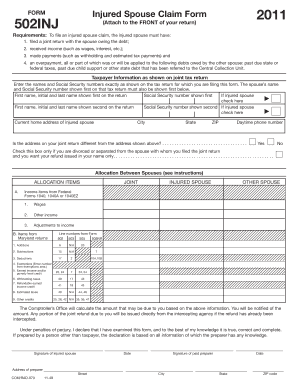

502 Injured Spouse Form

What is the 502 Injured Spouse Form

The 502 Injured Spouse Form is a tax form used by individuals in the United States to request their share of a tax refund that may have been applied to their spouse's past-due debts, such as child support or federal student loans. This form is particularly relevant for married couples who file jointly but want to protect their portion of the refund from being withheld due to their spouse's financial obligations. By submitting this form, the injured spouse can claim their rightful share of the refund, ensuring that their financial interests are safeguarded.

How to use the 502 Injured Spouse Form

Using the 502 Injured Spouse Form involves several steps to ensure that the process is completed accurately. First, gather all necessary information, including your tax return details and any documentation related to your spouse's debts. Next, fill out the form with accurate information, ensuring that you specify your claim to the refund. After completing the form, submit it to the appropriate tax authority, either electronically or via mail. It is essential to keep copies of all submitted documents for your records and to track the status of your claim.

Steps to complete the 502 Injured Spouse Form

Completing the 502 Injured Spouse Form requires careful attention to detail. Follow these steps:

- Obtain the form from the IRS website or a trusted source.

- Fill in your personal information, including your name, Social Security number, and address.

- Provide your spouse's information, ensuring accuracy to avoid delays.

- Indicate the amount of the refund you are claiming and any relevant financial details.

- Review the form for any errors or omissions before submission.

Legal use of the 502 Injured Spouse Form

The 502 Injured Spouse Form is legally recognized under U.S. tax law, allowing individuals to assert their rights to tax refunds. It is important to understand that this form must be filed correctly and within specified deadlines to be considered valid. The form serves as a legal document that provides evidence of your claim, and proper completion ensures compliance with IRS regulations. Failure to adhere to these legal requirements may result in delays or denial of your claim.

Eligibility Criteria

To qualify for using the 502 Injured Spouse Form, certain criteria must be met. You must be married and filing a joint tax return. Additionally, you should not be liable for the debts that led to the refund being withheld. If your spouse has past-due obligations that affect your tax refund, you may be eligible to file this form. It is crucial to assess your eligibility before submission to ensure that your claim is valid and supported by the necessary documentation.

Filing Deadlines / Important Dates

Filing deadlines for the 502 Injured Spouse Form align with the general tax filing deadlines in the United States. Typically, the deadline for submitting your tax return, along with the form, is April fifteenth of each year. If you miss this deadline, you may still file for an extension, but it is essential to submit the form as soon as possible to avoid losing your claim to the refund. Keeping track of these important dates is vital for ensuring the timely processing of your request.

Quick guide on how to complete 502 injured spouse form

Complete 502 Injured Spouse Form effortlessly on any device

Online document management has gained popularity among organizations and individuals alike. It offers a perfect environmentally-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage 502 Injured Spouse Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The optimal method to modify and electronically sign 502 Injured Spouse Form with ease

- Find 502 Injured Spouse Form and click Get Form to begin.

- Make use of the tools provided to complete your form.

- Emphasize important sections of the documents or conceal sensitive details using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method of sharing the form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 502 Injured Spouse Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 502 injured spouse form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 502 Injured Spouse Form?

The 502 Injured Spouse Form is a tax form that allows a spouse to claim their portion of a tax refund if the other spouse has debts that could offset it. This form is particularly important for individuals who want to protect their tax refund from being seized due to their partner's financial obligations. Understanding the application process of the 502 Injured Spouse Form can help you safeguard your financial rights.

-

How do I fill out the 502 Injured Spouse Form?

To fill out the 502 Injured Spouse Form, start by gathering necessary tax documents, including your tax returns and any relevant financial information. Ensure that you complete all sections correctly, particularly those pertaining to your income and your spouse's debts. A properly completed 502 Injured Spouse Form is critical for an accurate and timely refund.

-

What are the benefits of using airSlate SignNow for the 502 Injured Spouse Form?

Using airSlate SignNow for your 502 Injured Spouse Form allows you to eSign documents securely and efficiently, speeding up the submission process. The platform offers a user-friendly interface and robust features, helping you navigate the form with ease. Additionally, our solutions are cost-effective, ensuring you can manage your tax filings without breaking the bank.

-

Is there a cost associated with submitting the 502 Injured Spouse Form through airSlate SignNow?

While the 502 Injured Spouse Form itself is free to submit through the IRS, using airSlate SignNow may involve a nominal subscription fee. This fee provides access to premium features that streamline document management and eSigning. Overall, the affordability and efficiency of airSlate SignNow make it a worthwhile investment for handling your tax forms.

-

Can I save my 502 Injured Spouse Form for future use?

Yes, with airSlate SignNow, you can easily save your completed 502 Injured Spouse Form for future reference. This feature allows you to revisit and edit your form as needed, making annual tax filings more straightforward. It helps you stay organized and prepared for any upcoming financial obligations.

-

Does airSlate SignNow offer any integrations for accounting software when dealing with the 502 Injured Spouse Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enabling you to easily import and export data related to your 502 Injured Spouse Form. This integration simplifies the financial tracking process and enhances workflow efficiency, ensuring your tax documents are up to date and accurate.

-

What if I make a mistake on my 502 Injured Spouse Form?

If you discover a mistake on your 502 Injured Spouse Form, you can amend it by submitting a corrected version to the IRS. It's essential to address any errors promptly to avoid delays in processing your refund. AirSlate SignNow allows you to edit and replace documents effortlessly, minimizing potential issues.

Get more for 502 Injured Spouse Form

- Assignment of deed of trust by individual mortgage holder texas form

- Texas holder 497327581 form

- 3 day notice 497327582 form

- Texas pay rent form

- Texas vacate form

- 30 day notice to terminate month to month lease residential from landlord to tenant texas form

- Notice terminate lease form

- 30 day notice to terminate month to month lease for residential from tenant to landlord texas form

Find out other 502 Injured Spouse Form

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast