Request for Re Activation of a Dormant Account Branch 2024-2026

Understanding the Request for Reactivation of a Dormant Account

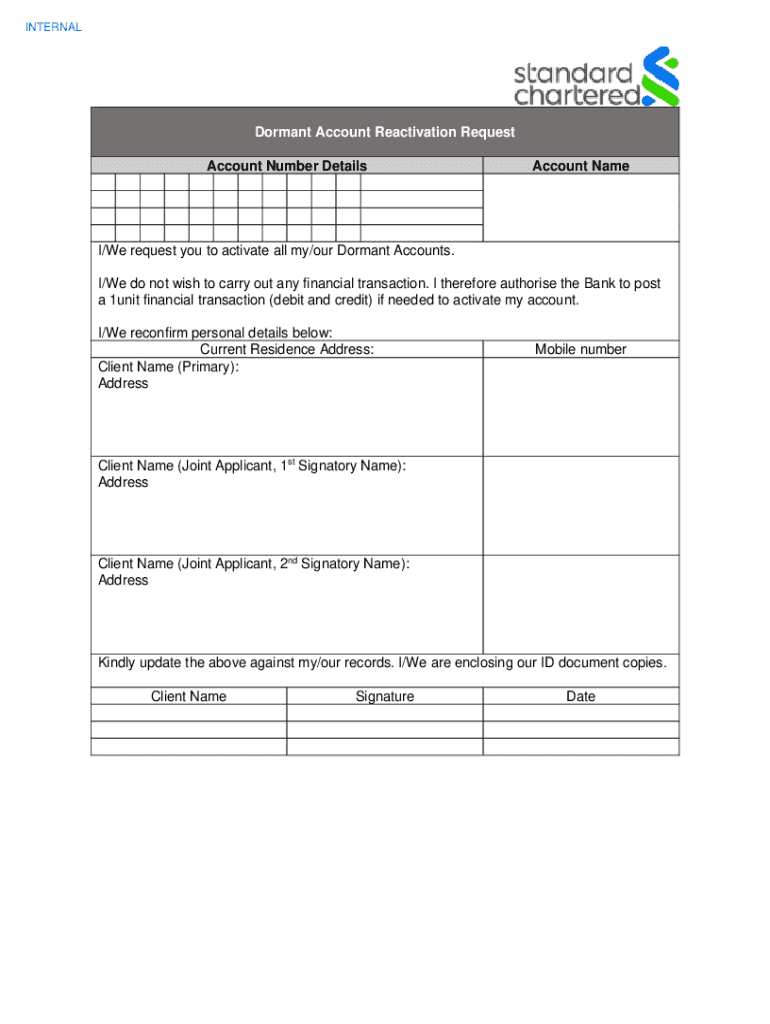

The Request for Reactivation of a Dormant Account is a formal document that customers must submit to their bank when they wish to reactivate an account that has been inactive for a specified period. This document typically requires the account holder to provide personal identification details, account information, and any other relevant data that the bank may need to verify the identity of the requester. Understanding the requirements and implications of this request is crucial for a smooth reactivation process.

Steps to Complete the Request for Reactivation of a Dormant Account

Completing the Request for Reactivation of a Dormant Account involves several key steps:

- Gather necessary personal identification documents, such as a government-issued ID and Social Security number.

- Locate your dormant account information, including the account number and any associated details.

- Fill out the request form accurately, ensuring all required fields are completed.

- Submit the form to your bank through the designated method, whether online, by mail, or in person.

- Follow up with the bank to confirm receipt of your request and inquire about the reactivation timeline.

Required Documents for Reactivation

When submitting the Request for Reactivation of a Dormant Account, specific documents are typically required to validate your identity and ownership of the account. These may include:

- A valid government-issued photo ID, such as a driver's license or passport.

- Proof of address, such as a utility bill or lease agreement.

- Any additional forms that the bank might specify, such as a signature verification form.

Form Submission Methods

The Request for Reactivation of a Dormant Account can usually be submitted through various methods, depending on the bank's policies. Common submission methods include:

- Online submission through the bank's secure portal.

- Mailing the completed form to the bank's designated address.

- Visiting a local branch to submit the request in person.

Eligibility Criteria for Reactivation

To successfully reactivate a dormant account, customers must meet certain eligibility criteria set by the bank. Generally, these criteria include:

- The account must be in the customer's name.

- The account should not have any outstanding debts or negative balances.

- The account holder must provide valid identification and any requested documentation.

Legal Use of the Request for Reactivation

The Request for Reactivation of a Dormant Account is not only a procedural formality but also a legal document that affirms the account holder's intent to regain access to their funds. It is essential that the information provided is accurate and truthful, as any discrepancies can lead to delays or denial of the request. Additionally, banks are required to comply with federal and state regulations regarding dormant accounts, which may include specific timelines for reactivation and customer notification.

Create this form in 5 minutes or less

Find and fill out the correct request for re activation of a dormant account branch

Create this form in 5 minutes!

How to create an eSignature for the request for re activation of a dormant account branch

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What steps do I need to follow to reactivate my Standard Chartered bank account?

To reactivate your Standard Chartered bank account, you should first contact customer service or visit a local branch. They will guide you through the necessary steps, which may include verifying your identity and updating your account information. It's essential to have your identification documents ready to expedite the process.

-

Are there any fees associated with reactivating my Standard Chartered bank account?

Typically, there are no fees for reactivating your Standard Chartered bank account. However, it's advisable to check with customer service for any specific conditions or potential charges that may apply based on your account type. Understanding these details can help you avoid unexpected costs.

-

Can I reactivate my Standard Chartered bank account online?

Yes, you can reactivate your Standard Chartered bank account online through the bank's official website or mobile app. Simply log in to your account and follow the prompts for reactivation. If you encounter any issues, customer support is available to assist you.

-

What documents do I need to reactivate my Standard Chartered bank account?

To reactivate your Standard Chartered bank account, you will typically need to provide identification documents such as a government-issued ID and proof of address. Additional documentation may be required depending on your account status. Always check with the bank for the most accurate requirements.

-

How long does it take to reactivate my Standard Chartered bank account?

The reactivation process for your Standard Chartered bank account can vary, but it usually takes a few business days. Once you submit the necessary information and documents, the bank will process your request and notify you once your account is active again. Patience is key during this time.

-

Will I lose my account history when I reactivate my Standard Chartered bank account?

No, reactivating your Standard Chartered bank account should not result in the loss of your account history. All previous transactions and account details should remain intact. If you have concerns, it's best to confirm with customer service before proceeding.

-

What benefits do I gain by reactivating my Standard Chartered bank account?

By reactivating your Standard Chartered bank account, you regain access to your funds, online banking features, and other banking services. This can enhance your financial management and provide you with the tools needed for effective budgeting and transactions. It's a step towards regaining control of your finances.

Get more for Request For Re Activation Of A Dormant Account Branch

Find out other Request For Re Activation Of A Dormant Account Branch

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free