Arizona Form 140 2024-2026

What is the Arizona Form 140

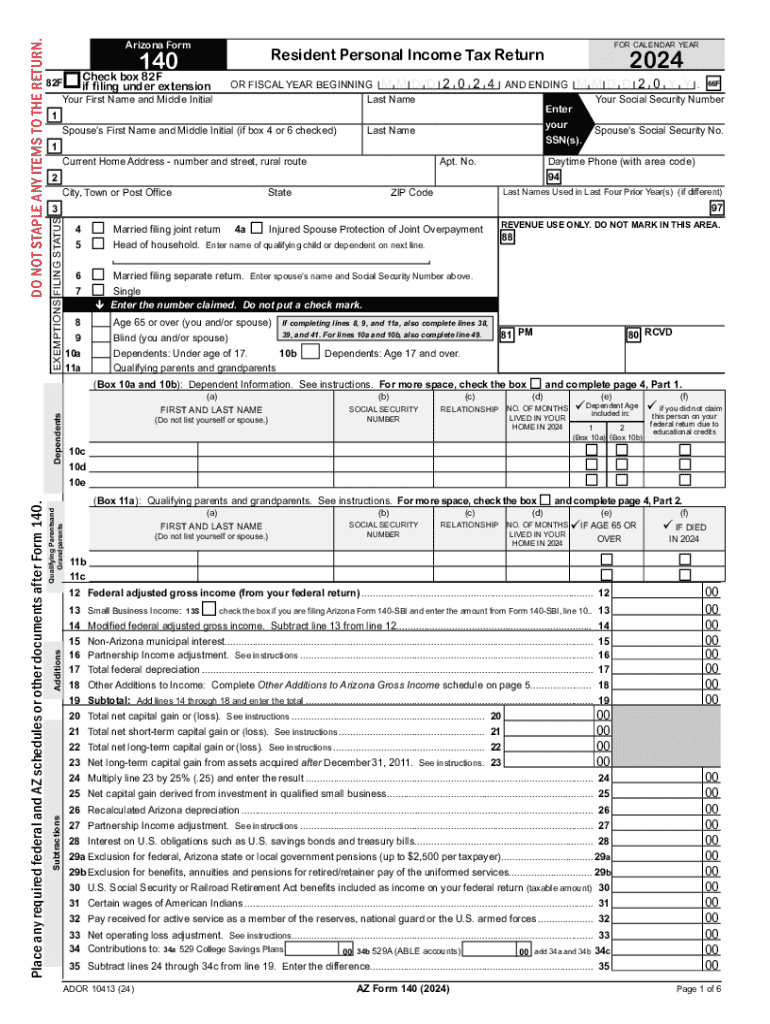

The Arizona Form 140 is the state's individual income tax return form used by residents to report their income and calculate their tax liability. This form is essential for individuals who earn income in Arizona, including wages, self-employment earnings, and investment income. The Arizona Department of Revenue requires this form to ensure accurate tax collection and compliance with state tax laws.

How to use the Arizona Form 140

To use the Arizona Form 140, taxpayers must gather their income information, including W-2 forms, 1099 forms, and any other relevant financial documents. The form requires personal information, such as name, address, and Social Security number, along with details about income, deductions, and credits. After filling out the form, individuals can either e-file it or print it for mailing to the Arizona Department of Revenue.

Steps to complete the Arizona Form 140

Completing the Arizona Form 140 involves several key steps:

- Gather all necessary documentation, including income statements and deduction records.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, dividends, and self-employment earnings.

- Calculate your total deductions and applicable tax credits.

- Determine your total tax liability and any refund or amount owed.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

The deadline for filing the Arizona Form 140 typically aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes in deadlines and consider filing early to avoid potential issues.

Form Submission Methods

Taxpayers can submit the Arizona Form 140 through various methods:

- Online: E-filing is available through approved tax software, which can streamline the submission process.

- Mail: Completed forms can be printed and sent via postal mail to the Arizona Department of Revenue.

- In-Person: Individuals may also choose to deliver their forms directly to a local Department of Revenue office.

Key elements of the Arizona Form 140

Key elements of the Arizona Form 140 include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Income Reporting: Detailed reporting of all income sources.

- Deductions and Credits: Information on applicable deductions and tax credits.

- Tax Calculation: A section to calculate total tax liability and any refund due.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 140 771920857

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140 771920857

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 140?

The Arizona Form 140 is the state's individual income tax return form used by residents to report their income and calculate their tax liability. It is essential for ensuring compliance with Arizona tax laws and is typically due on April 15th each year.

-

How can airSlate SignNow help with Arizona Form 140?

airSlate SignNow simplifies the process of completing and eSigning the Arizona Form 140 by providing an intuitive platform for document management. Users can easily fill out the form, add signatures, and securely send it to the appropriate tax authorities, streamlining the filing process.

-

Is there a cost associated with using airSlate SignNow for Arizona Form 140?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that enhance the efficiency of managing documents like the Arizona Form 140, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for Arizona Form 140 users?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for documents like the Arizona Form 140. These features ensure that users can manage their tax documents efficiently and securely.

-

Can I integrate airSlate SignNow with other software for Arizona Form 140 processing?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing users to streamline their workflow when processing the Arizona Form 140. This integration capability enhances productivity and ensures that all necessary tools are at your fingertips.

-

What are the benefits of using airSlate SignNow for filing Arizona Form 140?

Using airSlate SignNow for filing the Arizona Form 140 offers numerous benefits, including time savings, enhanced security, and improved accuracy. The platform reduces the risk of errors and ensures that your tax documents are filed correctly and on time.

-

Is airSlate SignNow secure for handling sensitive information like Arizona Form 140?

Yes, airSlate SignNow prioritizes security and employs advanced encryption methods to protect sensitive information, including the Arizona Form 140. Users can trust that their data is safe while using the platform for eSigning and document management.

Get more for Arizona Form 140

- Hud reasonable accommodation request form

- Income verification form pdf

- Employee cash advance form excel

- Health insurance census form

- Rental housing tribunal complaint form

- School club registration form

- Ssa statement of claimant form

- Data entry card for established party illinois state board of elections elections il form

Find out other Arizona Form 140

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy