Sc Deferred Compensation Forms

What are the SC Deferred Compensation Forms?

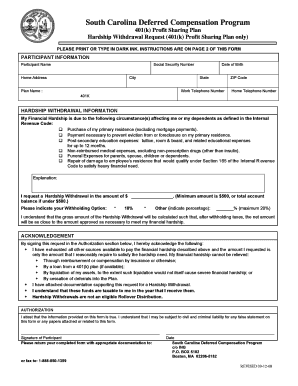

The SC deferred compensation forms are official documents used by employees to manage their deferred compensation plans. These forms allow individuals to defer a portion of their earnings to a future date, typically for retirement. The deferred compensation can be beneficial for tax planning, as it may reduce taxable income in the year the income is earned. Understanding these forms is crucial for anyone participating in a deferred compensation plan, as they outline the terms and conditions of the arrangement.

How to Use the SC Deferred Compensation Forms

Using the SC deferred compensation forms involves several steps to ensure proper completion and submission. First, gather all necessary personal and employment information, including your Social Security number and details about your employer's plan. Next, fill out the forms accurately, paying close attention to the sections that require specific details about your compensation deferral choices. Once completed, review the forms for accuracy before submitting them to your employer's HR department or the designated plan administrator.

Steps to Complete the SC Deferred Compensation Forms

Completing the SC deferred compensation forms requires careful attention to detail. Follow these steps:

- Read the instructions provided with the forms to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the amount of compensation you wish to defer and the duration of the deferral.

- Sign and date the forms to confirm your agreement to the terms.

- Submit the completed forms to your employer's HR department or the plan administrator.

Legal Use of the SC Deferred Compensation Forms

The SC deferred compensation forms must comply with federal and state regulations governing deferred compensation plans. These regulations ensure that the forms are legally binding and protect both the employee and employer. It is essential to understand the legal implications of deferring compensation, including potential tax consequences and the impact on retirement benefits. Consulting with a financial advisor or legal expert can provide clarity on these matters.

Key Elements of the SC Deferred Compensation Forms

Several key elements are essential for the SC deferred compensation forms to be valid:

- Employee Information: Accurate personal and employment details.

- Deferral Amount: Clear specification of the percentage or amount of salary to be deferred.

- Deferral Period: Duration for which the compensation will be deferred.

- Signature: The employee’s signature confirming their understanding and agreement.

Who Issues the SC Deferred Compensation Forms?

The SC deferred compensation forms are typically issued by the employer or the plan administrator overseeing the deferred compensation plan. Employers are responsible for providing these forms to eligible employees and ensuring that they comply with applicable laws and regulations. Employees should consult their HR department for the specific forms related to their deferred compensation plan.

Quick guide on how to complete sc deferred compensation forms

Effortlessly prepare Sc Deferred Compensation Forms on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed papers, enabling you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, update, and electronically sign your documents promptly without delays. Handle Sc Deferred Compensation Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to modify and electronically sign Sc Deferred Compensation Forms effortlessly

- Find Sc Deferred Compensation Forms and click Get Form to begin.

- Use the tools available to complete your form.

- Mark relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Review all the details and select the Done button to save your changes.

- Decide how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Sc Deferred Compensation Forms to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc deferred compensation forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are SC deferred compensation forms?

SC deferred compensation forms are documents that allow employees to defer a portion of their earnings to be paid at a later date, typically for retirement purposes. These forms help in managing tax liabilities and retirement savings effectively.

-

How can airSlate SignNow help with SC deferred compensation forms?

airSlate SignNow streamlines the process of sending and eSigning SC deferred compensation forms, making it easy for employees to complete necessary documentation. The platform provides a secure environment for managing sensitive information while ensuring compliance.

-

What features does airSlate SignNow offer for managing SC deferred compensation forms?

With airSlate SignNow, you gain access to features like customizable templates, automated workflows, and robust tracking capabilities for SC deferred compensation forms. These tools enhance efficiency and reduce the time required for document management.

-

Is airSlate SignNow suitable for small businesses handling SC deferred compensation forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing SC deferred compensation forms. It offers scalable features that grow with your business, ensuring that all document needs are met effectively.

-

What benefits do I gain by using airSlate SignNow for SC deferred compensation forms?

Using airSlate SignNow for SC deferred compensation forms provides benefits such as increased security, reduced paperwork, and improved turnaround time for document signing. This enables your organization to focus on core tasks while ensuring compliance.

-

Are there any integrations available for managing SC deferred compensation forms?

airSlate SignNow integrates seamlessly with various CRM and HR software, enhancing the management of SC deferred compensation forms. These integrations allow for better data flow and increased productivity across business operations.

-

How does pricing work for airSlate SignNow and SC deferred compensation forms?

airSlate SignNow offers competitive pricing based on your specific needs for managing SC deferred compensation forms. Several tiered plans are available, allowing businesses of all sizes to find a solution that fits their budget.

Get more for Sc Deferred Compensation Forms

- Professional corporation package for ohious legal forms

- Free joint venture agreement by spar group inc findformscom

- 2012 campaign disclosure manual for county candidates form

- A new mexico corporation form

- Business services secretary of state of new mexico form

- Become a notary secretary of state of new mexico form

- Operating agreement llc operating agreement free search form

- Contact us secretary of state of new mexico form

Find out other Sc Deferred Compensation Forms

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document