Formulario 499 R 4 2016-2026

What is the Formulario 499 R 4

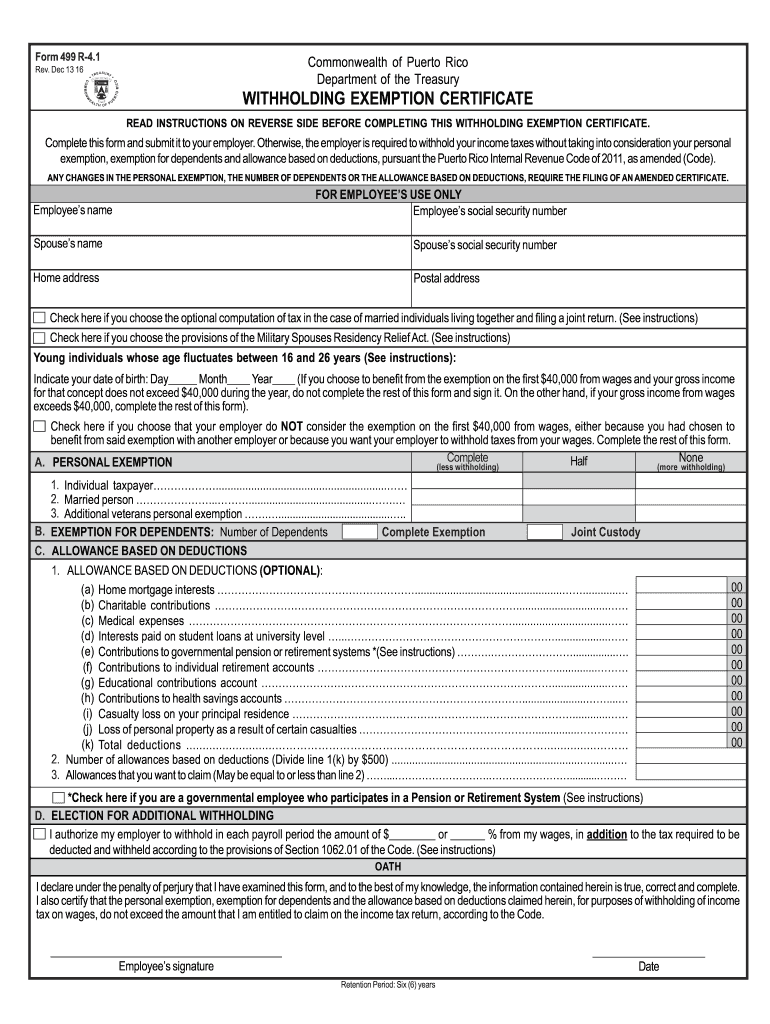

The Formulario 499 R 4 is a tax form used in Puerto Rico for individuals and entities to report their income and claim withholding exemptions. This form is essential for ensuring compliance with Puerto Rico's tax regulations and is particularly relevant for those who receive income subject to withholding. The 499 R 4 serves as a declaration for the withholding exemption certificate, allowing taxpayers to reduce the amount of tax withheld from their income based on their eligibility.

How to use the Formulario 499 R 4

Using the Formulario 499 R 4 involves several steps to ensure accurate reporting and compliance with tax laws. First, gather all necessary information regarding your income and any applicable exemptions. Next, fill out the form with your personal details, including your name, address, and tax identification number. Be sure to indicate the specific exemptions you are claiming. Once completed, review the form for accuracy before submitting it to the relevant tax authority. This process can be done electronically or by mail, depending on your preference and the requirements set forth by the Puerto Rico Department of Treasury.

Steps to complete the Formulario 499 R 4

Completing the Formulario 499 R 4 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including your income statements and previous tax returns.

- Provide your personal information, ensuring it matches your official identification.

- List all sources of income and any applicable deductions or exemptions.

- Double-check all entries for accuracy to avoid delays in processing.

- Submit the completed form electronically or by mail, following the guidelines provided by the tax authority.

Legal use of the Formulario 499 R 4

The Formulario 499 R 4 is legally recognized as a valid document for reporting income and claiming withholding exemptions in Puerto Rico. It adheres to the regulations set by the Puerto Rico Department of Treasury, ensuring that taxpayers can fulfill their obligations while minimizing their tax liabilities. Proper use of this form is crucial for compliance, as submitting inaccurate or incomplete information may result in penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 499 R 4 are critical for maintaining compliance with tax regulations. Typically, the form must be submitted by the end of the tax year, but specific deadlines can vary based on individual circumstances and changes in tax law. It is advisable to check with the Puerto Rico Department of Treasury for the most current deadlines to ensure timely submission and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Formulario 499 R 4 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically through the Puerto Rico Department of Treasury's online portal, which offers a streamlined process.

- Mail: For those who prefer traditional methods, the form can be printed, completed, and mailed to the appropriate tax office.

- In-Person: Taxpayers may also choose to submit the form in person at designated tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete puerto rico exemption form 2016 2019

Your assistance manual on preparing your Formulario 499 R 4

If you’re wondering how to fill out and submit your Formulario 499 R 4, here are some straightforward instructions to simplify the tax filing process.

To begin, you just need to register your airSlate SignNow account to revolutionize your document handling online. airSlate SignNow is an intuitive and robust document tool that enables you to adjust, create, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to modify any responses as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your Formulario 499 R 4 in minutes:

- Register your account and start editing PDFs in no time.

- Browse our catalog to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Formulario 499 R 4 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can heighten the risk of mistakes and postpone refunds. It’s important to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct puerto rico exemption form 2016 2019

Create this form in 5 minutes!

How to create an eSignature for the puerto rico exemption form 2016 2019

How to generate an electronic signature for your Puerto Rico Exemption Form 2016 2019 online

How to generate an eSignature for the Puerto Rico Exemption Form 2016 2019 in Chrome

How to generate an eSignature for signing the Puerto Rico Exemption Form 2016 2019 in Gmail

How to make an electronic signature for the Puerto Rico Exemption Form 2016 2019 right from your mobile device

How to generate an electronic signature for the Puerto Rico Exemption Form 2016 2019 on iOS

How to generate an eSignature for the Puerto Rico Exemption Form 2016 2019 on Android

People also ask

-

What is Formulario 499 R 4 and how can airSlate SignNow help?

Formulario 499 R 4 is a tax form used for reporting specific financial activities. With airSlate SignNow, you can easily send, eSign, and manage Formulario 499 R 4 documents in a secure and efficient manner. Our platform streamlines the signing process, ensuring compliance and accuracy in your submissions.

-

How does airSlate SignNow ensure the security of my Formulario 499 R 4?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your Formulario 499 R 4 and other sensitive documents. Additionally, our platform complies with industry standards, providing you peace of mind when handling your important paperwork.

-

Can I customize the Formulario 499 R 4 using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Formulario 499 R 4 to fit your specific needs. You can add fields, adjust formatting, and incorporate branding elements to ensure that your document aligns with your business’s identity. This flexibility helps you maintain professionalism while addressing your requirements.

-

What are the pricing options for using airSlate SignNow with Formulario 499 R 4?

airSlate SignNow offers various pricing plans to accommodate different business needs when dealing with Formulario 499 R 4. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget and document volume. Check our website for detailed pricing information and choose the best option for your organization.

-

Is it easy to integrate airSlate SignNow with other software for Formulario 499 R 4?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software applications, making it easy to incorporate Formulario 499 R 4 into your existing workflows. Whether you use CRM, project management, or accounting tools, our integration capabilities enhance efficiency and streamline your document processes.

-

What features does airSlate SignNow offer for managing Formulario 499 R 4?

airSlate SignNow offers a comprehensive suite of features for managing Formulario 499 R 4, including electronic signing, templates, document tracking, and collaboration tools. These features empower users to handle their documents efficiently, ensuring quick turnaround times and enhanced productivity.

-

Can I track the status of my Formulario 499 R 4 easily with airSlate SignNow?

Yes, tracking the status of your Formulario 499 R 4 is straightforward with airSlate SignNow. Our platform provides real-time updates and notifications, so you always know where your document stands in the signing process. This feature helps you stay organized and informed throughout the workflow.

Get more for Formulario 499 R 4

- 18 vision development milestones from birth to babys first birthday form

- Form 8060 55

- Plainedge girls softball association eteamz form

- Pizza taste test score sheet form

- Ohio professional registry form

- Changes to california business entity filings effective form

- International diploma verification form pdf

- Application to change contractor business name form

Find out other Formulario 499 R 4

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later