficient communication with tax professionals. This reduces the hassle of traditional paper-based filing and records management, making your tax season smoother.

-

Is there a cost associated with using airSlate SignNow for Arizona Form 140 tax?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who need to manage their Arizona Form 140 tax. Prices are competitive and designed to provide value for electronic document management. You can choose a plan that fits your budget while enjoying the benefits of seamless eSigning and document management.

-

What features does airSlate SignNow include for Arizona Form 140 tax?

AirSlate SignNow includes features such as template creation, document storage, and real-time notifications for document status updates. These features are particularly beneficial for users filing their Arizona Form 140 tax, ensuring you always know the status of your documents. Additionally, our platform supports legally binding eSignatures, making it a reliable solution for tax filing.

-

Is airSlate SignNow compliant with Arizona tax laws?

Yes, airSlate SignNow is designed to comply with state and federal regulations concerning eSignature and electronic document submissions. This compliance extends to the Arizona Form 140 tax, ensuring that your electronically signed documents are legally valid. You can trust our platform for secure and compliant tax filing.

-

Can I integrate airSlate SignNow with other tax software when filing Arizona Form 140 tax?

Absolutely! AirSlate SignNow offers integration with various tax and business software, enhancing your workflow when preparing the Arizona Form 140 tax. This integration allows for seamless data transfer and management, making it easier to compile necessary financial information for your tax filings.

-

What are the benefits of using airSlate SignNow for signing Arizona Form 140 tax?

Using airSlate SignNow for your Arizona Form 140 tax provides numerous benefits, including time savings, enhanced security, and reduced paperwork. Our platform's user-friendly interface simplifies the signing process and eliminates the need for in-person meetings. Additionally, all documents are stored securely, making it easy to access previous filings and related documents.

Get more for Qualifying Parentsand

- Notice breach lease form

- Florida violating form

- Florida provisions form

- Business credit application florida form

- Individual credit application florida form

- Interrogatories to plaintiff for motor vehicle occurrence florida form

- Interrogatories to defendant for motor vehicle accident florida form

- Fl llc form

Find out other Qualifying Parentsand

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now