Rev 1510 2019-2026

What is the Rev 1510?

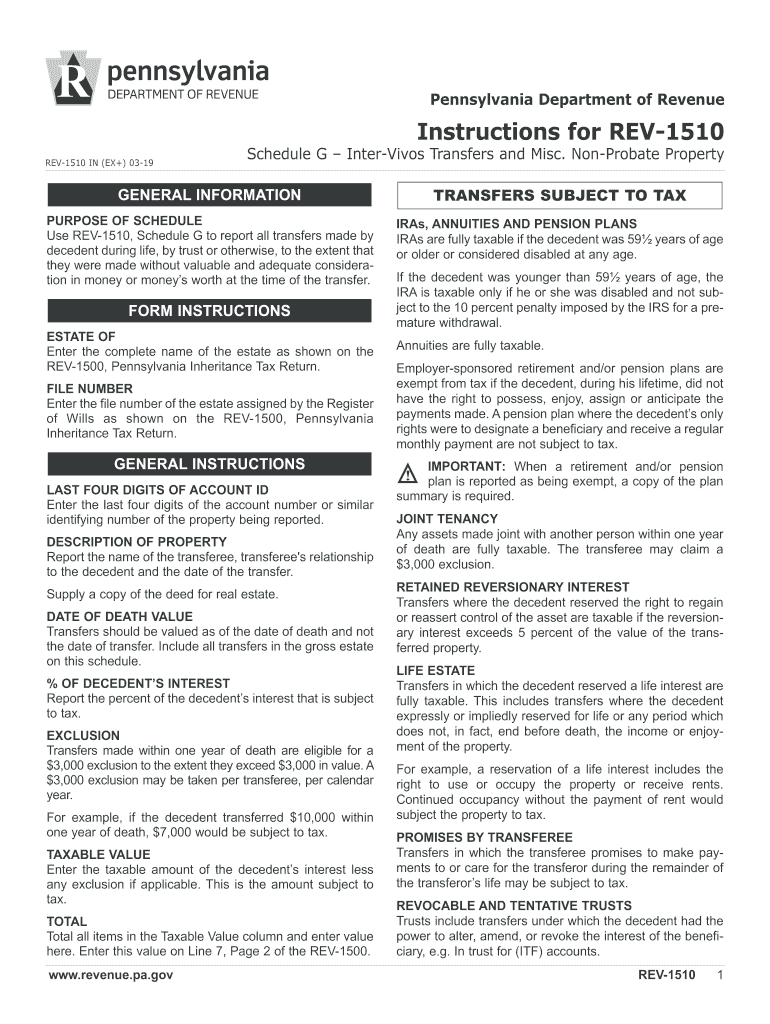

The Rev 1510 is a crucial form used in the context of estate planning and probate procedures in the United States. Specifically, it serves to report the transfer of assets from a deceased individual to their beneficiaries. This form is essential for ensuring that all relevant information regarding the deceased's estate is accurately documented and submitted to the appropriate authorities. The Rev 1510 is often associated with the Rev 1500 Schedule G, which details specific asset transfers, making it a vital component in the probate process.

Steps to Complete the Rev 1510

Completing the Rev 1510 involves several key steps to ensure accuracy and compliance with legal requirements. Follow these steps for a smooth process:

- Gather all necessary documentation related to the deceased's estate, including wills, asset lists, and beneficiary information.

- Fill out the Rev 1510 form, ensuring that all fields are completed accurately. Pay special attention to the sections detailing asset transfers.

- Review the completed form for any errors or omissions. It's crucial to ensure that all information is correct before submission.

- Sign and date the form, as required, to validate the information provided.

- Submit the completed Rev 1510 to the appropriate probate court or authority, either online, by mail, or in person, depending on state regulations.

Legal Use of the Rev 1510

The Rev 1510 must be used in accordance with state laws governing probate and estate administration. Its legal standing is reinforced by compliance with relevant statutes, ensuring that the transfer of assets is recognized by courts and other entities. When properly executed, the Rev 1510 serves as a legally binding document that can protect the rights of beneficiaries and facilitate the smooth distribution of the deceased's estate.

Required Documents

To successfully complete the Rev 1510, certain documents are typically required. These may include:

- A copy of the deceased's will, if available.

- Death certificate to confirm the passing of the individual.

- Detailed inventory of the deceased's assets, including real estate, bank accounts, and personal property.

- Identification documents for the executor or administrator of the estate.

- Any prior forms related to the estate, such as the Rev 1500 Schedule G.

Examples of Using the Rev 1510

The Rev 1510 can be utilized in various scenarios, such as:

- Transferring real estate from the deceased to heirs.

- Distributing financial assets, such as bank accounts or stocks, to beneficiaries.

- Documenting the transfer of personal property, including vehicles or valuable collectibles.

Each of these examples highlights the importance of accurately reporting asset transfers to ensure compliance with probate laws and protect the interests of all parties involved.

Filing Deadlines / Important Dates

Filing the Rev 1510 is subject to specific deadlines that vary by state. It is important to be aware of these timelines to avoid penalties or complications in the probate process. Generally, the Rev 1510 should be filed within a certain period following the death of the individual, often within a few months. Check with local probate courts for precise deadlines to ensure timely submission.

Quick guide on how to complete pa rev 1510 ex 2019

Effortlessly Prepare Rev 1510 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without hassles. Manage Rev 1510 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Edit and eSign Rev 1510 with Ease

- Obtain Rev 1510 and select Get Form to begin.

- Utilize the tools provided to submit your document.

- Highlight pertinent sections of your documents or obscure sensitive details using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Rev 1510 and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa rev 1510 ex 2019

Create this form in 5 minutes!

How to create an eSignature for the pa rev 1510 ex 2019

How to generate an electronic signature for the Pa Rev 1510 Ex 2019 in the online mode

How to generate an electronic signature for the Pa Rev 1510 Ex 2019 in Chrome

How to make an electronic signature for putting it on the Pa Rev 1510 Ex 2019 in Gmail

How to make an eSignature for the Pa Rev 1510 Ex 2019 right from your mobile device

How to make an electronic signature for the Pa Rev 1510 Ex 2019 on iOS

How to make an electronic signature for the Pa Rev 1510 Ex 2019 on Android OS

People also ask

-

What is the rev 1500 schedule g, and how does it relate to airSlate SignNow?

The rev 1500 schedule g is a tax form that individuals and businesses use to report specific financial information. airSlate SignNow simplifies the process of preparing and signing this form by providing an intuitive platform for document management and e-signatures, ensuring compliance and accuracy.

-

How much does airSlate SignNow cost for users needing to file rev 1500 schedule g?

airSlate SignNow offers competitive pricing plans tailored to different business needs. While prices can vary based on usage and features, businesses filing the rev 1500 schedule g can benefit from affordable subscription options that enhance their document handling efficiency.

-

What features does airSlate SignNow provide for handling the rev 1500 schedule g?

airSlate SignNow provides a range of features ideal for managing the rev 1500 schedule g, including customizable templates, collaboration tools, and secure e-signature options. These features streamline the process of filling out and signing tax forms, saving users valuable time.

-

How can airSlate SignNow help ensure compliance when filing rev 1500 schedule g?

airSlate SignNow enhances compliance for users filing the rev 1500 schedule g by maintaining robust security measures and offering audit trails for every document signed. This ensures that businesses can confidently submit tax documents while meeting all regulatory requirements.

-

Is it easy to integrate airSlate SignNow with other tools for filing rev 1500 schedule g?

Yes, airSlate SignNow easily integrates with various third-party applications and services, facilitating the management of documents related to the rev 1500 schedule g. This ensures a seamless workflow for users who rely on multiple platforms for their business operations.

-

What are the primary benefits of using airSlate SignNow for my rev 1500 schedule g submissions?

Using airSlate SignNow for submitting the rev 1500 schedule g offers numerous benefits, including increased efficiency in document processing and reduced turnaround times for signature gathering. The platform's user-friendly interface also minimizes errors, ensuring accurate submissions.

-

Can multiple users collaborate on a rev 1500 schedule g in airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate effortlessly on a single rev 1500 schedule g document. Teams can work together in real-time, making it easier to gather inputs and finalize tax forms quickly and efficiently.

Get more for Rev 1510

Find out other Rev 1510

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation