Form 8850 Tax Credit

What is the Form 8850 Tax Credit

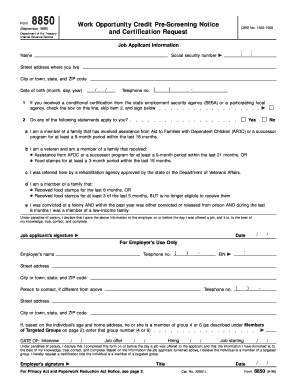

The Form 8850, officially known as the IRS Form 8850, is a critical document used to apply for the Work Opportunity Tax Credit (WOTC). This tax credit is designed to encourage employers to hire individuals from specific target groups who face barriers to employment. These groups include veterans, individuals receiving public assistance, and those with disabilities, among others. By completing and submitting this form, employers can potentially reduce their federal tax liability, making it an important tool for both job seekers and businesses.

Eligibility Criteria

To qualify for the tax credit associated with Form 8850, employers must hire individuals from designated target groups. The eligibility criteria include:

- Hiring individuals who are members of certain demographic groups, such as veterans, ex-felons, or long-term unemployed individuals.

- Ensuring that the new employee works a minimum number of hours within a specified period.

- Meeting any additional requirements set forth by the IRS related to the specific target group.

Understanding these criteria is essential for employers to maximize their tax benefits and support workforce diversity.

Steps to Complete the Form 8850 Tax Credit

Completing the Form 8850 involves several key steps to ensure accurate submission:

- Gather necessary information about the new hire, including their Social Security number and the target group they belong to.

- Fill out the form accurately, providing all required details in each section.

- Sign and date the form, ensuring that all information is correct before submission.

- Submit the completed form to the appropriate state workforce agency within the required timeframe.

Following these steps carefully helps ensure that the application for the tax credit is processed smoothly.

How to Obtain the Form 8850 Tax Credit

The Form 8850 can be obtained directly from the IRS website or through various tax preparation software. Employers can also request a printable version of the form in PDF format. It is essential to ensure that the most current version is used, as outdated forms may not be accepted. Additionally, many tax professionals can provide guidance on obtaining and completing the form.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of Form 8850. These guidelines outline the eligibility criteria, required documentation, and submission deadlines. Employers should familiarize themselves with these guidelines to avoid any compliance issues. It is also advisable to consult the IRS website for updates on any changes to the tax credit program or the form itself.

Required Documents

When submitting Form 8850, employers must include certain documents to support their application for the tax credit. These documents typically include:

- Proof of the new employee’s eligibility, such as documentation confirming their status as a member of a target group.

- Any additional forms or records required by the state workforce agency.

Having these documents ready can expedite the approval process and ensure compliance with IRS requirements.

Quick guide on how to complete form 8850 tax credit

Prepare Form 8850 Tax Credit with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb environmentally friendly solution to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Manage Form 8850 Tax Credit on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form 8850 Tax Credit effortlessly

- Find Form 8850 Tax Credit and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all your information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form 8850 Tax Credit while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8850 tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8850 form and why is it important?

The 8850 form is a document used by employers to apply for the Work Opportunity Tax Credit (WOTC) for hiring targeted groups of employees. Understanding the 8850 form is crucial for businesses looking to reduce their tax liabilities and encourage a diverse workforce. airSlate SignNow simplifies the process of eSigning and submitting the 8850 form, ensuring compliance and efficiency.

-

How can airSlate SignNow help with the 8850 form?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign the 8850 form securely. Our user-friendly interface allows for easy collaboration and quick turnaround, ensuring that your applications for the Work Opportunity Tax Credit are submitted swiftly. With airSlate SignNow, you can manage the 8850 form alongside your other important documents seamlessly.

-

What features does airSlate SignNow offer for handling the 8850 form?

airSlate SignNow offers features such as custom templates, document tracking, and automated reminders for the 8850 form. Users can easily customize their 8850 form templates to ensure compliance and correctness. Additionally, document security measures ensure that your sensitive information remains protected throughout the eSigning process.

-

Is there a cost associated with using airSlate SignNow for the 8850 form?

Yes, airSlate SignNow operates on a subscription-based pricing model that provides access to various features, including eSigning and document management for the 8850 form. There are different pricing tiers to accommodate businesses of all sizes, making it a cost-effective solution. The investment can lead to signNow financial benefits through tax credits associated with the successful submission of the 8850 form.

-

Can I integrate airSlate SignNow with other software for submitting the 8850 form?

Absolutely! airSlate SignNow supports various integrations with popular tools like CRM systems, cloud storage solutions, and project management software. This allows for a seamless workflow when working on the 8850 form and other documents. Integrating airSlate SignNow enhances productivity and ensures that your processes remain efficient.

-

What are the benefits of using airSlate SignNow for the 8850 form as a small business?

For small businesses, airSlate SignNow provides an accessible and efficient way to manage the 8850 form. The platform reduces the time and resources spent on paperwork, allowing small businesses to focus on growth. Furthermore, utilizing airSlate SignNow can improve compliance and error reduction in your 8850 form submissions.

-

How can I ensure the security of the 8850 form when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the 8850 form, by employing advanced encryption and compliance measures. Our platform adheres to industry standards for data protection, ensuring that your sensitive information remains safe during the eSigning process. You can confidently manage and submit the 8850 form knowing that your data is secure.

Get more for Form 8850 Tax Credit

- 5 day notice 497304435 form

- 5 day notice to pay rent or lease terminates nonresidential or commercial hawaii form

- Assignment of mortgage by individual mortgage holder hawaii form

- Assignment of mortgage by corporate mortgage holder hawaii form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property hawaii form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497304441 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property hawaii form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential hawaii form

Find out other Form 8850 Tax Credit

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement