Schedule K 1 Form PTE 2024

What is the Schedule K-1 Form PTE

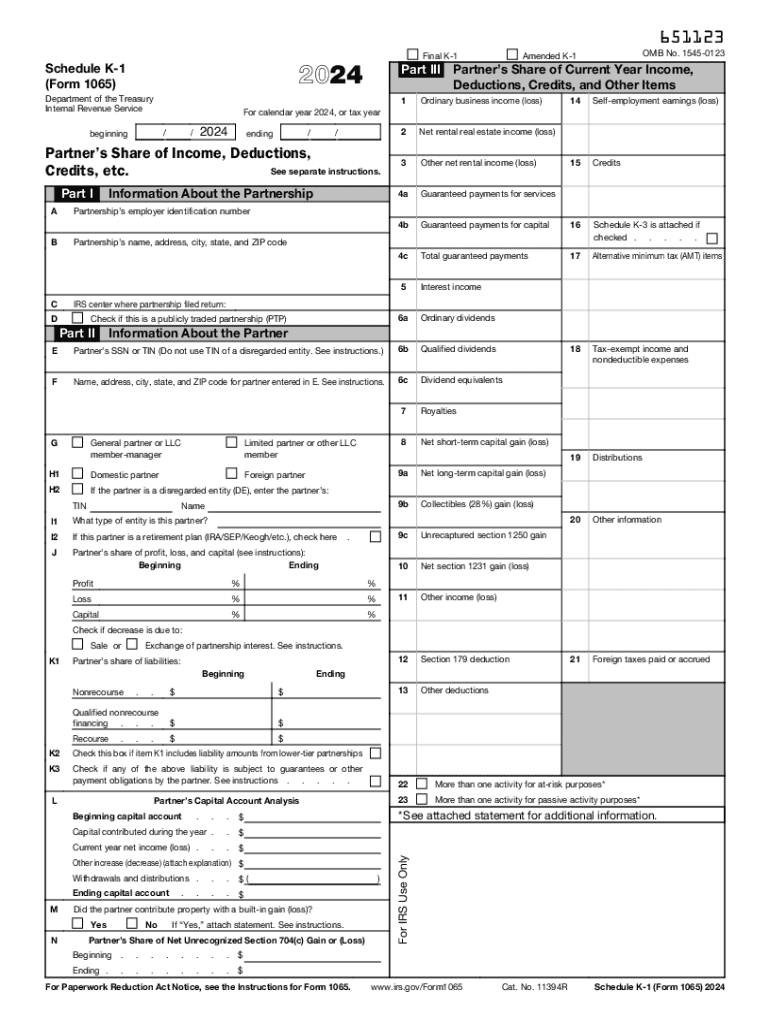

The Schedule K-1 form, specifically the Schedule K-1 (Form 1065), is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who are partners in a partnership or shareholders in an S corporation, as it provides a detailed breakdown of their share of the entity's income and expenses. Each partner or shareholder receives a K-1, which they must include when filing their personal tax returns. The information on the K-1 helps the IRS track the income that is passed through to individual taxpayers.

How to use the Schedule K-1 Form PTE

Using the Schedule K-1 form involves several steps. First, individuals must receive their K-1 from the partnership or S corporation in which they are involved. Once received, they should carefully review the form for accuracy, ensuring that all reported figures align with their records. The K-1 will include various types of income, deductions, and credits that need to be reported on the individual's tax return. It is crucial to input the information from the K-1 onto the appropriate lines of Form 1040 or other relevant tax forms. Properly using the K-1 ensures compliance with IRS regulations and accurate reporting of income.

Steps to complete the Schedule K-1 Form PTE

Completing the Schedule K-1 form requires attention to detail. Follow these steps:

- Obtain the K-1 from the partnership or S corporation.

- Review the form for any discrepancies or missing information.

- Identify the income types reported, such as ordinary business income, rental income, or capital gains.

- Transfer the relevant figures from the K-1 to your personal tax return, ensuring they are placed in the correct sections.

- Consult IRS guidelines or a tax professional if unsure about how to report specific items.

IRS Guidelines

The IRS provides specific guidelines for the use and reporting of the Schedule K-1 form. Taxpayers must ensure that they receive their K-1 by the tax filing deadline, which is typically March 15 for partnerships and S corporations. The IRS requires that all income reported on the K-1 be included on the individual’s tax return, regardless of whether the income was actually distributed. Additionally, any discrepancies or errors on the K-1 should be addressed with the issuing entity before filing the tax return to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 form are critical for compliance. Partnerships and S corporations must provide K-1s to their partners and shareholders by March 15 each year. Taxpayers must then report this information on their personal tax returns, which are typically due on April 15. If additional time is needed, individuals can file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties and interest.

Who Issues the Form

The Schedule K-1 form is issued by partnerships, S corporations, estates, and trusts. Each entity is responsible for preparing and distributing K-1s to their respective partners or shareholders. The issuing entity must ensure that the information is accurate and complete, as it directly affects the tax obligations of the recipients. Failure to provide accurate K-1s can lead to complications for both the issuing entity and the individual taxpayers.

Handy tips for filling out Schedule K 1 Form PTE online

Quick steps to complete and e-sign Schedule K 1 Form PTE online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for optimum straightforwardness. Use signNow to e-sign and send out Schedule K 1 Form PTE for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form pte

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form pte

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a K 1 tax form?

The K 1 tax form is a document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information to partners or shareholders about their share of the entity's income, which they must report on their personal tax returns. Understanding the K 1 tax form is essential for accurate tax filing.

-

How can airSlate SignNow help with K 1 tax forms?

airSlate SignNow simplifies the process of sending and eSigning K 1 tax forms. With our user-friendly platform, you can easily prepare, send, and track these important documents, ensuring that all parties receive them promptly. This streamlines your workflow and helps maintain compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for K 1 tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution allows you to manage K 1 tax forms efficiently without breaking the bank. You can choose a plan that fits your budget while enjoying all the essential features for document management.

-

What features does airSlate SignNow offer for managing K 1 tax forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for K 1 tax forms. These tools help you streamline the document workflow, reduce errors, and ensure that all necessary signatures are obtained quickly. Our platform is designed to enhance your productivity and efficiency.

-

Can I integrate airSlate SignNow with other software for K 1 tax forms?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easy to manage K 1 tax forms alongside your existing tools. This integration helps you maintain a cohesive workflow and ensures that all your financial documents are in sync.

-

What are the benefits of using airSlate SignNow for K 1 tax forms?

Using airSlate SignNow for K 1 tax forms provides numerous benefits, including enhanced security, faster processing times, and improved accuracy. Our platform reduces the risk of errors associated with manual handling and ensures that your documents are securely stored and easily accessible. This ultimately saves you time and effort during tax season.

-

How does airSlate SignNow ensure the security of K 1 tax forms?

airSlate SignNow prioritizes the security of your K 1 tax forms by employing advanced encryption and secure storage solutions. We comply with industry standards to protect sensitive information, ensuring that your documents are safe from unauthorized access. You can trust us to keep your data secure while you manage your tax forms.

Get more for Schedule K 1 Form PTE

Find out other Schedule K 1 Form PTE

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form