Pa Rev 1510 2015

What is the Pa Rev 1510

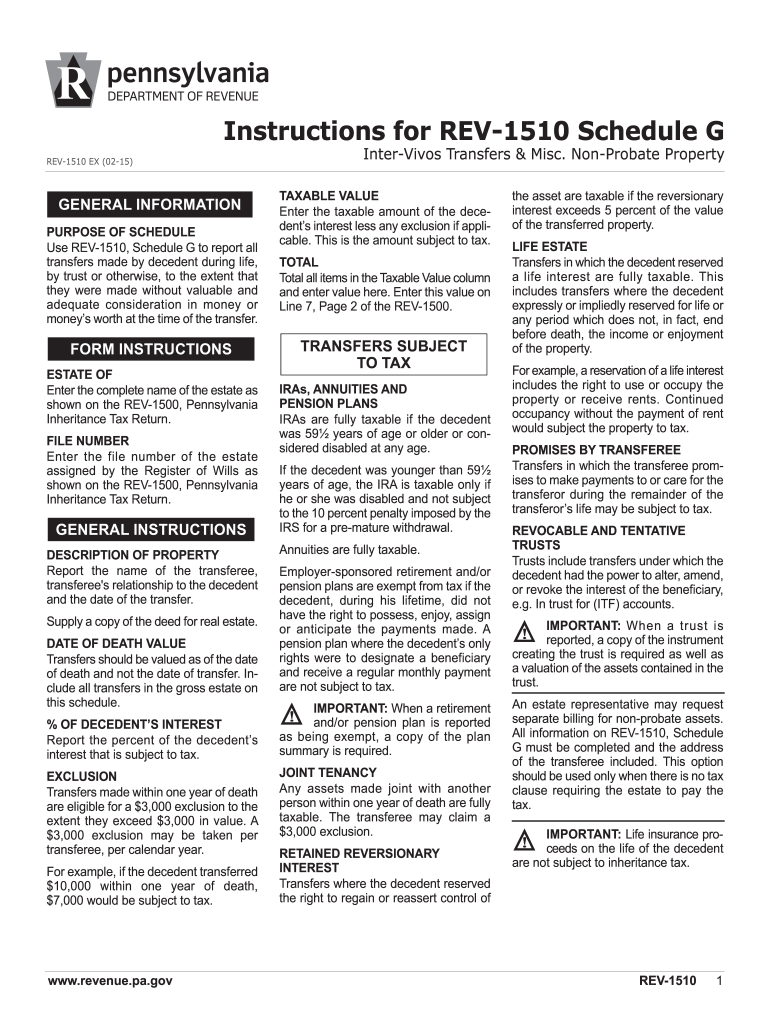

The Pa Rev 1510 is a tax form used in Pennsylvania for reporting inheritance tax. This form is essential for individuals who have received property or assets from a deceased person's estate. The Pennsylvania Department of Revenue requires this form to assess the tax obligations of beneficiaries. It includes detailed sections where taxpayers must provide information about the decedent, the relationship to the beneficiary, and the value of the inherited assets. Understanding the Pa Rev 1510 is crucial for ensuring compliance with state tax laws.

Steps to complete the Pa Rev 1510

Completing the Pa Rev 1510 involves several key steps to ensure accuracy and compliance with Pennsylvania tax regulations. Begin by gathering necessary information, including the decedent's details and the value of the inherited property. Next, fill out the form by providing the required information in the designated sections. It is important to double-check all entries for accuracy. Once completed, sign the form to validate it. Finally, submit the form to the Pennsylvania Department of Revenue by the specified deadline to avoid penalties.

Legal use of the Pa Rev 1510

The Pa Rev 1510 serves a legal purpose by documenting the inheritance tax obligations of beneficiaries in Pennsylvania. It is a legally binding document that must be filed accurately to comply with state tax laws. Failure to file the form or providing incorrect information can lead to penalties, including fines and interest on unpaid taxes. Therefore, it is essential for beneficiaries to understand their legal responsibilities when using the Pa Rev 1510 to ensure they meet all requirements set forth by the Pennsylvania Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Pa Rev 1510 are critical to avoid penalties. Generally, the form must be filed within nine months of the decedent's date of death. If the form is filed within three months, beneficiaries may qualify for a discount on the inheritance tax owed. It is important to keep track of these deadlines to ensure timely submission. Missing the deadline can result in additional interest and penalties, making it crucial for beneficiaries to adhere to the specified timeline.

Required Documents

To complete the Pa Rev 1510, several documents are required. Beneficiaries must provide a copy of the death certificate, which verifies the decedent's passing. Additionally, documentation detailing the value of the inherited property is necessary, such as appraisals or statements from financial institutions. Any previous tax returns related to the decedent may also be required to ensure accurate reporting. Gathering these documents beforehand can streamline the process of completing the Pa Rev 1510.

Form Submission Methods (Online / Mail / In-Person)

The Pa Rev 1510 can be submitted through various methods, providing flexibility for beneficiaries. The form can be filed online through the Pennsylvania Department of Revenue's e-filing system, which offers a convenient and efficient option. Alternatively, beneficiaries may choose to mail the completed form to the appropriate address specified by the Department of Revenue. In-person submissions are also accepted at designated state offices. Each method has its own advantages, and beneficiaries should select the one that best suits their needs.

Examples of using the Pa Rev 1510

There are various scenarios in which the Pa Rev 1510 is utilized. For instance, if an individual inherits a family home valued at $300,000, they must report this asset using the Pa Rev 1510. Similarly, if a beneficiary receives stocks or bonds from a deceased relative, the value of these assets must also be reported on the form. Each example highlights the importance of accurately reporting inherited assets to ensure compliance with Pennsylvania's inheritance tax laws.

Quick guide on how to complete instructions for rev 1510 schedule g inter vivos transfers ampamp misc non probate property formspublications

Your assistance manual on how to prepare your Pa Rev 1510

If you’re curious about how to finalize and send your Pa Rev 1510, here are some straightforward guidelines to simplify your tax declaration process.

To start, you just need to set up your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, create, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revert to make changes as necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Pa Rev 1510 within moments:

- Establish your account and begin handling PDFs in a matter of minutes.

- Utilize our directory to obtain any IRS tax document; explore through variants and schedules.

- Click Get form to access your Pa Rev 1510 in our editor.

- Populate the essential fillable sections with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if applicable).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in paper format can result in return mistakes and delays in refunds. Naturally, before electronically filing your taxes, check the IRS website for declaration guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct instructions for rev 1510 schedule g inter vivos transfers ampamp misc non probate property formspublications

Create this form in 5 minutes!

How to create an eSignature for the instructions for rev 1510 schedule g inter vivos transfers ampamp misc non probate property formspublications

How to create an eSignature for your Instructions For Rev 1510 Schedule G Inter Vivos Transfers Ampamp Misc Non Probate Property Formspublications in the online mode

How to generate an eSignature for the Instructions For Rev 1510 Schedule G Inter Vivos Transfers Ampamp Misc Non Probate Property Formspublications in Chrome

How to create an eSignature for putting it on the Instructions For Rev 1510 Schedule G Inter Vivos Transfers Ampamp Misc Non Probate Property Formspublications in Gmail

How to make an electronic signature for the Instructions For Rev 1510 Schedule G Inter Vivos Transfers Ampamp Misc Non Probate Property Formspublications from your smartphone

How to generate an eSignature for the Instructions For Rev 1510 Schedule G Inter Vivos Transfers Ampamp Misc Non Probate Property Formspublications on iOS

How to make an electronic signature for the Instructions For Rev 1510 Schedule G Inter Vivos Transfers Ampamp Misc Non Probate Property Formspublications on Android devices

People also ask

-

What is Pa Rev 1510 and how does it relate to airSlate SignNow?

Pa Rev 1510 refers to a specific document or form that can be easily integrated and managed using airSlate SignNow. This platform allows users to send, sign, and manage documents digitally, making the process of handling Pa Rev 1510 seamless and efficient.

-

How much does airSlate SignNow cost for managing Pa Rev 1510 documents?

The pricing for airSlate SignNow varies based on the features and volume of documents you need to manage, including Pa Rev 1510 forms. Typically, plans start at affordable rates that cater to different business sizes, ensuring that you have a cost-effective solution for all your document signing needs.

-

What features does airSlate SignNow offer for Pa Rev 1510?

airSlate SignNow offers a variety of features for managing Pa Rev 1510, including customizable templates, automated workflows, and secure eSignature capabilities. These features help streamline the signing process, ensuring that your documents are completed quickly and efficiently.

-

Can I integrate airSlate SignNow with other applications while using Pa Rev 1510?

Yes, airSlate SignNow supports various integrations with popular applications, which makes it easy to manage Pa Rev 1510 alongside your existing tools. This allows for a smoother workflow and better collaboration within your team.

-

What are the benefits of using airSlate SignNow for Pa Rev 1510?

Using airSlate SignNow for Pa Rev 1510 brings numerous benefits, including enhanced efficiency, reduced paper waste, and improved security. The platform simplifies the signing process, allowing you to focus on your core business activities without the hassle of traditional document management.

-

Is airSlate SignNow secure for handling Pa Rev 1510 documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your Pa Rev 1510 documents, including encryption and secure storage. This ensures that your sensitive information remains confidential and safe from unauthorized access.

-

How can I get started with airSlate SignNow for Pa Rev 1510?

Getting started with airSlate SignNow for managing Pa Rev 1510 is easy. Simply sign up for an account, explore the user-friendly interface, and start uploading your documents. Our support resources will guide you through the process to ensure you maximize the platform's capabilities.

Get more for Pa Rev 1510

- Vocabulary workshop level c unit 5 synonyms answers form

- Exit interview form 61905457

- Indiana tobacco quitline fax referral form fax number 1 800

- Lg861e form

- 5k waiver template form

- Mich uia form 1471

- Form 656 l sp rev 12 offer in compromise doubt as to liability spanish version

- Form 656 b sp rev 4 offer in compromise booklet spanish version

Find out other Pa Rev 1510

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now