Form911 Rev 10 Request for Taxpayer Advocate Service Assistance and Application for Taxpayer Assistance Order 2024

Understanding Form 911: Request for Taxpayer Advocate Service Assistance

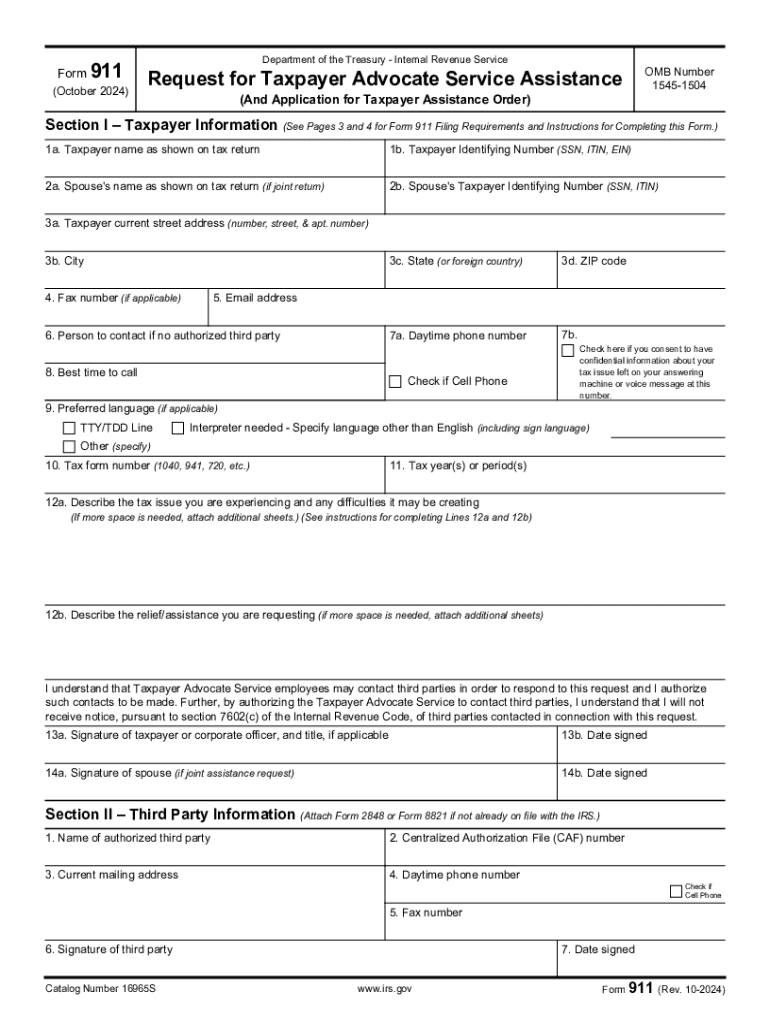

The Form 911, also known as the Request for Taxpayer Advocate Service Assistance and Application for Taxpayer Assistance Order, is designed to help taxpayers who are experiencing difficulties with the IRS. This form allows individuals to request assistance from the Taxpayer Advocate Service (TAS), which is an independent organization within the IRS. The TAS provides free help to taxpayers who are facing financial difficulties or who believe that their rights have been violated. Completing this form can initiate the process for receiving the necessary support and guidance regarding tax-related issues.

Steps to Complete Form 911

Completing Form 911 involves several key steps to ensure that your request for assistance is processed efficiently. Begin by gathering all relevant information, including your personal details, tax identification number, and a detailed description of your issue. Next, fill out the form accurately, providing clear information about your circumstances. Be sure to explain why you require assistance and any previous attempts you have made to resolve the issue with the IRS. After completing the form, review it for accuracy and completeness before submission.

Eligibility Criteria for Form 911

To qualify for assistance through Form 911, taxpayers must meet specific eligibility criteria. Generally, individuals who are experiencing financial hardship, facing an immediate threat of adverse action, or are unable to resolve their tax issues through normal IRS channels may qualify. Additionally, the TAS helps those who have not received a timely response from the IRS or who are experiencing significant delays in their tax matters. It is essential to provide sufficient documentation to support your claims when submitting the form.

Required Documents for Submission

When submitting Form 911, certain documents may be required to support your request for assistance. These documents can include proof of income, tax returns, correspondence with the IRS, and any other relevant records that demonstrate your situation. Providing comprehensive documentation can help expedite the review process and ensure that the Taxpayer Advocate Service has all necessary information to assist you effectively.

Form Submission Methods

Form 911 can be submitted through various methods, including online, by mail, or in person. For online submissions, taxpayers may use the IRS website to complete and send the form electronically. If opting for mail, ensure that the form is sent to the appropriate address as indicated in the instructions. In-person submissions can be made at local IRS offices, where assistance may also be available for completing the form. Each method has its advantages, so choose the one that best fits your needs.

IRS Guidelines for Form 911

The IRS provides specific guidelines for completing and submitting Form 911. These guidelines outline the necessary information to include, the submission process, and the expected timelines for receiving assistance. Familiarizing yourself with these guidelines can help ensure that your request is handled appropriately and that you receive the support you need in a timely manner. It is advisable to review the latest IRS publications related to Form 911 for any updates or changes in procedures.

Handy tips for filling out Form911 Rev 10 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order online

Quick steps to complete and e-sign Form911 Rev 10 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for optimum straightforwardness. Use signNow to e-sign and send out Form911 Rev 10 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form911 rev 10 request for taxpayer advocate service assistance and application for taxpayer assistance order

Create this form in 5 minutes!

How to create an eSignature for the form911 rev 10 request for taxpayer advocate service assistance and application for taxpayer assistance order

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is online assistance in the context of airSlate SignNow?

Online assistance with airSlate SignNow refers to the support and resources available to users as they navigate the platform. This includes tutorials, customer support, and community forums that help users maximize their experience. Our goal is to ensure that you have all the online assistance you need to efficiently send and eSign documents.

-

How does airSlate SignNow provide online assistance for new users?

For new users, airSlate SignNow offers comprehensive online assistance through step-by-step guides and video tutorials. These resources are designed to help you quickly understand how to use the platform effectively. Additionally, our customer support team is available to answer any questions you may have during your onboarding process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our pricing is competitive and designed to provide value, ensuring you receive the best online assistance for your investment. You can choose from monthly or annual subscriptions, with options that scale as your business grows.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features for document management, such as customizable templates, real-time tracking, and secure eSigning. These features enhance your workflow and provide the online assistance necessary to streamline your document processes. With our platform, you can manage your documents efficiently and securely.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM systems and cloud storage services. This allows you to enhance your workflow and receive online assistance from multiple platforms. Our integrations ensure that you can easily connect your existing tools with airSlate SignNow for a more efficient experience.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security for your documents. The online assistance we offer ensures that you can leverage these benefits fully. By streamlining your document processes, you can focus more on your core business activities.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore the platform's features and capabilities. During this trial, you will receive online assistance to help you understand how to utilize the tools effectively. This is a great way to determine if airSlate SignNow meets your business needs before committing to a subscription.

Get more for Form911 Rev 10 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order

Find out other Form911 Rev 10 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy