Nyc Forms Nyc 3l

What is the NYC Forms NYC 3L?

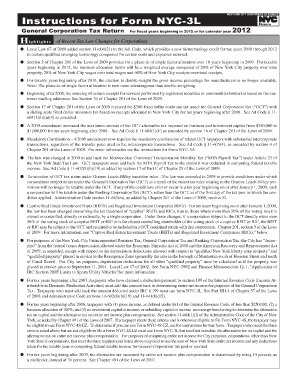

The NYC Forms NYC 3L is a specific form used within the New York City jurisdiction, primarily related to legal and administrative processes. It serves as an essential document for various applications, ensuring compliance with local regulations. Understanding its purpose is crucial for individuals and businesses operating in NYC, as it facilitates the proper handling of legal matters.

How to Use the NYC Forms NYC 3L

Using the NYC Forms NYC 3L involves several steps to ensure accuracy and compliance. First, gather all necessary information required for the form, including personal details and any relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once completed, the form can be submitted electronically or in paper format, depending on the requirements set forth by the issuing authority.

Steps to Complete the NYC Forms NYC 3L

Completing the NYC Forms NYC 3L requires attention to detail. Here are the steps to follow:

- Review the form to understand the required information.

- Collect all necessary documents, such as identification and supporting materials.

- Fill out the form, ensuring clarity and accuracy in each section.

- Double-check for any errors or omissions before submission.

- Submit the form according to the specified guidelines, whether online or via mail.

Legal Use of the NYC Forms NYC 3L

The legal use of the NYC Forms NYC 3L is governed by local laws and regulations. To be considered valid, the form must be completed correctly and submitted within the designated timeframes. Additionally, it is essential that all signatures are obtained as required, as this confirms the authenticity of the document and its acceptance by the relevant authorities.

Key Elements of the NYC Forms NYC 3L

Several key elements must be included in the NYC Forms NYC 3L for it to be valid. These elements typically include:

- Personal identification information of the applicant.

- Details regarding the purpose of the form.

- Signature lines for all required parties.

- Any necessary supporting documentation that may be required for submission.

Who Issues the Form

The NYC Forms NYC 3L is typically issued by a designated city agency or department. This can vary depending on the specific purpose of the form, such as applications for permits, licenses, or other legal matters. It is important to verify the issuing authority to ensure compliance with all local regulations and requirements.

Quick guide on how to complete nyc forms nyc 3l

Complete Nyc Forms Nyc 3l effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without any delays. Handle Nyc Forms Nyc 3l on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to amend and eSign Nyc Forms Nyc 3l without any hassle

- Locate Nyc Forms Nyc 3l and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Nyc Forms Nyc 3l and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc forms nyc 3l

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are NYC forms NYC 3L 2012 and how can airSlate SignNow help?

NYC forms NYC 3L 2012 are specific regulatory documents required for businesses operating in New York City. airSlate SignNow simplifies the process by allowing users to fill out, send, and eSign these forms digitally, ensuring compliance with local regulations effectively.

-

What features does airSlate SignNow offer for handling NYC forms NYC 3L 2012?

airSlate SignNow offers a range of features including customizable templates, document tracking, and secure eSigning options for NYC forms NYC 3L 2012. These tools streamline the workflow, making it easy to manage essential documents while ensuring that all signatures are legally binding.

-

Is airSlate SignNow a cost-effective solution for managing NYC forms NYC 3L 2012?

Yes, airSlate SignNow is designed to provide a cost-effective solution for businesses dealing with NYC forms NYC 3L 2012. With various pricing plans available, users can select a package that best fits their needs without compromising on essential features and functionality.

-

Can I integrate airSlate SignNow with other software I use for NYC forms NYC 3L 2012?

Absolutely! airSlate SignNow offers seamless integrations with popular platforms, helping users manage NYC forms NYC 3L 2012 alongside their existing systems. This enables efficient document management and enhances overall business productivity.

-

What benefits can businesses expect when using airSlate SignNow for NYC forms NYC 3L 2012?

By using airSlate SignNow for NYC forms NYC 3L 2012, businesses can expect increased efficiency, reduced processing time, and improved accuracy. The digital approach minimizes the risk of errors and ensures that important documents are processed in a timely manner.

-

How does airSlate SignNow ensure the security of NYC forms NYC 3L 2012?

Security is a top priority for airSlate SignNow. The platform uses industry-standard encryption and secure storage solutions to protect NYC forms NYC 3L 2012, ensuring that sensitive information remains confidential and compliant with legal requirements.

-

What support options are available for users of airSlate SignNow dealing with NYC forms NYC 3L 2012?

Users of airSlate SignNow have access to comprehensive support options, including tutorials, FAQs, and dedicated customer service. This ensures that any questions or issues related to NYC forms NYC 3L 2012 can be addressed promptly.

Get more for Nyc Forms Nyc 3l

- Evaluator designation letter certifyme net certifyme form

- Dd 2652 6150018 form

- Funds transfer application 0 00 translation cloud form

- Lab photosynthesis and cellular respiration triton science form

- Atel investor services form

- Treasurer record book form

- Md ccu payment plan form

- Rn continuing competence program forms continuing competence a strategy for safe competent practice and life long learning

Find out other Nyc Forms Nyc 3l

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement