Notice of Assessment Form

What is the Notice of Assessment

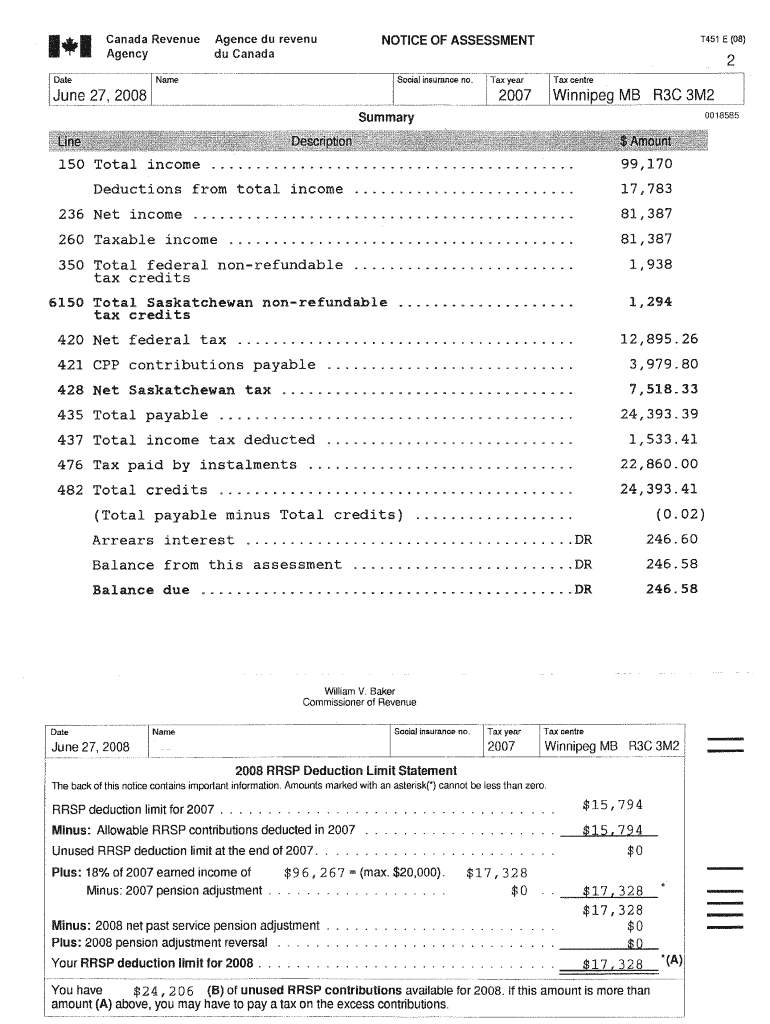

The Notice of Assessment (NOA) is an official document issued by the Canada Revenue Agency (CRA) that outlines an individual's or business's tax situation for a specific tax year. It provides essential information, including the total income reported, deductions claimed, and the amount of tax owed or refunded. The NOA serves as a confirmation of the CRA's assessment of the tax return submitted and is crucial for understanding one’s tax obligations and entitlements.

How to Obtain the Notice of Assessment

To obtain a Notice of Assessment, individuals can access it through several methods. The most common way is to log into the CRA's My Account portal, where users can view and download their NOA directly. Alternatively, individuals may receive a paper copy of the NOA by mail after their tax return has been processed. If a taxpayer cannot find their NOA, they can contact the CRA directly for assistance in obtaining a copy.

Steps to Complete the Notice of Assessment

Completing a Notice of Assessment involves several key steps. First, ensure that all relevant income and deductions are accurately reported on your tax return. After submitting your return, wait for the CRA to process it, which typically takes a few weeks. Once processed, review the NOA for accuracy, including the reported income and any adjustments made by the CRA. If discrepancies are found, it is essential to address them promptly by contacting the CRA to resolve any issues.

Key Elements of the Notice of Assessment

A typical Notice of Assessment includes several critical components. These elements are:

- Personal Information: Name, address, and identification number.

- Tax Year: The specific year for which the assessment applies.

- Income Details: Total income reported, including any additional income sources.

- Deductions and Credits: A summary of deductions claimed and tax credits applied.

- Tax Owed or Refund: The final calculation showing the amount owed or refund due.

Legal Use of the Notice of Assessment

The Notice of Assessment is a legally binding document that serves as proof of an individual's or business's tax status. It can be used in various legal contexts, such as applying for loans, mortgages, or government benefits. Additionally, the NOA can be critical in disputes with the CRA regarding tax obligations or in cases of audit. Maintaining accurate records of your NOA is essential for legal and financial purposes.

Examples of Using the Notice of Assessment

The Notice of Assessment can be utilized in multiple scenarios. For instance, when applying for a mortgage, lenders often require a copy of the NOA to verify income and tax compliance. Similarly, if a taxpayer is seeking financial aid for education or housing, the NOA may be requested to confirm income levels. Furthermore, in the event of an audit, the NOA serves as a reference point for the CRA's assessment of the taxpayer's financial situation.

Quick guide on how to complete canada revenue agence du revenu notice of assessment

Complete Notice Of Assessment effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Notice Of Assessment on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Notice Of Assessment with ease

- Locate Notice Of Assessment and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with specialized tools from airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Alter and eSign Notice Of Assessment to ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

What form do I fill out, a W9 or a W8-BEN? I am a US citizen living in Canada as a permanent resident. I am a freelancer (not an employee on a payroll) working for someone in the US, but I will be reporting my earnings to Canada Revenue, not the IRS.

You fill out a W-9. As a US citizen, you are taxed on your worldwide income. It doesn't matter if you don't even set foot in the US.You will however receive a foreign tax credit on your US return equal to the tax paid in Canada or the US tax on the same income, whichever is lower.You also must file an FBAR each year with the US Treasury if you have non-US financial accounts totalling $10K or more. This is measured by finding the highest balance at any time of year for each account and adding up those numbers. Failure to file carries signNow penalties.

-

We got our 12th results after filling out the form of DU. Do we have to upload it now? If yes, how?

Yes you have to upload it now.You can do it easily by logging in DU websiteTHERE WILL BE OPTION OF UPLOADING MARKSHEET UPLOAD YOUR PHOTO COPY OF MARKSHEET.A SIMPLE AS THAT.

-

I'm a Canadian/Australian. I've lost my right to vote. No Canadian Agency informed me that I had to fill in a voting form if I'm out of Canada for 4 years or more. What recourse is there for me, now?

Update 2: Unfortunately, an appeals court has reinstated the 5-year requirement, so Canadians living long-term abroad again cannot vote again. This decision is being appealed.Update: A recent Ontario court decision has struck down the 5-year requirement. Elections Canada is now allowing Canadians abroad to register to vote internationally as long as they have at some point resided in Canada.Previous answer: Canadian citizens who reside outside Canada for long periods of time and don't plan to return can't vote in Canadian elections.The Canadian constitution only guarantees a right to vote in elections for seats of the House of Commons and legislative assemblies. Provinces can set residency requirements. You do not reside in any district for which there is an election for the seat, so no election applies to you.

Create this form in 5 minutes!

How to create an eSignature for the canada revenue agence du revenu notice of assessment

How to make an eSignature for the Canada Revenue Agence Du Revenu Notice Of Assessment in the online mode

How to generate an electronic signature for the Canada Revenue Agence Du Revenu Notice Of Assessment in Chrome

How to generate an eSignature for signing the Canada Revenue Agence Du Revenu Notice Of Assessment in Gmail

How to generate an eSignature for the Canada Revenue Agence Du Revenu Notice Of Assessment from your smart phone

How to create an eSignature for the Canada Revenue Agence Du Revenu Notice Of Assessment on iOS devices

How to generate an electronic signature for the Canada Revenue Agence Du Revenu Notice Of Assessment on Android OS

People also ask

-

What is a notice of assessment CRA sample?

A notice of assessment CRA sample is an official document issued by the Canada Revenue Agency (CRA) that outlines your tax situation after filing. This sample provides essential information about your income, deductions, and the assessed amount owed or refunded. Having a reliable notice of assessment CRA sample helps ensure you understand your tax obligations.

-

How can airSlate SignNow help with notice of assessment CRA samples?

airSlate SignNow enables you to easily send and eSign your notice of assessment CRA samples electronically. By utilizing our solution, you can streamline the process of managing your tax documents securely and efficiently. This not only saves time but also provides you with peace of mind knowing your documents are in good hands.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. Whether you are a small business or a large corporation, you can choose a plan that allows you to send and eSign documents, including your notice of assessment CRA sample, effectively. We provide transparency in our pricing to help you make informed decisions.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, you can enjoy features such as secure eSignature, document templates, and real-time tracking. Specifically, when it comes to notice of assessment CRA samples, you can create, manage, and send these documents effortlessly. Our platform ensures document integrity and compliance, making your tax processes more straightforward.

-

Is airSlate SignNow compliant with legal eSignature laws?

Yes, airSlate SignNow complies with all major eSignature laws, including those set forth by the CRA. This means your notice of assessment CRA sample can be signed electronically in a manner that is legally enforceable. We prioritize compliance to ensure your documents meet all necessary regulations.

-

Can airSlate SignNow integrate with other software or platforms?

Absolutely, airSlate SignNow integrates seamlessly with various business applications, enhancing efficiency. You can link it with your accounting software to easily manage your notice of assessment CRA samples alongside other financial documents. This integration allows for better workflow and document handling.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including your notice of assessment CRA sample, increases productivity and reduces paper waste. Our platform offers a user-friendly interface that simplifies the signing process, ensuring quick turnaround. Additionally, our secure storage solutions keep your sensitive information protected.

Get more for Notice Of Assessment

- Standing order form las vegas

- Report card template form

- Living will form ohio 100076130

- Sales tax exempt certificate form

- Manufacturing data report example form

- Final draft 10124 241661 schedule m1c non form

- Form est additional charge for underpayment of

- M15np additional charge for underpayment of estimated tax form

Find out other Notice Of Assessment

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe