Fl F Estate Tax 2013-2026

What is the Florida Estate Tax?

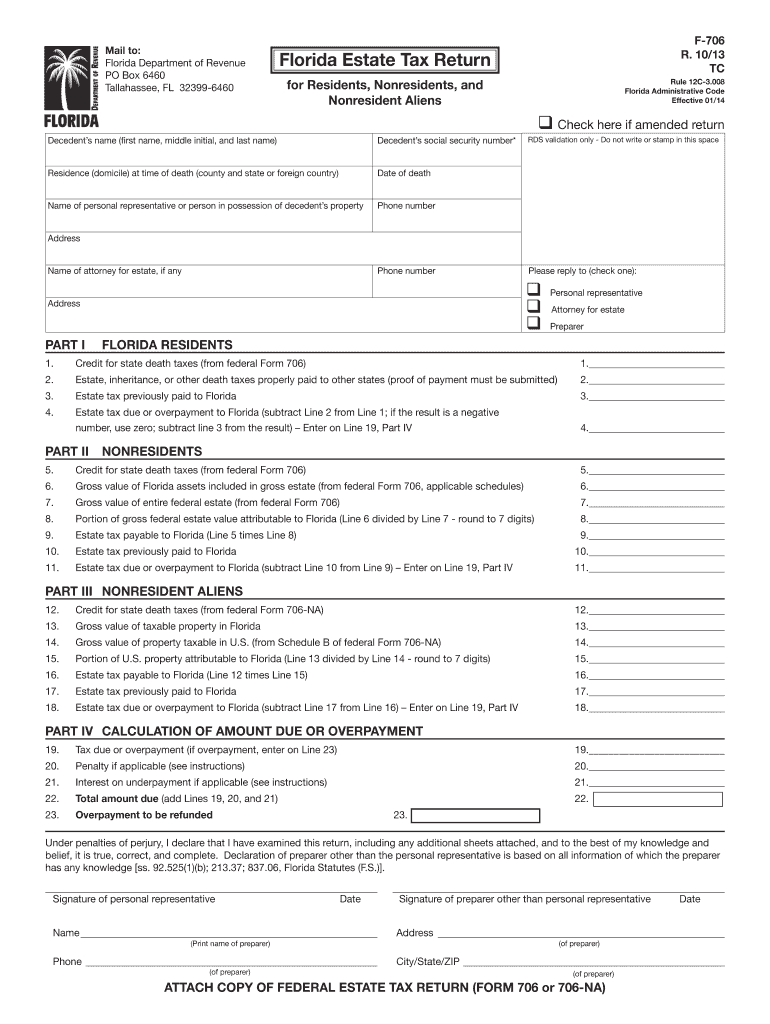

The Florida estate tax, also known as the FL 706, is a tax imposed on the transfer of an estate upon the death of an individual. This tax is calculated based on the value of the deceased's estate, which includes all assets such as real estate, bank accounts, investments, and personal property. While Florida does not currently impose a state estate tax, the federal estate tax may apply, particularly for estates exceeding a certain value threshold. Understanding the nuances of this tax is crucial for estate planning and ensuring compliance with applicable laws.

Steps to Complete the Florida Estate Tax Return

Completing the Florida estate tax return involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including a comprehensive list of assets, debts, and expenses related to the estate. Next, determine the fair market value of each asset at the time of death. Once you have compiled this information, fill out the FL 706 form, ensuring that all details are accurate and complete. After completing the form, review it thoroughly before submitting it to the appropriate tax authority, either online or via mail.

Required Documents for the Florida Estate Tax

When preparing to file the Florida estate tax return, certain documents are essential for a smooth process. Key documents include:

- A certified copy of the death certificate

- Documentation of all assets, including appraisals and statements

- Records of debts and liabilities

- Any prior estate tax returns, if applicable

- Legal documents such as wills or trust agreements

Having these documents ready will facilitate the completion of the FL 706 and help ensure compliance with legal requirements.

Legal Use of the Florida Estate Tax Return

The legal use of the Florida estate tax return is critical for ensuring that the transfer of assets complies with federal and state laws. The FL 706 must be filed accurately to avoid penalties and ensure that the estate is settled according to the deceased's wishes. Electronic filing options are available, providing a secure method to submit the return while maintaining compliance with legal standards. Utilizing a reliable eSignature platform can enhance the process, ensuring that all signatures are valid and legally binding.

Filing Deadlines for the Florida Estate Tax

Filing deadlines for the Florida estate tax return are crucial to avoid penalties. Generally, the FL 706 must be filed within nine months of the date of death. However, extensions may be available under certain circumstances. It is important to stay informed about any changes in regulations that may affect these deadlines. Keeping track of important dates ensures that the estate is managed efficiently and in compliance with legal requirements.

Penalties for Non-Compliance with the Florida Estate Tax

Failure to comply with the requirements of the Florida estate tax can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to file the FL 706 accurately and on time to avoid these consequences. Understanding the implications of non-compliance can help individuals and executors manage estate responsibilities effectively.

Quick guide on how to complete fl f estate tax

Effortlessly Prepare Fl F Estate Tax on Any Device

Managing documents online has gained immense popularity among organizations and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documentation, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Handle Fl F Estate Tax on any platform with the airSlate SignNow apps available for Android or iOS and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign Fl F Estate Tax Effortlessly

- Locate Fl F Estate Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Fl F Estate Tax to ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fl f estate tax

Create this form in 5 minutes!

How to create an eSignature for the fl f estate tax

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is FL 706 in the context of airSlate SignNow?

FL 706 is a document type associated with the functionalities offered by airSlate SignNow. It enables users to easily create, send, and electronically sign necessary documents, streamlining the workflow process for businesses.

-

How much does airSlate SignNow cost for using FL 706?

The pricing for using airSlate SignNow with FL 706 varies depending on the subscription plan you choose. We offer flexible pricing options to accommodate different business needs, ensuring that companies can access the features they require without overspending.

-

What features does airSlate SignNow offer for FL 706 document management?

airSlate SignNow provides multiple features for FL 706 document management, including document templates, bulk sending, and real-time tracking. These features help businesses maintain efficiency and ensure that all processes are completed smoothly.

-

Are there any benefits of using airSlate SignNow for FL 706 documents?

Yes, using airSlate SignNow for FL 706 documents comes with numerous benefits, including improved compliance, faster turnaround times, and enhanced security for sensitive information. By using our platform, businesses can also reduce their reliance on paper, contributing to a more sustainable approach.

-

Can I integrate airSlate SignNow with other applications while using FL 706?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to handle FL 706 documents alongside your favorite business tools. This integration enhances overall efficiency and can help synchronize your document workflows.

-

Is it easy to use airSlate SignNow for FL 706 documents?

Yes, airSlate SignNow is designed to be user-friendly, ensuring that anyone can utilize it for managing FL 706 documents without extensive training. With an intuitive interface and straightforward functionalities, businesses can quickly get started and see the benefits.

-

What support options are available for airSlate SignNow users with FL 706?

airSlate SignNow provides comprehensive support options for users dealing with FL 706 documents. Users can access online resources, frequently asked questions, and customer service representatives for assistance at any step of the process.

Get more for Fl F Estate Tax

Find out other Fl F Estate Tax

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later