Contract of Sale Made as of Blumberg Legal Forms Online

What is the Contract of Sale Made As Of Blumberg Legal Forms Online

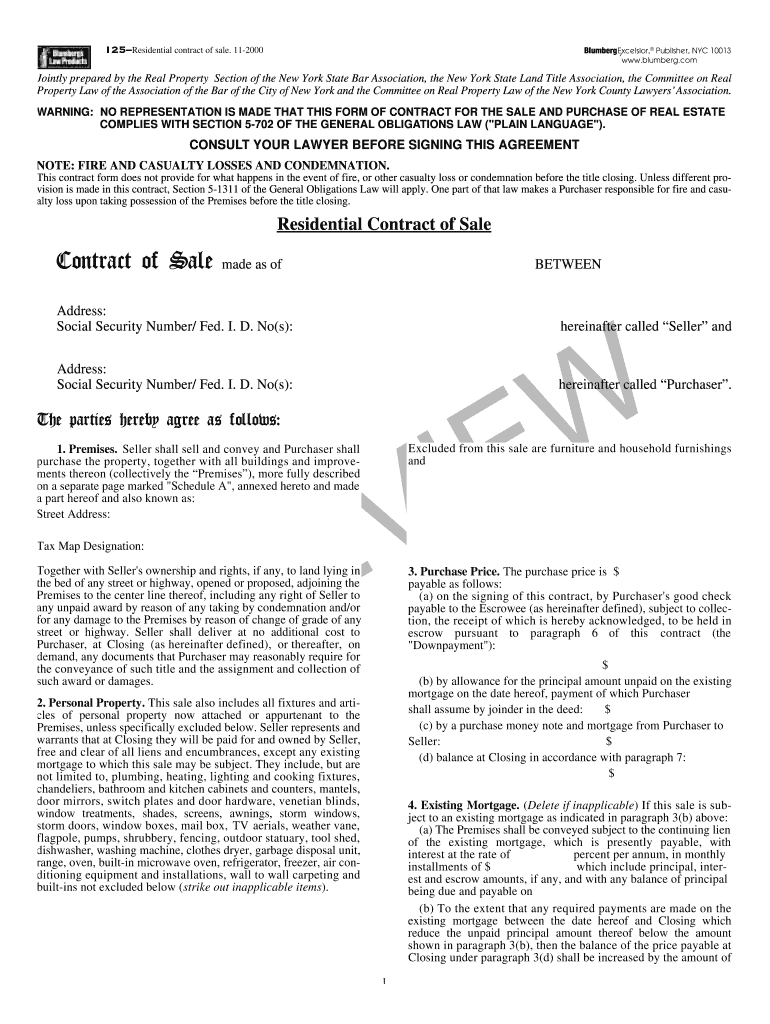

The Contract of Sale Made As Of Blumberg Legal Forms Online is a legally binding document used primarily in real estate transactions. This form outlines the terms and conditions under which a property is sold, including the purchase price, payment terms, and responsibilities of both the buyer and seller. It serves as a critical tool for ensuring that all parties involved understand their obligations and rights throughout the transaction process.

How to Use the Contract of Sale Made As Of Blumberg Legal Forms Online

Using the Contract of Sale Made As Of Blumberg Legal Forms Online involves several straightforward steps. First, access the form through a reliable digital platform. Next, fill in the necessary details, including buyer and seller information, property description, and agreed-upon terms. It is essential to review the completed document for accuracy before proceeding to eSign. This ensures that all parties are in agreement and that the contract is legally enforceable.

Steps to Complete the Contract of Sale Made As Of Blumberg Legal Forms Online

Completing the Contract of Sale Made As Of Blumberg Legal Forms Online requires careful attention to detail. Follow these steps:

- Access the form from a trusted source.

- Enter the buyer's and seller's names and contact information.

- Provide a detailed description of the property, including address and legal description.

- Specify the purchase price and payment terms.

- Outline any contingencies, such as inspections or financing.

- Review the document thoroughly for any errors or omissions.

- eSign the document to finalize the agreement.

Legal Use of the Contract of Sale Made As Of Blumberg Legal Forms Online

The legal use of the Contract of Sale Made As Of Blumberg Legal Forms Online is governed by state laws and regulations. For the contract to be enforceable, it must meet specific legal requirements, such as proper signatures and compliance with local real estate laws. Utilizing a platform that provides an electronic certificate of completion enhances the document's validity and compliance with eSignature regulations, ensuring that it holds up in court if necessary.

Key Elements of the Contract of Sale Made As Of Blumberg Legal Forms Online

Key elements of the Contract of Sale Made As Of Blumberg Legal Forms Online include:

- Identification of the buyer and seller.

- Complete property description.

- Purchase price and payment terms.

- Contingencies and conditions for sale.

- Closing date and possession details.

- Signatures of all parties involved.

State-Specific Rules for the Contract of Sale Made As Of Blumberg Legal Forms Online

State-specific rules for the Contract of Sale Made As Of Blumberg Legal Forms Online can vary significantly. Each state may have unique requirements regarding disclosures, contingencies, and the format of the contract itself. It is crucial to be aware of these regulations to ensure compliance and avoid potential legal issues. Consulting with a real estate professional familiar with local laws can provide valuable guidance in this area.

Quick guide on how to complete contract of sale made as of blumberg legal forms online

Complete Contract Of Sale Made As Of Blumberg Legal Forms Online effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Contract Of Sale Made As Of Blumberg Legal Forms Online on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Contract Of Sale Made As Of Blumberg Legal Forms Online without effort

- Locate Contract Of Sale Made As Of Blumberg Legal Forms Online and click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Contract Of Sale Made As Of Blumberg Legal Forms Online and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

As the nature always try to fill out the void, how can atoms be made of 99,99% of void? Why do they not collapse on themselves?

Under the much older planetary model of electrons, I think it was assumed that the electrons (relativistic?) kinetic energy kept them in orbits flying around around rather than collapsing, similar to planetary gravitation, or something like that.Under the semi older but now not quite accurate probability model, mathematically, there's the most likelihood of finding an electron in a shell some distance away from the nucleus, but that doesn't necessarily mean the electron doesn't pass closer to the nucleus…if I understand correctly. See here: Why Don't Electrons Just Fall Into the Nucleus of an Atom?Under the current understanding, electrons, neutrons, protons, and everything else are just some sort of emergent perturbations of underlying quantum fields, and the whole game no longer even makes any sense in a way that we can classically imagine it. It's beyond my understanding as to why those quantum fields seem to resolve, at least in terms of physical interaction, into something that seems to have an outer probability electron shell and a lot of empty space in between. I will leave it to the experts so perhaps answer that (cue Viktor T. Toth).

-

How can I fill out the online application form of JVM Shyamli Ranchi?

Go to Jawahar Vidiya Mandir website

Create this form in 5 minutes!

How to create an eSignature for the contract of sale made as of blumberg legal forms online

How to create an eSignature for your Contract Of Sale Made As Of Blumberg Legal Forms Online online

How to create an eSignature for your Contract Of Sale Made As Of Blumberg Legal Forms Online in Google Chrome

How to generate an eSignature for signing the Contract Of Sale Made As Of Blumberg Legal Forms Online in Gmail

How to generate an eSignature for the Contract Of Sale Made As Of Blumberg Legal Forms Online straight from your mobile device

How to create an electronic signature for the Contract Of Sale Made As Of Blumberg Legal Forms Online on iOS

How to generate an electronic signature for the Contract Of Sale Made As Of Blumberg Legal Forms Online on Android OS

People also ask

-

What are Blumberg legal forms?

Blumberg legal forms are a comprehensive collection of attorney-prepared legal documents designed for various personal and business needs. These forms cover a wide range of legal areas and ensure compliance with state laws. Using airSlate SignNow, you can easily access, customize, and execute these forms electronically.

-

How can I access Blumberg legal forms through airSlate SignNow?

You can access Blumberg legal forms directly through the airSlate SignNow platform by subscribing to our service. Once you sign up, you will have a user-friendly interface to search, select, and fill out the specific forms you need. This seamless access streamlines your document management process.

-

What features does airSlate SignNow offer for managing Blumberg legal forms?

AirSlate SignNow provides several features to enhance your experience with Blumberg legal forms, including templates for ease of use, integration with existing workflows, and electronic signature capabilities. Additionally, our platform allows for real-time collaboration, making it easy to work with others on legal documents. These features help to improve efficiency and accuracy.

-

Are there any costs associated with using Blumberg legal forms on airSlate SignNow?

Yes, using Blumberg legal forms on airSlate SignNow involves a subscription fee, which varies depending on the plan you choose. Our pricing is designed to be cost-effective, providing you with valuable access to professional legal forms at a fraction of the traditional cost. We encourage you to review our pricing plans to find the best fit for your needs.

-

What benefits do Blumberg legal forms provide?

Blumberg legal forms offer numerous benefits, including saving time, reducing the risk of errors, and ensuring legal compliance. By utilizing these professionally developed forms within airSlate SignNow, businesses can focus on their core activities while simplifying their legal processes. This leads to increased efficiency and peace of mind.

-

Can I customize Blumberg legal forms in airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize Blumberg legal forms to meet your specific requirements. You can modify text, add or remove fields, and tailor each document to your specific situation. This level of customization ensures that your legal forms accurately reflect your needs.

-

Does airSlate SignNow integrate with other applications for using Blumberg legal forms?

Yes, airSlate SignNow offers robust integrations with various applications, enhancing the usability of Blumberg legal forms. You can connect our platform with tools like Google Drive, Dropbox, and others, allowing for seamless document storage and sharing. This integration helps streamline your workflow and improve overall productivity.

Get more for Contract Of Sale Made As Of Blumberg Legal Forms Online

Find out other Contract Of Sale Made As Of Blumberg Legal Forms Online

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors