Form 5522 Missouri Department of Revenue MO Gov

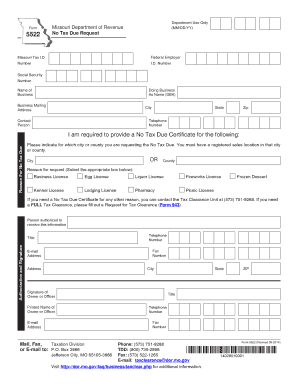

What is the Form 5522 Missouri Department Of Revenue?

The Form 5522 is a document issued by the Missouri Department of Revenue, primarily used for specific tax-related purposes. This form is essential for individuals and businesses to report certain information accurately to the state. Understanding the purpose of the form is crucial for ensuring compliance with state tax regulations.

How to obtain the Form 5522 Missouri Department Of Revenue

The Form 5522 can be obtained directly from the Missouri Department of Revenue's official website. Users can access the form in a downloadable format, allowing for easy printing and completion. Additionally, physical copies may be available at local Department of Revenue offices, ensuring that individuals without internet access can still obtain the necessary documentation.

Steps to complete the Form 5522 Missouri Department Of Revenue

Completing the Form 5522 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, such as identification numbers and relevant financial data. Next, fill out the form carefully, ensuring that all sections are completed as required. After filling out the form, review it for any errors before submitting it to the appropriate department. The final step is to retain a copy for your records, which is essential for future reference.

Legal use of the Form 5522 Missouri Department Of Revenue

The Form 5522 is legally binding when completed and submitted according to state regulations. To ensure its legal standing, it must be filled out accurately and signed by the appropriate parties. Compliance with Missouri state laws regarding tax documentation is essential for the form to be recognized as valid by the authorities.

Key elements of the Form 5522 Missouri Department Of Revenue

Key elements of the Form 5522 include personal identification information, tax identification numbers, and specific financial details relevant to the reporting requirements. Each section of the form is designed to capture essential data that the Missouri Department of Revenue needs to process tax information accurately. Understanding these elements helps in completing the form correctly and efficiently.

Form Submission Methods (Online / Mail / In-Person)

The Form 5522 can be submitted through various methods to accommodate different preferences. Individuals may choose to file the form online through the Missouri Department of Revenue's electronic filing system, which offers a quick and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate address provided by the Department or submitted in person at local offices. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete form 5522 missouri department of revenue mo gov

Effortlessly prepare Form 5522 Missouri Department Of Revenue MO gov on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Form 5522 Missouri Department Of Revenue MO gov on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to modify and electronically sign Form 5522 Missouri Department Of Revenue MO gov with ease

- Obtain Form 5522 Missouri Department Of Revenue MO gov and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal value as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 5522 Missouri Department Of Revenue MO gov and ensure exceptional communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5522 missouri department of revenue mo gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5522 and why is it important?

Form 5522 is a specific document used for various regulatory processes, often related to financial or compliance requirements. Utilizing airSlate SignNow to complete and eSign form 5522 streamlines your workflow, ensuring that documents are processed efficiently and securely.

-

How does airSlate SignNow handle form 5522 electronically?

With airSlate SignNow, you can easily upload and customize form 5522 for your specific needs. Our platform allows you to incorporate fillable fields, making it simple for recipients to complete the form electronically, which enhances accuracy and saves time.

-

Is there a cost associated with using airSlate SignNow for form 5522?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan includes features for electronically signing and managing documents, including form 5522, ensuring you receive a cost-effective solution to document management.

-

What are the key features of airSlate SignNow for managing form 5522?

Key features of airSlate SignNow for form 5522 include custom templates, real-time tracking, and secure storage. These features help you manage the signing process efficiently while ensuring compliance and enhancing document security.

-

Can I integrate airSlate SignNow with other applications for form 5522?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Workspace, Salesforce, and more. This allows you to seamlessly incorporate the electronic signing of form 5522 into your existing workflows and systems.

-

How secure is the signing process for form 5522 with airSlate SignNow?

The signing process for form 5522 through airSlate SignNow is highly secure. We implement industry-standard encryption, secure servers, and compliance with regulations like GDPR and HIPAA to ensure your sensitive data is protected.

-

What benefits does using airSlate SignNow for form 5522 offer?

Using airSlate SignNow for form 5522 enhances efficiency, reduces paper usage, and accelerates the signing process. Our platform ensures that documents are easily accessible, allowing you to focus more on your business operations rather than paperwork.

Get more for Form 5522 Missouri Department Of Revenue MO gov

- Hawaii foreign judgment enrollment hawaii form

- Hawaii estate 497304583 form

- Hawaii eviction form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497304585 form

- Hawaii annual file form

- Sample notices resolutions stock ledger and certificate hawaii form

- Minutes for organizational meeting hawaii hawaii form

- Hawaii sample letter form

Find out other Form 5522 Missouri Department Of Revenue MO gov

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online