Sci W8 Form

What is the Sci W8 Form

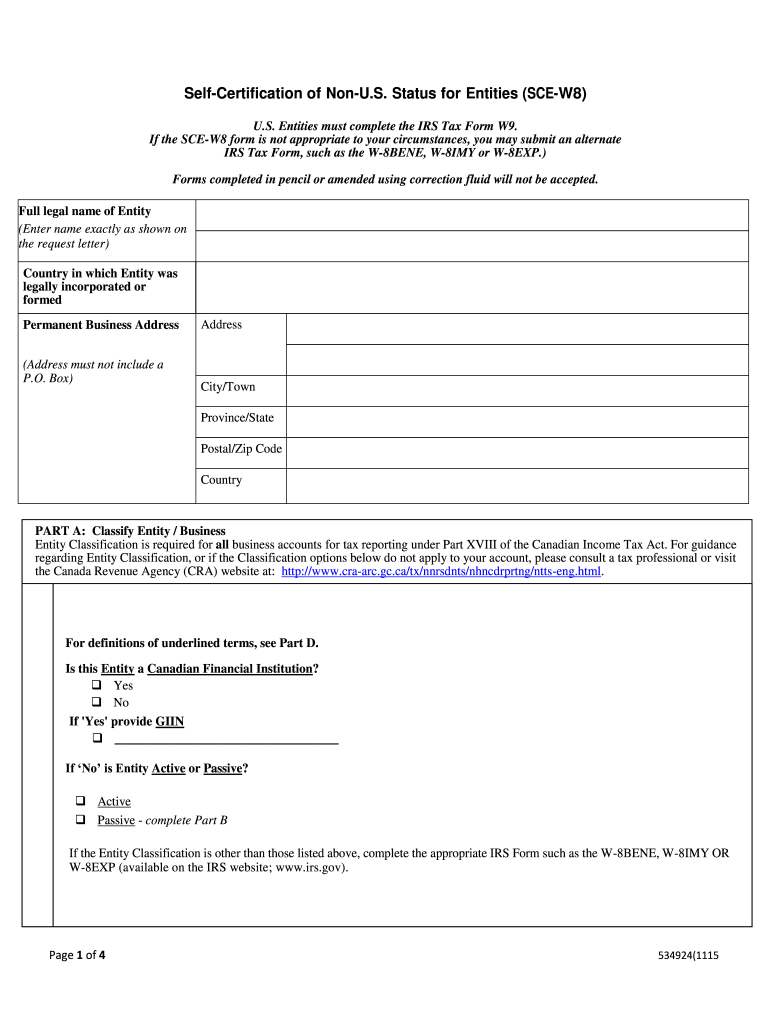

The Sci W8 form is a tax document used by foreign individuals and entities to certify their foreign status for tax withholding purposes in the United States. This form is essential for ensuring that the correct amount of tax is withheld from payments made to non-resident aliens or foreign entities. By completing the Sci W8 form, taxpayers can claim a reduced rate of withholding or exemption from U.S. tax on certain types of income, such as dividends, interest, and royalties. Understanding the purpose of this form is crucial for compliance with U.S. tax laws.

How to use the Sci W8 Form

Using the Sci W8 form involves several steps to ensure accurate completion and submission. First, identify the type of income for which the form is required. Next, fill out the form with accurate personal or entity information, including the name, country of citizenship, and address. It's important to provide the correct taxpayer identification number, if applicable. After completing the form, it should be submitted to the withholding agent or payer, who will use it to determine the correct amount of tax to withhold. Ensure that the form is updated regularly, especially if there are changes in circumstances.

Steps to complete the Sci W8 Form

Completing the Sci W8 form involves a systematic approach to ensure all necessary information is provided. Follow these steps:

- Download the latest version of the Sci W8 form from the IRS website.

- Fill in your name and the name of the entity, if applicable.

- Provide your country of citizenship and your permanent address.

- Include your taxpayer identification number, if you have one.

- Sign and date the form to certify that the information provided is accurate.

Once completed, submit the form to the relevant withholding agent to ensure compliance with U.S. tax regulations.

Legal use of the Sci W8 Form

The legal use of the Sci W8 form is governed by U.S. tax laws, specifically those pertaining to foreign income and taxation. By submitting this form, foreign individuals and entities can establish their non-resident status, which may exempt them from certain U.S. tax obligations. It is important to ensure that the form is filled out accurately and submitted on time to avoid potential penalties. The form must also be kept up to date to reflect any changes in the taxpayer's status or information.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Sci W8 form. Taxpayers should refer to the IRS instructions accompanying the form to understand the requirements fully. These guidelines detail who should file the form, the types of income covered, and the implications of providing false information. Adhering to these guidelines is essential for maintaining compliance and avoiding issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Sci W8 form are critical for ensuring compliance with U.S. tax laws. Generally, the form should be submitted before the first payment is made to the foreign individual or entity. If there are changes in circumstances that affect the information on the form, it should be updated and resubmitted as soon as possible. Staying aware of these deadlines helps avoid unnecessary withholding and potential penalties.

Quick guide on how to complete td fillable forms sce w8

Easily Prepare Sci W8 Form on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed forms, allowing you to locate the necessary document and securely store it online. airSlate SignNow equips you with all the necessary features to draft, adjust, and eSign your paperwork swiftly without delays. Handle Sci W8 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Effortless Way to Adjust and eSign Sci W8 Form

- Locate Sci W8 Form and select Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize essential parts of your documents or obscure sensitive information with the specialized tools that airSlate SignNow offers.

- Create your eSignature using the Sign feature, which only takes a moment and holds the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to save your changes.

- Select your preferred method to share the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or errors that require reprinting. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign Sci W8 Form to ensure seamless communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

Being in a sole proprietorship business in the Philippines, do I need to fill out any W8/W9 forms in order to be paid by a company that was recently bought by a US corporation?

NOT a W-9 as that is for domestic vendors.You do not even have to fill out a W-8BEN (probably the actual correct form) if you wish to have US taxes taken out of your payments and paid to the IRS. It is only required if you wish to have no US taxes withheld on your payment.

-

How do I fill the W8-BEN-E form for engaging as a service provider for a US based company?

Which specific question do you have an issue with ? I’ve done it in the past and can guide you on any specific issue you have …

Create this form in 5 minutes!

How to create an eSignature for the td fillable forms sce w8

How to generate an eSignature for your Td Fillable Forms Sce W8 online

How to create an eSignature for the Td Fillable Forms Sce W8 in Chrome

How to create an eSignature for signing the Td Fillable Forms Sce W8 in Gmail

How to create an electronic signature for the Td Fillable Forms Sce W8 from your smartphone

How to generate an eSignature for the Td Fillable Forms Sce W8 on iOS

How to create an electronic signature for the Td Fillable Forms Sce W8 on Android devices

People also ask

-

What is SCI W8 and how does it relate to airSlate SignNow?

SCI W8 is a critical document used by foreign individuals to claim a reduced rate of withholding tax on U.S. income. With airSlate SignNow, users can easily eSign the SCI W8 form, streamlining the process and ensuring compliance with IRS regulations.

-

How does airSlate SignNow simplify the completion of the SCI W8 form?

airSlate SignNow simplifies the SCI W8 form by providing an intuitive interface that allows users to fill out, review, and eSign documents quickly. Our platform ensures that all fields are clearly labeled, making it easy to provide the necessary information without confusion.

-

What are the pricing options for using airSlate SignNow for SCI W8 forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it a cost-effective solution for managing SCI W8 forms. Whether you're a small business or a large organization, there's a plan that fits your budget and document volume requirements.

-

Are there any benefits to using airSlate SignNow for SCI W8 documentation?

Using airSlate SignNow for SCI W8 documentation offers signNow benefits, such as improved efficiency, reduced paperwork, and enhanced security. The platform encrypts your data, ensuring that sensitive information is protected while providing a seamless eSigning experience.

-

Can airSlate SignNow integrate with other software for managing SCI W8 forms?

Yes, airSlate SignNow can easily integrate with various productivity tools, CRM systems, and cloud storage solutions. This integration allows you to manage your SCI W8 forms more effectively, streamlining your workflow and ensuring that all relevant documents are accessible in one place.

-

How secure is the eSigning process for SCI W8 forms with airSlate SignNow?

The eSigning process for SCI W8 forms with airSlate SignNow is highly secure, featuring advanced encryption and compliance with industry standards. We prioritize the security of your documents, ensuring that all transactions are protected against unauthorized access.

-

Is it easy to track the status of SCI W8 form submissions with airSlate SignNow?

Yes, airSlate SignNow provides users with real-time tracking of SCI W8 form submissions. This feature allows you to monitor who has signed the document and when, ensuring better management of your paperwork and reducing any potential delays.

Get more for Sci W8 Form

- Alabama department of revenue forms

- P 306 nomination for appointment of personal representative with lower priority 11 14 fill in probate forms

- Tf 200 exhibit list trial prep form

- Hawaii paternity action information

- Blank motion form maricopa county

- Mesa sales tax form 2016

- Member complaint and appeal form

- Form uc 018 form uc 020 unemployment tax and wage report

Find out other Sci W8 Form

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement