Draft of Form 8962 2024

Understanding Form 8962

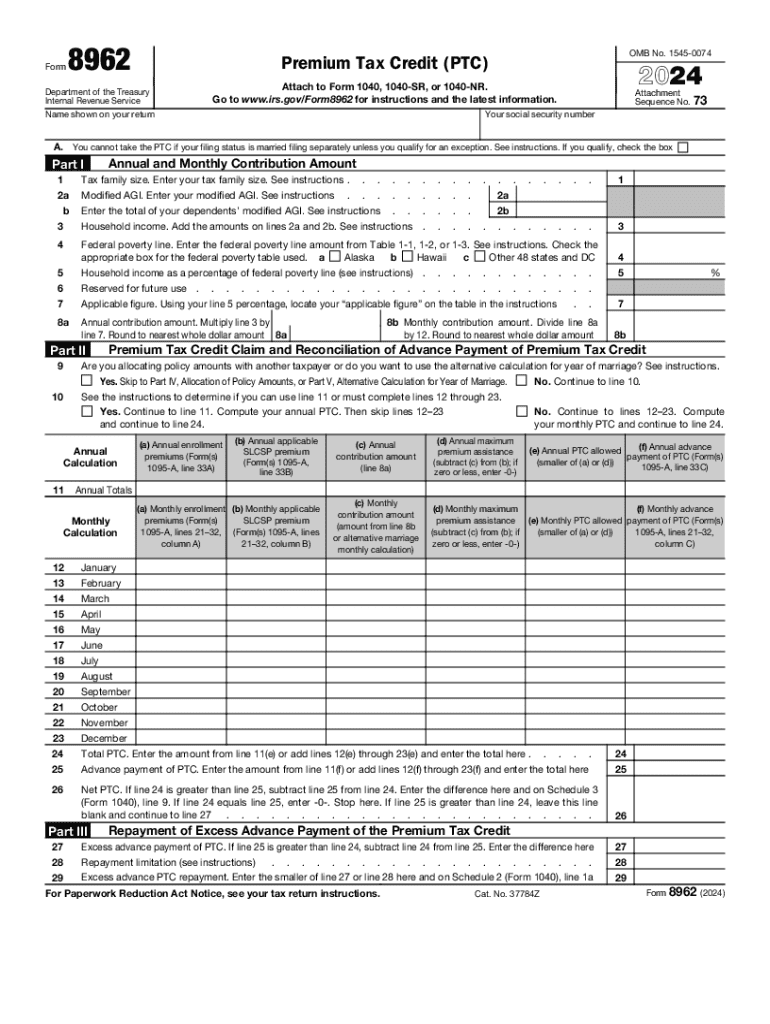

Form 8962, also known as the Premium Tax Credit form, is a crucial document for individuals who wish to reconcile their premium tax credits when filing their federal income tax returns. This form is used to determine eligibility for the premium tax credit, which helps lower the cost of health insurance purchased through the Health Insurance Marketplace. By completing Form 8962, taxpayers can ensure they receive the correct amount of tax credits based on their income and family size.

Steps to Complete Form 8962

Completing Form 8962 involves several key steps:

- Gather necessary documents: Collect your Form 1095-A, which provides information about your health insurance coverage.

- Calculate your annual household income: This includes all sources of income for you and your household members.

- Determine your expected contribution: Use the IRS guidelines to calculate what you are expected to pay for health coverage based on your income.

- Fill out Form 8962: Input the required information, including your premium tax credit amount and any adjustments necessary.

- Review and submit: Ensure all information is accurate before submitting the form with your tax return.

Obtaining Form 8962

Form 8962 can be easily obtained through the IRS website. It is available as a downloadable PDF, which can be printed for completion. Additionally, tax preparation software often includes Form 8962, allowing users to fill it out digitally. For those who prefer a physical copy, local IRS offices may provide printed versions of the form.

IRS Guidelines for Form 8962

The IRS provides specific guidelines for completing Form 8962 to ensure accuracy and compliance. Taxpayers must follow these guidelines closely to avoid errors that could lead to penalties. Key points include:

- Ensure that the information on Form 8962 matches the data reported on Form 1095-A.

- Be aware of the income thresholds that determine eligibility for the premium tax credit.

- File Form 8962 with your federal tax return to avoid delays in processing your refund.

Filing Deadlines for Form 8962

Form 8962 must be filed with your federal income tax return by the standard tax filing deadline, which is typically April 15. If you are unable to file by this date, you may request an extension, but it is crucial to ensure that Form 8962 is submitted along with your return to avoid any issues with your premium tax credit.

Eligibility Criteria for the Premium Tax Credit

To qualify for the premium tax credit and, consequently, to use Form 8962, certain eligibility criteria must be met. These include:

- You must have purchased health insurance through the Health Insurance Marketplace.

- Your household income must fall within the range set by the IRS for the premium tax credit.

- You cannot be eligible for other types of minimum essential coverage, such as Medicare or Medicaid.

Handy tips for filling out Draft Of Form 8962 online

Quick steps to complete and e-sign Draft Of Form 8962 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for optimum straightforwardness. Use signNow to e-sign and send Draft Of Form 8962 for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct draft of form 8962

Create this form in 5 minutes!

How to create an eSignature for the draft of form 8962

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8962 and why is it important?

Form 8962 is used to calculate the premium tax credit for health insurance purchased through the Health Insurance Marketplace. It is essential for individuals who want to ensure they receive the correct amount of financial assistance when filing their taxes. Understanding how to complete form 8962 can help avoid potential tax penalties.

-

How can airSlate SignNow help with form 8962?

airSlate SignNow provides a seamless way to eSign and send form 8962 electronically. Our platform simplifies the document management process, allowing users to complete and submit their forms quickly and securely. This ensures that you can focus on your health coverage without worrying about paperwork.

-

Is there a cost associated with using airSlate SignNow for form 8962?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage your documents, including form 8962, without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing form 8962?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like 8962. These tools enhance efficiency and ensure that your documents are completed accurately and on time. Our user-friendly interface makes it easy to navigate through the process.

-

Can I integrate airSlate SignNow with other software for form 8962?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 8962 alongside your existing workflows. This integration capability enhances productivity and ensures that all your documents are in one place, making it easier to track and manage your submissions.

-

What are the benefits of using airSlate SignNow for form 8962?

Using airSlate SignNow for form 8962 offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your documents are signed and sent quickly, reducing the risk of errors. Additionally, the secure environment protects your sensitive information.

-

How does airSlate SignNow ensure the security of my form 8962?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your form 8962 and other documents. Our platform is designed to safeguard your data, ensuring that only authorized users can access sensitive information. You can trust us to keep your documents secure.

Get more for Draft Of Form 8962

Find out other Draft Of Form 8962

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement