Form 8ta Ex

What is the Form 8ta ne?

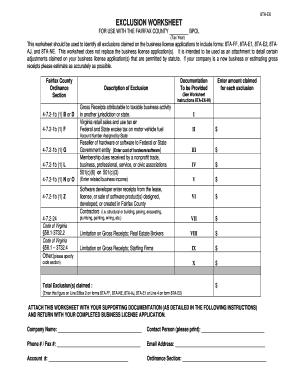

The Form 8ta ne is a document used in specific legal and administrative contexts, particularly within Fairfax County. It serves various purposes, including applications, notifications, or declarations required by local government entities. Understanding its function is crucial for ensuring compliance with local regulations.

Steps to complete the Form 8ta ne

Completing the Form 8ta ne involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, such as personal details and any supporting documentation. Carefully fill out each section of the form, ensuring that all entries are clear and legible. After completing the form, review it thoroughly for any errors before submission.

Legal use of the Form 8ta ne

The legal validity of the Form 8ta ne hinges on its proper execution and adherence to relevant laws. To be considered legally binding, the form must be signed by the appropriate parties, and any required notarization must be completed. Utilizing a reliable eSignature platform can enhance the security and authenticity of the document.

Form Submission Methods

The Form 8ta ne can typically be submitted through various methods, including online, by mail, or in person. Each method has specific requirements and processing times, so it is essential to choose the one that best fits your needs. Ensure that you follow the guidelines for the chosen submission method to avoid delays or complications.

Key elements of the Form 8ta ne

Understanding the key elements of the Form 8ta ne is essential for proper completion. Important components include the title of the form, the purpose it serves, and the sections that require specific information. Additionally, the form may include areas for signatures and dates, which are critical for its legal validity.

Required Documents

When completing the Form 8ta ne, certain documents may be required to support your application or declaration. Commonly needed documents include identification, proof of residency, and any relevant financial records. Gathering these documents in advance can streamline the process and ensure that your submission is complete.

Quick guide on how to complete form 8ta ex

Effortlessly prepare Form 8ta Ex on any device

The management of documents online has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow offers you all the tools required to swiftly create, modify, and eSign your documents without delays. Manage Form 8ta Ex on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 8ta Ex with ease

- Obtain Form 8ta Ex and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that function.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8ta Ex and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8ta ex

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 8ta ne and how does it relate to airSlate SignNow?

8ta ne refers to the innovative features offered by airSlate SignNow for document signing and management. With 8ta ne, businesses can easily send and eSign documents, streamlining their workflow and enhancing efficiency.

-

How does airSlate SignNow pricing work?

The pricing for airSlate SignNow is structured to provide flexibility and value for businesses of all sizes. With options that fit varying budgets, the 8ta ne solution ensures that companies can choose a plan that best suits their needs without sacrificing essential features.

-

What features does airSlate SignNow offer for eSigning?

airSlate SignNow features robust eSigning capabilities that include customizable templates, advanced security measures, and user-friendly interfaces. The 8ta ne offerings ensure that users can sign documents from anywhere, at any time, making the process efficient and reliable.

-

How can airSlate SignNow benefit my business?

Using airSlate SignNow provides numerous benefits, including time savings, improved accuracy, and enhanced customer satisfaction. The 8ta ne solution automates many document processes, allowing your team to focus on core business activities and drive growth.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with a variety of applications, enhancing its functionality. The 8ta ne feature set allows businesses to connect with CRM systems, cloud storage services, and more, creating a cohesive digital environment.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and data protection measures. With the 8ta ne capabilities, businesses can confidently manage sensitive documents, ensuring compliance with industry regulations.

-

What types of documents can be signed using airSlate SignNow?

airSlate SignNow supports the signing of various document types, including contracts, agreements, and forms. The versatility of the 8ta ne solution allows businesses to handle any legal paperwork efficiently without hassle.

Get more for Form 8ta Ex

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children texas form

- Mutual wills or last will and testaments for man and woman living together not married with minor children texas form

- Texas cohabitation form

- Tx paternity form

- Bill of sale in connection with sale of business by individual or corporate seller texas form

- Office lease agreement texas form

- Texas notice hearing form

- Hearing date form

Find out other Form 8ta Ex

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors