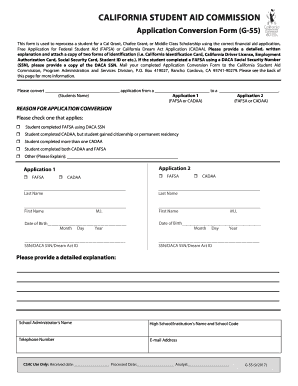

G55 Form

What is the G55 Form

The G55 form is a document used primarily for tax purposes, specifically related to the reporting of certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses that need to disclose specific income, deductions, or credits. Understanding the G55 form is crucial for ensuring compliance with federal tax regulations and for accurately reporting financial data.

How to obtain the G55 Form

Obtaining the G55 form is a straightforward process. It can be downloaded directly from the IRS website or requested through tax preparation software that supports IRS forms. Additionally, individuals can contact the IRS directly for assistance in acquiring a physical copy of the form. It is advisable to ensure you have the most current version of the G55 form to avoid any issues during filing.

Steps to complete the G55 Form

Completing the G55 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Download the G55 form from the IRS website or access it through your tax software.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form according to the instructions provided, whether online, by mail, or in person.

Legal use of the G55 Form

The G55 form must be used in compliance with IRS regulations to ensure its legal validity. This includes adhering to guidelines regarding the accuracy of information reported and the timeliness of submissions. Using the G55 form correctly can help avoid penalties and ensure that individuals and businesses meet their tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the G55 form are crucial to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, it is important to check for any specific deadlines that may apply to your situation, as extensions or different rules may exist for businesses or specific tax situations.

Required Documents

To complete the G55 form accurately, several documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Records of deductions and credits.

- Previous tax returns for reference.

- Any supporting documentation required by the IRS for specific claims.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the G55 form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to ensure that the form is completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete g55 form

Effortlessly Prepare G55 Form on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle G55 Form on any device using the airSlate SignNow apps available for Android and iOS, and enhance any document-related process today.

How to Modify and eSign G55 Form with Ease

- Obtain G55 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or obscure confidential details using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes only a few seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign G55 Form to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the g55 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the G55 form and why is it important?

The G55 form is a crucial document used for various business transactions. It ensures compliance with regulatory requirements and helps maintain accurate records. Understanding the G55 form is vital for businesses looking to streamline their documentation process.

-

How can airSlate SignNow assist with filling out the G55 form?

With airSlate SignNow, you can easily fill out the G55 form using our user-friendly interface. The platform allows for electronic signatures, which simplifies the signing process. This ensures that your G55 form is completed efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the G55 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans provide access to features that enhance the process of handling important documents like the G55 form. You can choose a plan that fits your budget and requirements.

-

What are the main features of airSlate SignNow for managing the G55 form?

airSlate SignNow includes features such as customizable templates, electronic signatures, and document tracking that are beneficial for managing the G55 form. These tools enhance workflow efficiency and ensure document security. By using these features, businesses can streamline their paperwork processes.

-

Can I integrate airSlate SignNow with other applications for the G55 form?

Absolutely! airSlate SignNow supports integration with numerous applications, such as Google Drive and Salesforce, to help manage your G55 form. This connectivity allows for seamless document sharing and retrieval, making it easier to incorporate the G55 form into your existing workflows.

-

What benefits does using airSlate SignNow provide for the G55 form?

Using airSlate SignNow for the G55 form offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Businesses can save on costs associated with paper-based processes and benefit from a more organized approach to document management. This ultimately leads to a more streamlined operation.

-

What kind of support is available for users of the G55 form in airSlate SignNow?

airSlate SignNow provides comprehensive support for users handling the G55 form. This includes online resources, tutorials, and a dedicated support team ready to assist with any queries. The goal is to ensure that users can effectively utilize the platform for their G55 form needs.

Get more for G55 Form

- Unmarried joint tenants with the right of form

- Purchase including the taking of x rays form

- Certificate we certify that the full consideration paid for the property described in this form

- Certificate we certify that the full consideration paid for the property described in this warranty form

- To individual without alternative form

- Legal assistance guide wills form

- Itemized and verified account of lien claim individual form

- To wit form

Find out other G55 Form

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template