Florida Estate Tax Return F 706 Fillable Online Form 2011

What is the Florida Estate Tax Return F 706 Fillable Online Form

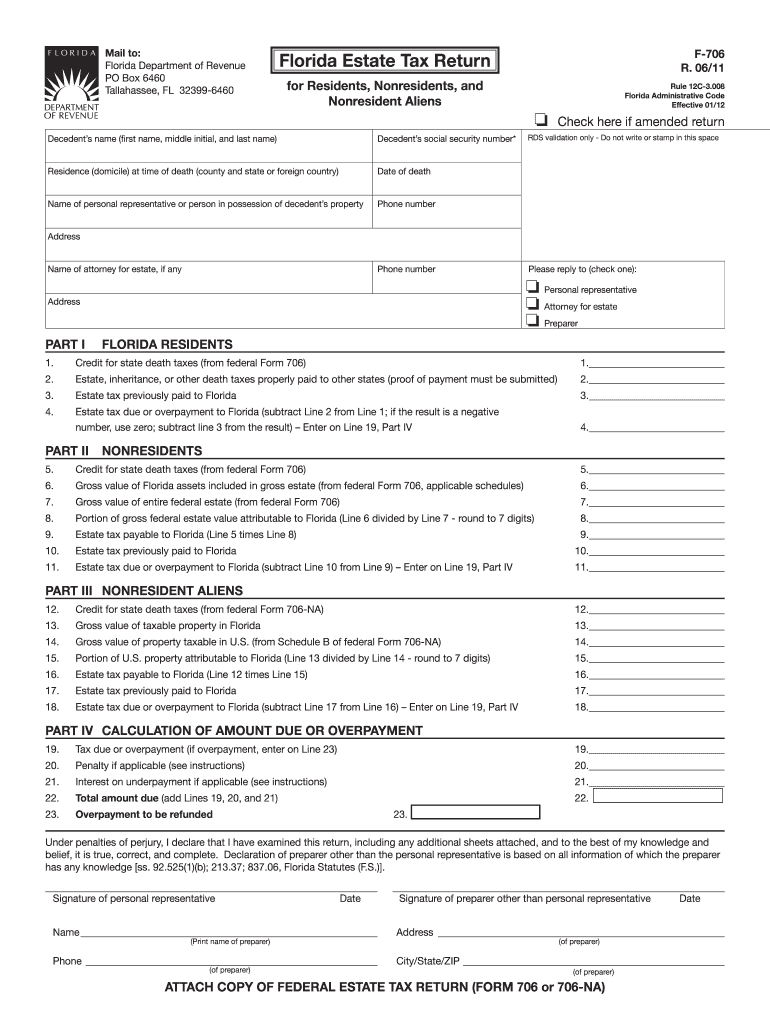

The Florida Estate Tax Return F 706 is a crucial document used to report the estate tax obligations of a deceased individual in Florida. This fillable online form allows executors or personal representatives to provide necessary financial information about the estate, including assets, liabilities, and the value of the estate at the time of death. By using the fillable online version, users can streamline the process of completing and submitting the form, ensuring accuracy and compliance with state regulations.

How to use the Florida Estate Tax Return F 706 Fillable Online Form

To effectively use the Florida Estate Tax Return F 706 fillable online form, begin by accessing the form through a secure platform that supports electronic signatures. Carefully read the instructions provided with the form to understand the required information. Fill in the necessary fields, ensuring that all data is accurate and complete. Once the form is filled out, review it for any errors before applying your electronic signature. Finally, submit the form electronically to the appropriate state agency, keeping a copy for your records.

Steps to complete the Florida Estate Tax Return F 706 Fillable Online Form

Completing the Florida Estate Tax Return F 706 fillable online form involves several key steps:

- Access the form on a secure platform.

- Read the instructions carefully to understand what information is required.

- Fill in all required fields, including details about the deceased, assets, and liabilities.

- Double-check all entries for accuracy.

- Apply your electronic signature to validate the form.

- Submit the completed form electronically to the designated authority.

- Retain a copy of the submitted form for your records.

Legal use of the Florida Estate Tax Return F 706 Fillable Online Form

The Florida Estate Tax Return F 706 fillable online form is legally recognized as a valid document for reporting estate taxes in Florida. It complies with state laws and regulations, allowing for electronic signatures under the ESIGN Act. This legal recognition ensures that the form can be used to fulfill tax obligations without the need for physical paperwork, thus promoting efficiency and accuracy in the filing process.

Required Documents

When completing the Florida Estate Tax Return F 706 fillable online form, certain documents are essential for accurate reporting. These typically include:

- The death certificate of the deceased.

- A detailed inventory of the estate's assets, including real estate, bank accounts, and personal property.

- Documentation of any debts or liabilities associated with the estate.

- Previous tax returns, if applicable, to provide context for the estate's financial situation.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Florida Estate Tax Return F 706. Generally, the return must be filed within nine months of the date of death of the individual. Failure to meet this deadline may result in penalties or interest charges on the owed taxes. Executors should mark their calendars and ensure all necessary documentation is prepared well in advance of the due date.

Quick guide on how to complete florida estate tax return f 706 fillable online form

Your assistance manual on how to prepare your Florida Estate Tax Return F 706 Fillable Online Form

If you’re wondering how to finalize and transmit your Florida Estate Tax Return F 706 Fillable Online Form, here are some straightforward instructions on how to simplify tax processing.

Initially, you just need to create your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is a very user-friendly and robust document solution that allows you to edit, draft, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to amend responses as necessary. Streamline your tax management with enhanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your Florida Estate Tax Return F 706 Fillable Online Form in just a few minutes:

- Establish your account and begin working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Florida Estate Tax Return F 706 Fillable Online Form in our editor.

- Populate the necessary fillable fields with your details (text, numbers, ticks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save modifications, print your copy, dispatch it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Be aware that paper submissions can increase errors and delay refunds. Moreover, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct florida estate tax return f 706 fillable online form

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

Create this form in 5 minutes!

How to create an eSignature for the florida estate tax return f 706 fillable online form

How to make an eSignature for your Florida Estate Tax Return F 706 Fillable Online Form in the online mode

How to make an electronic signature for the Florida Estate Tax Return F 706 Fillable Online Form in Chrome

How to generate an electronic signature for putting it on the Florida Estate Tax Return F 706 Fillable Online Form in Gmail

How to generate an eSignature for the Florida Estate Tax Return F 706 Fillable Online Form straight from your smart phone

How to generate an electronic signature for the Florida Estate Tax Return F 706 Fillable Online Form on iOS

How to make an eSignature for the Florida Estate Tax Return F 706 Fillable Online Form on Android

People also ask

-

What is the Florida Estate Tax Return F 706 Fillable Online Form?

The Florida Estate Tax Return F 706 Fillable Online Form is a legal document required for filing estate taxes in Florida. This form allows executors to report the value of an estate and calculate taxes owed. Using the fillable online version simplifies the process, making it easier to complete and submit.

-

How can I access the Florida Estate Tax Return F 706 Fillable Online Form?

You can easily access the Florida Estate Tax Return F 706 Fillable Online Form through the airSlate SignNow platform. Our user-friendly interface allows you to fill out the form online and save your progress at any time, ensuring a seamless filing experience.

-

Is the Florida Estate Tax Return F 706 Fillable Online Form free to use?

While accessing the Florida Estate Tax Return F 706 Fillable Online Form is free, there may be associated fees for premium features or additional services on the airSlate SignNow platform. We offer various pricing plans to fit different needs, making it a cost-effective choice for estate tax filings.

-

What features does the Florida Estate Tax Return F 706 Fillable Online Form offer?

The Florida Estate Tax Return F 706 Fillable Online Form offers features such as real-time collaboration, e-signature integration, and secure document storage. These features streamline the filing process, ensuring that you can complete the form efficiently and accurately.

-

Can I save my progress on the Florida Estate Tax Return F 706 Fillable Online Form?

Yes, the airSlate SignNow platform allows you to save your progress on the Florida Estate Tax Return F 706 Fillable Online Form. You can return to your form at any time to complete it, ensuring that you have ample time to gather all necessary information before submission.

-

Does airSlate SignNow integrate with other software for filing the Florida Estate Tax Return F 706 Fillable Online Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to file the Florida Estate Tax Return F 706 Fillable Online Form. This integration helps to streamline your workflow, saving you time and reducing the risk of errors.

-

What are the benefits of using the Florida Estate Tax Return F 706 Fillable Online Form from airSlate SignNow?

Using the Florida Estate Tax Return F 706 Fillable Online Form from airSlate SignNow offers numerous benefits, including ease of use, accessibility, and secure e-signature capabilities. Our platform simplifies the filing process, ensuring that you can comply with tax regulations without hassle.

Get more for Florida Estate Tax Return F 706 Fillable Online Form

- Hpcsa form 12

- Texas peace officeramp39s crash report form cr 3 112015 mail to

- Fpgec application form

- Td fillable forms sce w8

- Ssa 3885 2014 2019 form

- Travelsafe insurance bluecrosscomph form

- Upmc release information form

- Miscellaneous services form consulate general of india chicago miscellaneous services form consulate general of india chicago

Find out other Florida Estate Tax Return F 706 Fillable Online Form

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy