Axis Bank Indemnity Bond Format

What is the Axis Bank Indemnity Bond Format

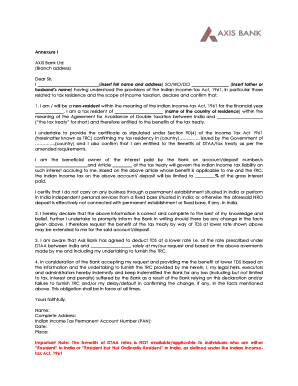

The Axis Bank indemnity bond format is a legal document used to protect the bank from potential losses arising from certain transactions or agreements. This bond serves as a guarantee that the signatory will compensate the bank for any losses incurred due to their actions or omissions. It is commonly required when individuals or entities need to secure loans, issue guarantees, or handle other financial transactions that involve risk. The format typically includes essential details such as the names of the parties involved, the specific obligations being indemnified, and the conditions under which the bond is enforceable.

Key elements of the Axis Bank Indemnity Bond Format

The key elements of the Axis Bank indemnity bond format include the following:

- Parties Involved: Clearly identifies the indemnifier (the person or entity providing the bond) and the indemnified (the bank or institution).

- Purpose of the Bond: Specifies the reason for the indemnity, detailing the transactions or obligations covered.

- Terms and Conditions: Outlines the specific terms under which the indemnity applies, including any limitations or exclusions.

- Duration: Indicates the time period for which the indemnity bond is valid.

- Signatures: Requires the signatures of all parties involved, often with witness signatures to validate the document.

Steps to complete the Axis Bank Indemnity Bond Format

Completing the Axis Bank indemnity bond format involves several straightforward steps:

- Obtain the Format: Acquire the official indemnity bond format from Axis Bank or a reliable source.

- Fill in the Details: Accurately enter the names of the indemnifier and indemnified, along with the purpose of the bond.

- Specify Terms: Clearly outline the terms and conditions, ensuring all relevant obligations are included.

- Review: Carefully review the document for accuracy and completeness to avoid potential issues.

- Sign and Date: All parties must sign and date the document, often in the presence of a witness.

How to use the Axis Bank Indemnity Bond Format

The Axis Bank indemnity bond format is used primarily in transactions that require a guarantee against potential losses. To use the bond effectively, follow these guidelines:

- Ensure the bond is correctly filled out with all necessary information.

- Submit the completed bond to Axis Bank as part of the application process for loans or guarantees.

- Retain a copy of the signed bond for your records, as it may be required for future reference.

- Understand the obligations outlined in the bond to ensure compliance with its terms.

Legal use of the Axis Bank Indemnity Bond Format

The legal use of the Axis Bank indemnity bond format is governed by contract law. For the bond to be enforceable, it must meet specific legal requirements:

- The parties involved must have the legal capacity to enter into a contract.

- The bond must have a lawful purpose and not violate any laws or regulations.

- Consideration must be present, meaning something of value must be exchanged between the parties.

- The bond must be executed voluntarily, without coercion or undue influence.

Quick guide on how to complete axis bank indemnity bond format

Complete Axis Bank Indemnity Bond Format effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, amend, and eSign your documents quickly without delays. Manage Axis Bank Indemnity Bond Format on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Axis Bank Indemnity Bond Format without any hassle

- Obtain Axis Bank Indemnity Bond Format and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Bid farewell to lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Axis Bank Indemnity Bond Format and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the axis bank indemnity bond format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an indemnity bond format?

The indemnity bond format is a structured document that outlines the terms and responsibilities of the parties involved in a bonding agreement. It serves as a guarantee that one party will compensate the other in case of a loss or damage. This format is essential for businesses seeking to protect themselves legally and financially.

-

How can I create an indemnity bond format using airSlate SignNow?

Creating an indemnity bond format with airSlate SignNow is straightforward. You can start with a customizable template or create your own from scratch using our intuitive document editor. Once your indemnity bond format is ready, you can easily send it for eSignature to all necessary parties.

-

What are the benefits of using the indemnity bond format provided by airSlate SignNow?

Using the indemnity bond format from airSlate SignNow ensures that your documents are legally compliant and securely signed. The benefits include quick turnaround times, enhanced security features, and the ability to track document status. This saves time and reduces the risk associated with traditional paper signing.

-

Is there a cost associated with using the indemnity bond format on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is competitively priced for the value it offers. Our pricing plans are designed to accommodate businesses of all sizes, providing access to the indemnity bond format along with other essential features. You can choose a plan that best fits your needs.

-

Can the indemnity bond format be integrated with other software?

Absolutely! The indemnity bond format can be seamlessly integrated with various CRM and document management systems. airSlate SignNow offers integrations that help streamline your workflow, making it easy to send and manage your indemnity bond format alongside other business processes.

-

What types of businesses can benefit from the indemnity bond format?

Any business that deals with contracts, partnerships, or financial responsibilities can benefit from using an indemnity bond format. This includes construction companies, service providers, and any organization that needs to ensure compliance and protect against liabilities. It's a crucial tool for risk management.

-

How does airSlate SignNow ensure the security of my indemnity bond format?

airSlate SignNow adopts top-tier security measures to protect your indemnity bond format and sensitive information. This includes data encryption, secure storage, and compliance with industry standards. You can trust that your documents are safe and accessible only to authorized parties.

Get more for Axis Bank Indemnity Bond Format

- Trademark assignment agreement secgov form

- Cancellation of contract at fault form

- Please be advised that the insurance policy on the mobile home occupied by name expired form

- Assignment of domain names on the internet intaorg form

- We are canceling your subscription to moderne magazine because we have not received form

- Individual and form

- Hud multifamily rental project and health federal register form

- Cancellation of unfilled order form

Find out other Axis Bank Indemnity Bond Format

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form