How to Reactivate Standard Chartered Bank Account 2015

Understanding the Standard Chartered Dormant Account Activation

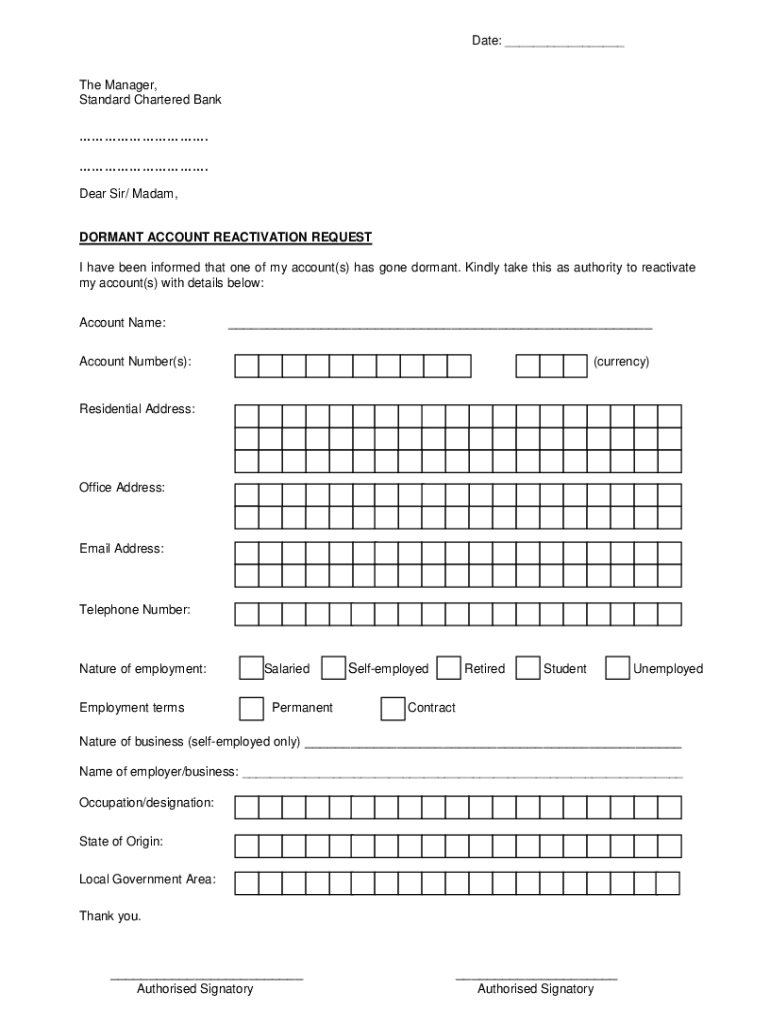

The process of reactivating a dormant account with Standard Chartered involves several key steps. A dormant account is typically one that has not had any transactions for a specified period, often considered inactive by the bank. To reactivate your account, you may need to provide identification and complete a specific application form. This ensures that the bank can verify your identity and comply with regulatory requirements.

Steps to Complete the Standard Chartered Dormant Account Activation

To successfully reactivate your dormant account, follow these essential steps:

- Gather necessary identification documents, such as a government-issued ID and proof of address.

- Obtain the dormant account activation form from Standard Chartered, either online or at a branch.

- Fill out the form accurately, ensuring all details match your identification documents.

- Submit the completed form along with the required documents either online or in person at a branch.

- Await confirmation from the bank regarding the status of your account reactivation.

Required Documents for Reactivating Your Account

When applying for the reactivation of your dormant account, you typically need to provide the following documents:

- A valid government-issued photo ID, such as a driver’s license or passport.

- Proof of address, which can be a utility bill or bank statement dated within the last three months.

- The completed dormant account activation form.

Legal Use of the Standard Chartered Dormant Account Activation Form

The dormant account activation form must be completed in accordance with legal standards to ensure its validity. This includes providing accurate information and signing the form where required. Electronic signatures are acceptable, provided they comply with the ESIGN and UETA regulations, which recognize the legality of eSignatures in the United States.

Application Process and Approval Time

The application process for reactivating a dormant account can vary based on individual circumstances. Typically, once you submit your application along with the required documents, the bank may take several business days to process your request. You will receive a notification regarding the approval status, which may include instructions on any further actions required to complete the reactivation.

Examples of Using the Dormant Account Activation Form

When filling out the dormant account activation form, you may encounter various scenarios. For instance, if you have multiple accounts with Standard Chartered, ensure that you specify which account you wish to reactivate. Additionally, if your identification documents have changed since your account was last active, provide updated information to avoid processing delays.

Quick guide on how to complete how to reactivate standard chartered bank account

Complete How To Reactivate Standard Chartered Bank Account effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a fantastic eco-friendly alternative to conventional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle How To Reactivate Standard Chartered Bank Account on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to edit and electronically sign How To Reactivate Standard Chartered Bank Account with ease

- Locate How To Reactivate Standard Chartered Bank Account and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring the reprinting of new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign How To Reactivate Standard Chartered Bank Account to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to reactivate standard chartered bank account

Create this form in 5 minutes!

How to create an eSignature for the how to reactivate standard chartered bank account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is standard chartered dormant account activation?

Standard Chartered dormant account activation is the process of reactivating a bank account that has been inactive for a specified period. This allows account holders to access their funds and continue using banking services without any penalties or fees. It is crucial for maintaining the account's good standing with the bank.

-

How can I activate my standard chartered dormant account?

To activate your standard chartered dormant account, you can visit the nearest branch, use the online banking portal, or contact customer service. You may need to provide identification and other relevant information to verify your identity. Once the process is initiated, you will regain access to your account immediately or within a few business days.

-

Are there any fees for standard chartered dormant account activation?

Typically, there are no charges associated with standard chartered dormant account activation. However, any outstanding fees or charges incurred during the account's dormancy may be applicable. Always check with your bank's policies to confirm any potential fees.

-

What documents are required for standard chartered dormant account activation?

To activate your standard chartered dormant account, you will generally need to provide a valid form of identification, such as a passport or driver's license. Additionally, you may need to submit proof of address and any other documents specified by the bank. It’s advisable to confirm the requirements directly with Standard Chartered.

-

What are the benefits of standard chartered dormant account activation?

Activating your standard chartered dormant account allows you to regain access to your funds and banking services, ensuring that your financial resources are being utilized effectively. It helps maintain your creditworthiness and avoids potential penalties. Furthermore, keeping your account active reduces the risk of it being closed by the bank due to inactivity.

-

Can I activate multiple standard chartered dormant accounts simultaneously?

Yes, you can activate multiple standard chartered dormant accounts at the same time, provided you meet the identification and documentation requirements for each account. It's recommended to check with Standard Chartered to understand the specific processes for activating multiple accounts to ensure a smooth experience.

-

Is there a time limit for standard chartered dormant account activation?

While there is no strict time limit for standard chartered dormant account activation, it’s advisable to activate your account as soon as possible to avoid potential fees or account closure. Each bank may have its own policies regarding dormancy periods, so keeping track of your account activity is beneficial.

Get more for How To Reactivate Standard Chartered Bank Account

- Idaho cancellation form

- Satisfaction release or cancellation of deed of trust by individual idaho form

- Partial release of property from deed of trust for corporation idaho form

- Partial release of property from deed of trust for individual idaho form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy idaho form

- Warranty deed for parents to child with reservation of life estate idaho form

- Idaho community property form

- Warranty deed for separate or joint property to joint tenancy idaho form

Find out other How To Reactivate Standard Chartered Bank Account

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template