Arizona Fillable Form 140py

What is the Arizona Fillable Form 140py

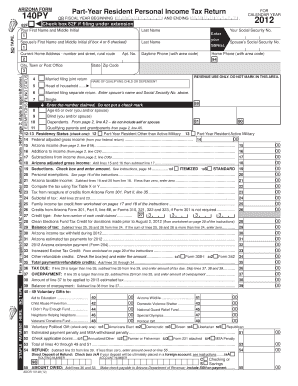

The Arizona Fillable Form 140py is a state-specific tax form used by residents of Arizona to report their income and calculate their tax liability. This form is particularly designed for individuals who have income from sources other than wages, such as self-employment or rental income. It is essential for ensuring compliance with Arizona tax laws and is a key document for filing state taxes accurately.

How to use the Arizona Fillable Form 140py

Using the Arizona Fillable Form 140py involves several steps to ensure that all required information is accurately provided. Begin by downloading the form from a reliable source. Next, fill in your personal information, including your name, address, and Social Security number. Follow the instructions carefully to report your income, deductions, and credits. Once completed, review the form for accuracy before submitting it.

Steps to complete the Arizona Fillable Form 140py

Completing the Arizona Fillable Form 140py requires careful attention to detail. Here are the steps to follow:

- Download the form from an authorized website.

- Fill in your personal details in the designated sections.

- Report your income, ensuring you include all applicable sources.

- Claim any deductions or credits you are eligible for.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Arizona Fillable Form 140py

The Arizona Fillable Form 140py is legally binding when filled out and submitted according to state regulations. To ensure its legal validity, it is important to comply with all requirements set forth by the Arizona Department of Revenue. This includes providing accurate information and submitting the form by the designated deadline. Utilizing a secure electronic signature can further enhance the form's legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Fillable Form 140py are crucial for compliance. Typically, the form must be submitted by April 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Arizona Department of Revenue's official announcements for any changes to deadlines or additional important dates related to tax filing.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Fillable Form 140py can be submitted through various methods. Taxpayers may choose to file online using the Arizona Department of Revenue's e-filing system, which is often the fastest option. Alternatively, the completed form can be printed and mailed to the appropriate address. Some individuals may also opt to submit the form in person at designated tax offices. Each method has its own processing times and requirements.

Quick guide on how to complete arizona fillable form 140py

Complete Arizona Fillable Form 140py seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the resources needed to draft, revise, and electronically sign your documents swiftly without delays. Handle Arizona Fillable Form 140py on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Arizona Fillable Form 140py effortlessly

- Find Arizona Fillable Form 140py and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Arizona Fillable Form 140py and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona fillable form 140py

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Fillable Form 140py?

The Arizona Fillable Form 140py is a digital tax form that allows residents to file their personal income taxes efficiently. It simplifies the filing process by providing fillable fields and automatic calculations, ensuring accuracy and ease of use.

-

How can I access the Arizona Fillable Form 140py?

You can easily access the Arizona Fillable Form 140py through the airSlate SignNow platform. Simply create an account, navigate to the forms section, and search for the 140py form to start filling it out online.

-

What features does the Arizona Fillable Form 140py offer?

The Arizona Fillable Form 140py includes features like eSignature capabilities, automatic data saving, and real-time validation checks. These features ensure that your form is completed correctly, helping you avoid penalties and delays in your tax filing.

-

Is the Arizona Fillable Form 140py secure?

Yes, the Arizona Fillable Form 140py is secure when using airSlate SignNow. The platform employs advanced encryption technology to protect your personal information and documents, giving you peace of mind while filing your taxes.

-

Can I integrate the Arizona Fillable Form 140py with other software?

Absolutely! The Arizona Fillable Form 140py can be integrated with various accounting and finance software tools available in the airSlate SignNow ecosystem. This allows for seamless data transfer and enhances your overall tax preparation workflow.

-

What are the benefits of using the Arizona Fillable Form 140py?

Using the Arizona Fillable Form 140py streamlines your tax filing process and reduces the chances of errors. The user-friendly interface and integrated eSignature options make it a convenient choice for both individuals and businesses looking to save time and ensure compliance.

-

Is there a cost associated with the Arizona Fillable Form 140py?

The Arizona Fillable Form 140py is available through airSlate SignNow at an affordable price. Pricing plans vary depending on the features you require and the size of your business, making it a cost-effective solution for all users.

Get more for Arizona Fillable Form 140py

Find out other Arizona Fillable Form 140py

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors