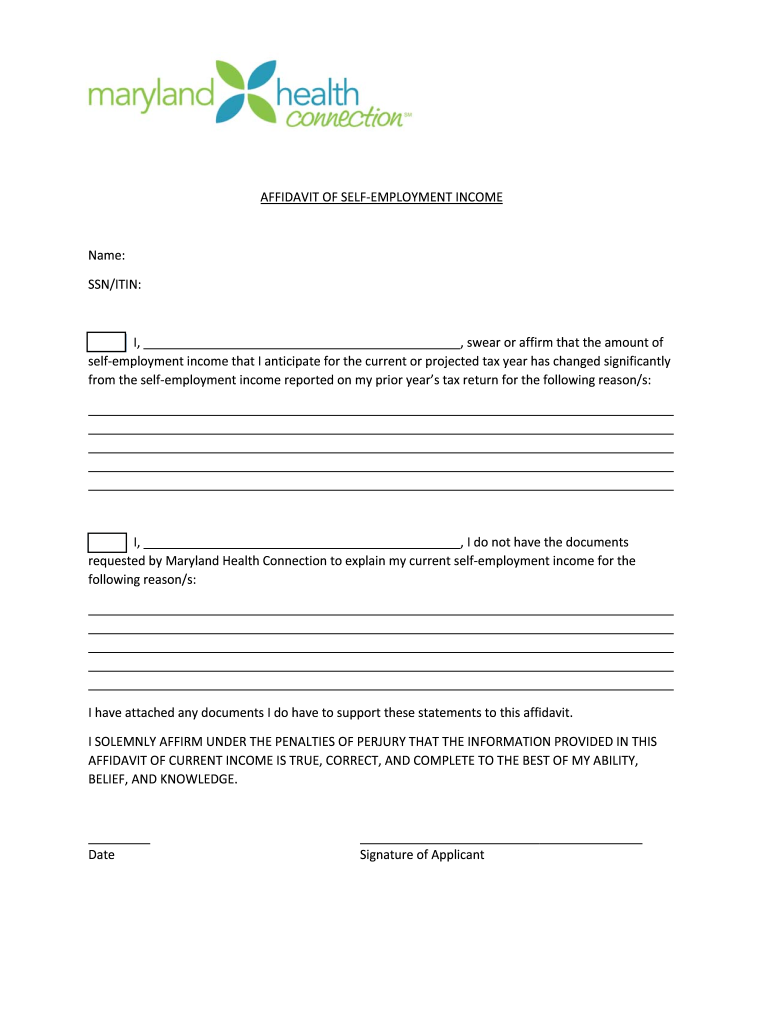

Affidavit of Self Employment Income Form

What is the Affidavit of Self Employment Income

The affidavit of self employment income is a legal document used to verify an individual's income derived from self-employment. This form is often required by various organizations, including financial institutions and government agencies, to assess eligibility for loans, benefits, or other financial assistance. It serves as a sworn statement that outlines the individual's income sources and amounts, providing a clear picture of their financial situation.

How to use the Affidavit of Self Employment Income

This affidavit can be utilized in multiple scenarios, such as applying for health insurance, securing a loan, or verifying income for tax purposes. To use the affidavit effectively, individuals need to fill it out accurately, ensuring all income sources are documented. Once completed, the affidavit must be signed in the presence of a notary public to authenticate the document, making it legally binding.

Steps to complete the Affidavit of Self Employment Income

Completing the affidavit involves several key steps:

- Gather necessary financial documents, such as tax returns, profit and loss statements, and bank statements.

- Fill out the affidavit with accurate information regarding your self-employment income.

- Review the document for completeness and accuracy.

- Sign the affidavit in front of a notary public to ensure its legal validity.

Key elements of the Affidavit of Self Employment Income

Important components of the affidavit include:

- Your full name and contact information.

- A detailed description of your self-employment activities.

- Income amounts from various sources, typically averaged over a specified period.

- A declaration affirming the truthfulness of the information provided.

- Signature and date, along with the notary's acknowledgment.

Legal use of the Affidavit of Self Employment Income

The affidavit of self employment income is legally recognized in the United States, provided it meets certain criteria. It must be signed by the individual claiming the income and notarized to ensure authenticity. This legal standing allows it to be used in various applications, including loan approvals and government assistance programs, making it a vital document for self-employed individuals.

Required Documents

When preparing to complete the affidavit, individuals should have the following documents on hand:

- Recent tax returns, typically for the last two years.

- Profit and loss statements that reflect income and expenses.

- Bank statements that corroborate income claims.

- Any contracts or agreements related to self-employment work.

Quick guide on how to complete affidavit of self employment income maryland health connection

Complete Affidavit Of Self Employment Income effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Handle Affidavit Of Self Employment Income on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Affidavit Of Self Employment Income smoothly

- Obtain Affidavit Of Self Employment Income and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Select how you want to share your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Affidavit Of Self Employment Income to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

To use Google AdMob in my iOS apps, do I need to fill out a form, similar to Apple's "Paid Applications" contract? And do I need to connect it to Apple somehow (so that they can take a share of the ad income)?

Hi ,To integrate ADMob in your application, no need to fill out form or connect with apple , Complete the following steps to link an app.Sign in to your AdMob account at https://apps.admob.com.Click Apps in the sidebar.Select the name of the app you want to link. Note: If you don't see it in the list of recent apps, you can click All apps, then click the name of the app.Click App settings in the sidebar.Click the icon in the "App info" section.Click the link to link your app with the appropriate app store. A dialog box appears.Enter the app name, developer name, app ID, and/or OS and click Search. Note: If an Android app doesn't appear in the search results in AdMob and it's been at least 1 week since you published it, our Application Visibility and Discoverability troubleshooter may help.Click Select beside the app you want to link to.If you need any help you can connect with us at Kodesoft TechnologiesOr If you have any idea in your mind. do share your idea at - Kodesoft Technologies

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

If I am the owner of my business, do I need to fill out the column that asks for my annual income if employed in the visa forms for B2 visa application?

Well I thought that I shouldn't fill that and when I applied, I didn't. However an immigration attorney later told me that it was a mistake to not fill that up. I didn't agreed with him though.I don't have any arguments in favour or against it, but definitely it says if you are an employee so I strongly believe it should be skipped.But on other hand, how do Visa officer knows that how much you are earning ?Tough situation so maybe more consultants need to share their opinion.

Create this form in 5 minutes!

How to create an eSignature for the affidavit of self employment income maryland health connection

How to make an eSignature for the Affidavit Of Self Employment Income Maryland Health Connection online

How to make an eSignature for the Affidavit Of Self Employment Income Maryland Health Connection in Chrome

How to generate an eSignature for signing the Affidavit Of Self Employment Income Maryland Health Connection in Gmail

How to generate an eSignature for the Affidavit Of Self Employment Income Maryland Health Connection right from your smart phone

How to create an electronic signature for the Affidavit Of Self Employment Income Maryland Health Connection on iOS devices

How to create an eSignature for the Affidavit Of Self Employment Income Maryland Health Connection on Android OS

People also ask

-

What is an affidavit of self employment income?

An affidavit of self employment income is a legal document that verifies an individual's income from self-employment. This document is often required by lenders or financial institutions to assess creditworthiness. It's essential for freelancers and entrepreneurs to have a reliable way to present their income, which is where airSlate SignNow can help.

-

How can airSlate SignNow help me create an affidavit of self employment income?

airSlate SignNow provides an easy-to-use platform to create, sign, and send an affidavit of self employment income. You can customize your document with templates, add necessary fields, and collect eSignatures efficiently. This streamlines the process, allowing you to focus on managing your business.

-

What features does airSlate SignNow offer for managing my affidavit of self employment income?

With airSlate SignNow, you can create templates for your affidavit of self employment income, eSign documents any time, and set reminders for deadlines. The platform also allows you to track document status and automatically store completed forms securely. This makes document management simpler and more organized.

-

Is airSlate SignNow cost-effective for creating an affidavit of self employment income?

Yes, airSlate SignNow is a cost-effective solution for creating an affidavit of self employment income. With transparent pricing plans and features designed to save you time and money, it’s an economical choice for self-employed individuals. The efficiency gained can ultimately lead to increased productivity.

-

Can I integrate airSlate SignNow with other tools for my affidavit of self employment income?

Absolutely! airSlate SignNow integrates seamlessly with various software applications such as Google Drive, Salesforce, and Dropbox. This allows you to easily manage your affidavit of self employment income alongside your other business tools, enhancing workflow and document accessibility.

-

What benefits can I expect from using airSlate SignNow for my affidavit of self employment income?

By using airSlate SignNow, you benefit from increased efficiency and reduced turnaround times for your affidavit of self employment income. The platform’s user-friendly interface and secure eSigning capabilities elevate the signing process. This results in faster approvals and a more professional presentation of your financial information.

-

How secure is the eSigning process for my affidavit of self employment income with airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform uses bank-level encryption to ensure that your affidavit of self employment income and other documents are protected. Additionally, eSignatures are legally binding, thus adding an extra layer of security and authenticity to your signed documents.

Get more for Affidavit Of Self Employment Income

- Jd request form huntington district u s army

- Rent arrears payment plan template form

- Unclaimed property utah form

- Celebrate recovery leader requirements form

- Wir sind an der anmietung des objektes form

- Goethe c1 prfung pdf form

- Printable car gift letter family member 183608 form

- Uez annual report form

Find out other Affidavit Of Self Employment Income

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free