Az Bingo Form 837

What is the Arizona Bingo Tax Form 837

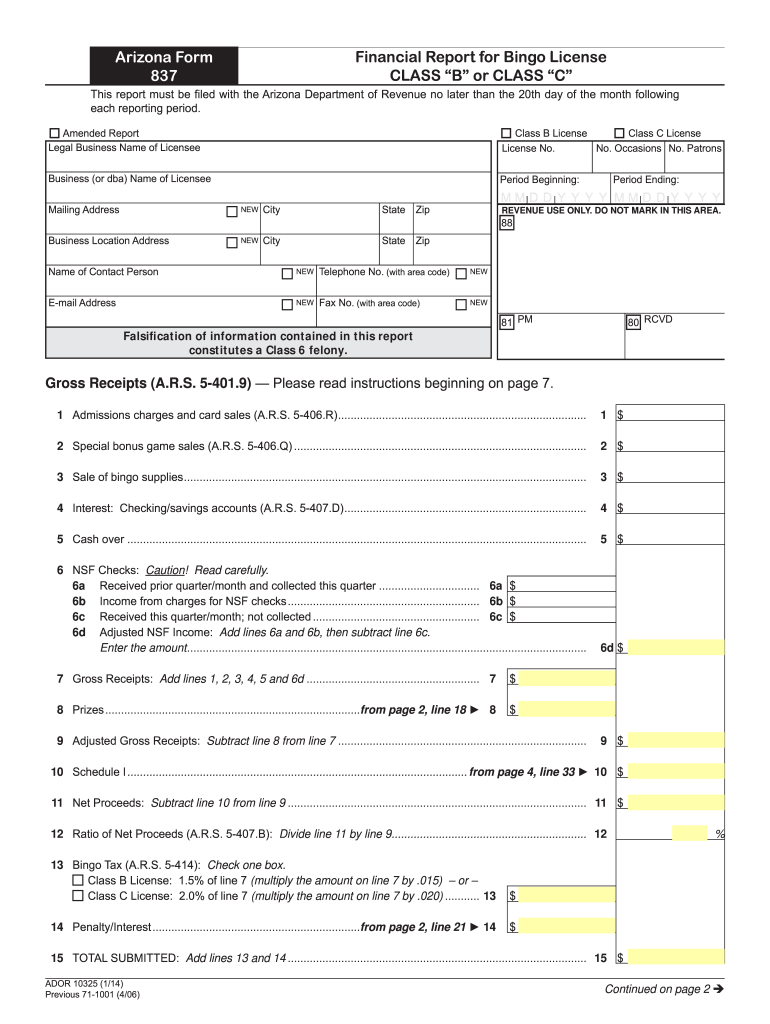

The Arizona Bingo Tax Form 837 is a specialized document used by organizations that conduct bingo games within the state of Arizona. This form is essential for reporting the income generated from bingo activities and ensuring compliance with state tax regulations. It is primarily utilized by non-profit organizations, charitable entities, and other groups that host bingo events to raise funds. Proper completion and submission of this form help maintain transparency and accountability in the management of bingo operations.

How to use the Arizona Bingo Tax Form 837

Using the Arizona Bingo Tax Form 837 involves several key steps. First, organizations must gather all necessary financial information related to their bingo operations, including total revenue, expenses, and any applicable deductions. Once the information is compiled, the form can be filled out accurately, ensuring that all sections are completed according to the guidelines provided by the Arizona Department of Revenue. After completing the form, organizations should review it for accuracy and submit it by the designated deadline to avoid penalties.

Steps to complete the Arizona Bingo Tax Form 837

Completing the Arizona Bingo Tax Form 837 requires careful attention to detail. Here are the essential steps:

- Gather financial records related to bingo operations, including revenue and expenses.

- Obtain the most recent version of the Arizona Bingo Tax Form 837 from the Arizona Department of Revenue.

- Fill out the form, ensuring that all required sections are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the completed form by the deadline, either online or by mail.

Legal use of the Arizona Bingo Tax Form 837

The Arizona Bingo Tax Form 837 must be used in accordance with state laws and regulations governing bingo operations. Organizations are required to file this form to report their bingo-related income and pay any associated taxes. Failure to comply with these legal requirements can result in penalties, including fines or loss of the ability to conduct bingo games. It is crucial for organizations to understand their legal obligations and ensure that they are using the form correctly to remain compliant.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Bingo Tax Form 837 are critical for organizations to note. Typically, the form must be submitted annually, with specific due dates established by the Arizona Department of Revenue. Organizations should keep track of these dates to ensure timely submission and avoid any late fees or penalties. It is advisable to check for any updates or changes to deadlines each year to remain compliant.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting the Arizona Bingo Tax Form 837. The form can be submitted online through the Arizona Department of Revenue's electronic filing system, which offers a convenient way to file and track submissions. Alternatively, organizations may choose to mail the completed form to the appropriate address provided by the department. In-person submissions may also be possible at designated locations, allowing for direct interaction with revenue officials if needed.

Quick guide on how to complete az bingo form 837

Easily Create Az Bingo Form 837 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow provides all the necessary tools to quickly create, modify, and electronically sign your documents without any delays. Handle Az Bingo Form 837 on any device using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The Most Efficient Way to Modify and eSign Az Bingo Form 837 Effortlessly

- Locate Az Bingo Form 837 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or cover sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a standard wet ink signature.

- Review all your information and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Az Bingo Form 837 to ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the az bingo form 837

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona bingo tax form 837?

The Arizona bingo tax form 837 is a document used by organizations that conduct bingo games in Arizona to report their gross income and pay associated taxes. This form ensures compliance with state regulations and is essential for maintaining your operational license. Accurately completing the Arizona bingo tax form 837 is crucial for avoiding penalties and ensuring smooth operations.

-

How does airSlate SignNow help with the Arizona bingo tax form 837?

airSlate SignNow provides an efficient platform for electronically signing and sending documents, including the Arizona bingo tax form 837. This simplifies the process of gathering signatures from necessary parties and allows for easy document tracking. With airSlate SignNow, you can ensure timely submission of the Arizona bingo tax form 837, reducing the risk of delays.

-

Is there a cost associated with using airSlate SignNow for the Arizona bingo tax form 837?

Yes, there is a pricing model for using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. You can choose from various plans that fit your needs, allowing you to manage the Arizona bingo tax form 837 and other documents efficiently. The investment ensures you have a reliable tool for your documentation needs.

-

What features does airSlate SignNow offer for managing the Arizona bingo tax form 837?

airSlate SignNow offers features such as customizable templates, secure eSignatures, and document tracking, which are essential when managing the Arizona bingo tax form 837. These tools enhance efficiency and ensure that all parties involved can act promptly. Additionally, the software is user-friendly, making it simple to navigate through the submission process.

-

Can airSlate SignNow integrate with other software for filing the Arizona bingo tax form 837?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your ability to file the Arizona bingo tax form 837 efficiently. You can connect it with accounting software, CRM systems, and more to streamline document management and compliance workflows. This integration allows for a smoother overall process.

-

How secure is the information shared when filing the Arizona bingo tax form 837 with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and robust data protection measures to safeguard the information shared during the filing of the Arizona bingo tax form 837. You can trust that your sensitive data remains confidential and secure while utilizing our services.

-

What are the benefits of using airSlate SignNow for the Arizona bingo tax form 837?

Using airSlate SignNow for the Arizona bingo tax form 837 comes with numerous benefits, including time savings, increased accuracy, and better compliance with regulatory requirements. By leveraging our eSignature solutions, you can minimize the chances of errors and ensure prompt filing, giving you peace of mind. It's an essential tool for any organization involved in bingo operations.

Get more for Az Bingo Form 837

- Civil form 4 913

- Civil form 4 914

- Civil form 4 915

- 4916 missouri department of revenue mogov form

- The medical department of the united states army in the form

- Petition by landlord for termination of tenancy and judgment form

- Forms and publications pdf

- New mexico judgment for restitutionus legal forms

Find out other Az Bingo Form 837

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed