Wage Deduction Authorization Agreement Form

What is the Wage Deduction Authorization Agreement

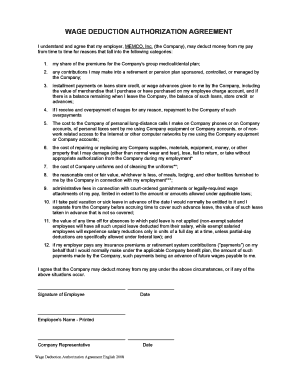

The Wage Deduction Authorization Agreement is a formal document that allows an employer to deduct specified amounts from an employee’s wages for various purposes. This agreement is crucial in ensuring that deductions are made legally and with the employee's consent. It typically outlines the reasons for the deductions, such as loan repayments, benefits contributions, or other financial obligations. Understanding this agreement is essential for both employers and employees to maintain transparency and compliance with labor laws.

How to use the Wage Deduction Authorization Agreement

Using the Wage Deduction Authorization Agreement involves several steps to ensure that both parties are clear on the terms. First, the employee must review the agreement to understand the deductions being proposed. Once satisfied, the employee signs the document, indicating their consent. The employer then keeps this signed agreement on file to document the authorization for the deductions. It is important for both parties to retain copies for their records, ensuring that there is a mutual understanding of the terms outlined in the agreement.

Steps to complete the Wage Deduction Authorization Agreement

Completing the Wage Deduction Authorization Agreement requires careful attention to detail. Here are the steps involved:

- Review the agreement thoroughly to understand the terms and conditions.

- Fill in the required personal information, including the employee's name, address, and identification number.

- Specify the amount to be deducted and the frequency of deductions.

- Provide a clear reason for the deductions, ensuring it aligns with the legal requirements.

- Sign and date the agreement to confirm consent.

- Submit the completed form to the employer for processing.

Legal use of the Wage Deduction Authorization Agreement

The legal use of the Wage Deduction Authorization Agreement is governed by federal and state labor laws. Employers must ensure that deductions are made only with the employee's written consent and for permissible reasons. The agreement should comply with regulations such as the Fair Labor Standards Act (FLSA) and any applicable state laws. Failure to adhere to these legal requirements can result in penalties for the employer and potential disputes with the employee.

Key elements of the Wage Deduction Authorization Agreement

Several key elements must be included in the Wage Deduction Authorization Agreement to ensure its validity:

- Employee Information: Full name, address, and identification details.

- Deductions Details: Clear description of the deductions, including amounts and frequency.

- Reason for Deductions: Justification for each deduction, ensuring it complies with legal standards.

- Employee Consent: Signature and date to confirm agreement to the terms.

- Employer Information: Name and contact details of the employer or HR representative.

Examples of using the Wage Deduction Authorization Agreement

Examples of the Wage Deduction Authorization Agreement in practice include scenarios where employees authorize deductions for:

- Loan repayments for personal or educational loans.

- Health insurance premiums or retirement plan contributions.

- Union dues or other membership fees.

- Charitable contributions as part of workplace giving programs.

Each of these examples illustrates the importance of having a clear and legally compliant agreement to protect both the employee's rights and the employer's interests.

Quick guide on how to complete wage deduction authorization agreement

Effortlessly Prepare Wage Deduction Authorization Agreement on Any Gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the appropriate template and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your files promptly and without hindrance. Manage Wage Deduction Authorization Agreement on any device using airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to Edit and eSign Wage Deduction Authorization Agreement with Ease

- Obtain Wage Deduction Authorization Agreement and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the files or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your alterations.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Wage Deduction Authorization Agreement and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage deduction authorization agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of DoD Instruction 1336 01 January 23 2019?

DoD Instruction 1336 01 January 23 2019 outlines the policy for electronic signatures and document management within the Department of Defense. This instruction supports compliance with federal regulations, enhancing efficiency and security in handling official documents.

-

How does airSlate SignNow comply with DoD Instruction 1336 01 January 23 2019?

AirSlate SignNow ensures compliance with DoD Instruction 1336 01 January 23 2019 by providing secure electronic signatures and maintaining a robust audit trail for all documents. Our solution meets the standards set forth by the DoD, making it a reliable choice for defense contractors and agencies.

-

What pricing options are available for using airSlate SignNow?

AirSlate SignNow offers competitive pricing tailored to the needs of businesses, including options for individual, team, and enterprise users. Each plan provides access to features that are compliant with DoD Instruction 1336 01 January 23 2019, ensuring you get value along with regulatory peace of mind.

-

What features does airSlate SignNow provide for document management?

AirSlate SignNow includes features like customizable templates, advanced security options, and seamless integrations with popular applications. These functionalities help organizations meet the requirements established by DoD Instruction 1336 01 January 23 2019, promoting efficient workflow management.

-

Can airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow integrates with a wide range of software solutions, including CRM and project management tools. This versatility allows you to streamline your processes while adhering to regulations like DoD Instruction 1336 01 January 23 2019, enhancing overall productivity.

-

What benefits does airSlate SignNow offer for organizations operating under DoD guidelines?

By using airSlate SignNow, organizations operating under DoD guidelines can improve their document handling efficiency and compliance with DoD Instruction 1336 01 January 23 2019. Our intuitive platform reduces paperwork and accelerates signatures, leading to faster decision-making.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow employs advanced encryption and security features to protect sensitive documents. Our commitment to security ensures compliance with DoD Instruction 1336 01 January 23 2019, safeguarding your valuable data throughout the signing process.

Get more for Wage Deduction Authorization Agreement

Find out other Wage Deduction Authorization Agreement

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter