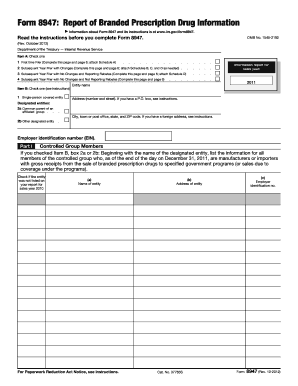

Form 8947

What is the Form 8947

The Form 8947, also known as the IRS Form 8947, is a tax form used for reporting certain transactions related to the sale of a business or its assets. This form is particularly relevant for businesses that have undergone significant changes, such as mergers, acquisitions, or sales. It helps the Internal Revenue Service (IRS) track the tax implications of these transactions and ensures compliance with federal tax laws.

How to Use the Form 8947

Using the Form 8947 involves several steps to ensure accurate reporting. First, gather all relevant financial information regarding the transaction, including the sale price, costs associated with the sale, and any liabilities transferred. Next, complete the form by entering the required details, such as the names of the parties involved and the nature of the transaction. Finally, submit the completed form to the IRS as part of your tax return or as a standalone document, depending on your specific situation.

Steps to Complete the Form 8947

Completing the Form 8947 requires careful attention to detail. Follow these steps:

- Collect all necessary documentation related to the transaction.

- Fill in the basic information, including your name, address, and taxpayer identification number.

- Provide details about the transaction, including the type of sale and the date of the transaction.

- Calculate any gain or loss from the sale and report it accurately on the form.

- Review the completed form for accuracy before submission.

Legal Use of the Form 8947

The legal use of the Form 8947 is crucial for ensuring compliance with IRS regulations. To be considered valid, the form must be filled out accurately and submitted within the appropriate deadlines. Additionally, it is essential to retain copies of the form and related documents for your records, as they may be needed in case of an audit or inquiry from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8947 vary depending on the nature of the transaction and the type of taxpayer involved. Generally, it should be filed by the due date of your tax return, including extensions. It is important to stay informed about any changes to filing deadlines, as these can impact your compliance and potential penalties.

Required Documents

When completing the Form 8947, certain documents are required to support the information provided. These may include:

- Sales agreements or contracts related to the transaction.

- Financial statements showing the business's performance.

- Documentation of any liabilities transferred during the sale.

- Tax identification numbers for all parties involved.

Penalties for Non-Compliance

Failing to file the Form 8947 or submitting inaccurate information can result in penalties from the IRS. These penalties can include fines, interest on unpaid taxes, and potential legal action. It is essential to ensure that the form is completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete form 8947

Complete Form 8947 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a fantastic environmentally friendly alternative to traditional printed and signed papers, as you can find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Form 8947 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form 8947 with ease

- Find Form 8947 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and bears the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8947 and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8947

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8947 and how can airSlate SignNow assist with it?

Form 8947, also known as the 'Internal Revenue Service's Authorization for Electronic Signature,' allows for the electronic submission of certain tax documents. airSlate SignNow makes it simple to prepare, sign, and send Form 8947 securely, ensuring compliance with IRS regulations while streamlining your document workflow.

-

Is airSlate SignNow suitable for businesses that need to manage Form 8947?

Yes, airSlate SignNow is an excellent fit for businesses that frequently handle Form 8947. Our platform provides an intuitive interface for creating and managing the form, making it easy for users to collect eSignatures and maintain records efficiently.

-

How much does it cost to use airSlate SignNow for processing Form 8947?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Pricing depends on the features you select, but we ensure a cost-effective solution for managing documents like Form 8947 without compromising on quality or efficiency.

-

What features does airSlate SignNow provide for handling Form 8947?

Our platform offers a variety of features for handling Form 8947, including customizable templates, automated workflows, and secure eSignature options. These features streamline the process of preparing and submitting the form, saving you time and ensuring accuracy.

-

Can I integrate airSlate SignNow with other tools for managing Form 8947?

Absolutely! airSlate SignNow seamlessly integrates with numerous tools, including CRM systems, cloud storage solutions, and accounting software, making it easy to manage Form 8947 alongside your other business applications. This integration enhances workflow efficiency and reduces data entry errors.

-

What are the benefits of using airSlate SignNow for Form 8947?

Using airSlate SignNow for Form 8947 offers several benefits, including increased efficiency, enhanced security, and improved compliance with IRS standards. Our platform simplifies the signing process and provides an easy way to track document status, ensuring that your submissions are handled promptly.

-

Is it easy to sign and send Form 8947 with airSlate SignNow?

Yes, signing and sending Form 8947 using airSlate SignNow is straightforward and user-friendly. With just a few clicks, you can upload the form, add recipient email addresses, and collect signatures electronically, simplifying your document management process.

Get more for Form 8947

- It due diligence checklist free technology mampampa template form

- Common insurance terms in mobile alabama and mississippi form

- 08 checklist for potential director and officer liability issues form

- The cftc division of enforcement enforcement manual form

- A comprehensive guide to due diligence issues in mergers form

- Prioritized industrialoperational due diligence information request

- Listing rules and guidance entire sectionlisting rule form

- Data room index form

Find out other Form 8947

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple