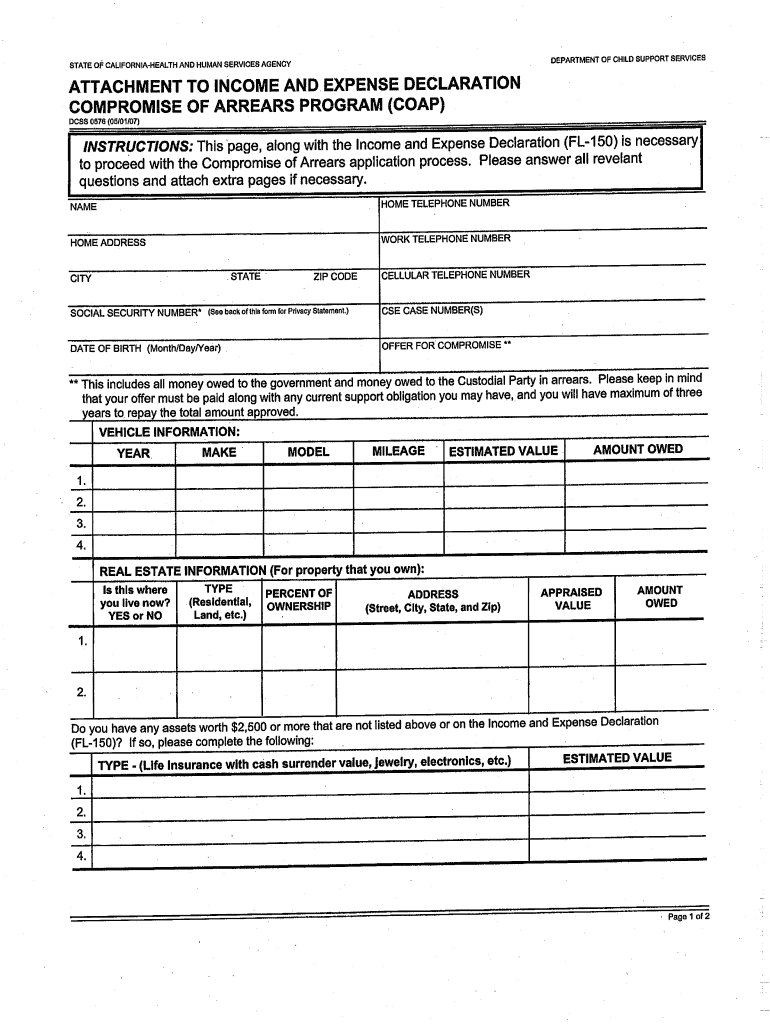

ATTACHMENT to INCOME and EXPENSE DECLARATION Placer Ca Form

Understanding the attachment to income and expense declaration

The attachment sheet for income and expense declaration is a crucial document used to provide detailed financial information to tax authorities. It allows individuals or businesses to declare their income and expenses accurately, ensuring compliance with tax regulations. This attachment is particularly important for self-employed individuals, freelancers, and small business owners who need to itemize their earnings and expenditures for tax purposes. By including this attachment, taxpayers can support their claims and provide transparency in their financial reporting.

Steps to complete the attachment to income and expense declaration

Completing the income and expense declaration attachment involves several key steps:

- Gather relevant financial documents: Collect all necessary documents, such as bank statements, invoices, receipts, and previous tax returns.

- List your income sources: Clearly outline all sources of income, including wages, freelance earnings, rental income, and any other revenue streams.

- Detail your expenses: Itemize all business-related expenses, such as office supplies, travel costs, and utility bills. Ensure you have receipts to support these claims.

- Fill out the form: Accurately enter your income and expenses into the attachment sheet, following any specific instructions provided.

- Review and verify: Double-check all entries for accuracy and completeness before submitting the form.

Legal use of the attachment to income and expense declaration

The attachment to income and expense declaration is legally binding when filled out correctly and submitted to the appropriate tax authority. It must comply with all relevant tax laws and regulations. Failure to provide accurate information can lead to penalties or audits. Therefore, it is essential to ensure that all figures are truthful and supported by documentation. Utilizing a reliable eSignature solution can enhance the legitimacy of the submission, ensuring that the document is executed properly and securely.

Required documents for the attachment to income and expense declaration

To complete the income and expense declaration attachment, you will need to provide several key documents:

- Bank statements for the reporting period.

- Invoices and receipts for all income received.

- Documentation for all business-related expenses.

- Previous tax returns for reference.

- Any relevant financial statements or reports.

Filing deadlines for the attachment to income and expense declaration

It is important to be aware of the filing deadlines for the income and expense declaration attachment to avoid penalties. Typically, these deadlines align with the overall tax filing deadlines set by the IRS. For most individuals, the deadline is April 15 of each year. However, if you are self-employed or have other specific circumstances, it may be necessary to file earlier or request an extension. Always check the IRS website or consult a tax professional for the most current information regarding deadlines.

Form submission methods for the attachment to income and expense declaration

The attachment to income and expense declaration can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online submission: Many tax authorities allow for electronic filing through secure portals.

- Mail: Completed forms can often be mailed directly to the appropriate tax office.

- In-person submission: Some taxpayers may choose to deliver their forms in person at local tax offices.

Quick guide on how to complete attachment to income and expense declaration placer ca

Effortlessly Prepare ATTACHMENT TO INCOME AND EXPENSE DECLARATION Placer Ca on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hassle. Manage ATTACHMENT TO INCOME AND EXPENSE DECLARATION Placer Ca on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign ATTACHMENT TO INCOME AND EXPENSE DECLARATION Placer Ca with Ease

- Obtain ATTACHMENT TO INCOME AND EXPENSE DECLARATION Placer Ca and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Select pertinent sections of the documents or redact sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign ATTACHMENT TO INCOME AND EXPENSE DECLARATION Placer Ca to ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Which form for which ITR do I have to fill out for the income from the salary and income from insurance commission?

You may be filed form no. 1. Under the head salary you may fill the amount of salary and under the head income from other sources you Malay fill commission from LIC.

Create this form in 5 minutes!

How to create an eSignature for the attachment to income and expense declaration placer ca

How to make an electronic signature for the Attachment To Income And Expense Declaration Placer Ca in the online mode

How to make an eSignature for the Attachment To Income And Expense Declaration Placer Ca in Google Chrome

How to create an eSignature for putting it on the Attachment To Income And Expense Declaration Placer Ca in Gmail

How to generate an eSignature for the Attachment To Income And Expense Declaration Placer Ca from your smart phone

How to make an eSignature for the Attachment To Income And Expense Declaration Placer Ca on iOS

How to make an eSignature for the Attachment To Income And Expense Declaration Placer Ca on Android OS

People also ask

-

What is an attachment sheet for income and expense declaration?

An attachment sheet for income and expense declaration is a document that allows you to consolidate and report your income and expenses in a structured format. This sheet helps in organizing your financial information, making it easier for tax compliance and audits. Using airSlate SignNow, you can eSign and send this document securely.

-

How do I create an attachment sheet for income and expense declaration using airSlate SignNow?

Creating an attachment sheet for income and expense declaration with airSlate SignNow is simple. You can start by using our customizable templates or upload your own document. The platform allows you to add fields for data entry, making it user-friendly for all your income and expense reporting needs.

-

Is there a cost associated with using the attachment sheet for income and expense declaration feature?

AirSlate SignNow offers a variety of pricing plans that include access to features like the attachment sheet for income and expense declaration. Pricing can vary based on the selected plan, ensuring that you get a cost-effective solution tailored to your business needs. For detailed pricing, visit our pricing page or contact our sales team.

-

What are the benefits of using an attachment sheet for income and expense declaration?

Using an attachment sheet for income and expense declaration streamlines your financial reporting process. It helps ensure accuracy, minimizes errors, and saves time when preparing your documents for tax submission. With airSlate SignNow, you can also track changes and manage signatures efficiently.

-

Can I integrate the attachment sheet for income and expense declaration with other software?

Yes, the attachment sheet for income and expense declaration can be integrated with various software solutions through airSlate SignNow's extensive API. This allows you to sync data and streamline your workflow between different applications, enhancing productivity and efficiency in managing your declarations.

-

How secure is my data when using the attachment sheet for income and expense declaration?

AirSlate SignNow prioritizes the security of your data. The attachment sheet for income and expense declaration, like all our documents, is protected using advanced encryption technologies. We adhere to strict security standards to ensure that your financial information remains confidential and secure during storage and transmission.

-

What types of documents can I use with the attachment sheet for income and expense declaration?

You can use a variety of document types with the attachment sheet for income and expense declaration, including PDFs, Word documents, and spreadsheets. AirSlate SignNow supports multiple formats, allowing you to upload and convert documents easily. This flexibility ensures your financial reporting meets all requirements.

Get more for ATTACHMENT TO INCOME AND EXPENSE DECLARATION Placer Ca

- Aswb accommodations form

- Bearing checksheet new fedexcom form

- Printable tax organizer form

- Notice of motion to pay by instalments form 46

- Draft of form 8962

- Form911 rev 10 request for taxpayer advocate service assistance and application for taxpayer assistance order

- Schedule k 1 form pte

- Schedule j form and instructions income tax pro

Find out other ATTACHMENT TO INCOME AND EXPENSE DECLARATION Placer Ca

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document