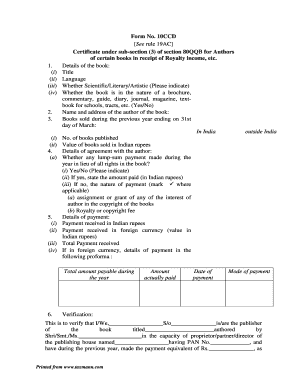

Form 10ccd

What is the Form 10ccd

The Form 10ccd is a specific document used in various legal and administrative processes. It is essential for individuals and businesses to understand its purpose and application. This form is typically associated with compliance requirements and may be necessary for specific transactions or filings. Understanding the context in which the Form 10ccd is utilized can help ensure that it is completed accurately and submitted in a timely manner.

How to use the Form 10ccd

Using the Form 10ccd involves several steps to ensure proper completion and submission. First, gather all relevant information required for the form, including personal or business details. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is advisable to review the form for any errors before submission. Depending on the requirements, you may need to submit the form electronically or via mail. Familiarizing yourself with the specific instructions associated with the Form 10ccd will facilitate a smoother process.

Steps to complete the Form 10ccd

Completing the Form 10ccd requires attention to detail. Follow these steps for successful completion:

- Gather necessary documents and information, such as identification and relevant financial records.

- Access the Form 10ccd, ensuring you have the most current version.

- Fill in each section of the form, providing accurate and complete information.

- Review the form for any mistakes or omissions.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the Form 10ccd

The Form 10ccd is legally binding when completed and submitted in accordance with applicable laws. To ensure its legality, it is crucial to follow the guidelines set forth by relevant authorities. This includes adhering to eSignature laws and maintaining compliance with privacy regulations. Proper execution of the form, including obtaining necessary signatures, will enhance its validity in legal contexts.

Key elements of the Form 10ccd

Understanding the key elements of the Form 10ccd is vital for accurate completion. The form typically includes sections for personal or business information, purpose of the form, and any required signatures. Each element serves a specific function, contributing to the overall integrity of the document. Ensuring that all key elements are addressed will help facilitate a successful submission.

Form Submission Methods

The Form 10ccd can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through designated platforms, which may offer a streamlined process.

- Mailing the completed form to the appropriate address, ensuring it is sent well before any deadlines.

- In-person submission at designated locations, which may provide immediate confirmation of receipt.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical when dealing with the Form 10ccd. Each jurisdiction may have specific dates by which the form must be submitted. Missing these deadlines can result in penalties or delays in processing. It is advisable to check for any updates or changes to deadlines regularly to ensure compliance.

Quick guide on how to complete form 10ccd

Effortlessly Prepare Form 10ccd on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly option compared to traditional printed and signed papers, allowing you to obtain the right format and securely store it in the cloud. airSlate SignNow offers all the tools necessary to swiftly create, modify, and eSign your documents without any delays. Handle Form 10ccd on any platform using the airSlate SignNow Android or iOS applications and streamline your document processes today.

Editing and eSigning Form 10ccd with Ease

- Find Form 10ccd and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your document or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information, then click on the Done button to save your changes.

- Decide how you would like to send your form: via email, SMS, invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form navigation, and mistakes that necessitate reprinting. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 10ccd to maintain excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10ccd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 10ccd form and how can it be used?

The 10ccd form is a document that is essential for certain business processes, particularly for compliance in various industries. With airSlate SignNow, you can easily create, send, and eSign the 10ccd form securely and efficiently. This allows your business to streamline operations and ensure that all necessary paperwork is handled correctly.

-

How does airSlate SignNow help with the 10ccd form?

airSlate SignNow offers a user-friendly platform for managing the 10ccd form, making it simple to prepare and sign electronically. The robust features include templates, automation, and real-time tracking, ensuring that you never miss a step in the signing process. This enhances productivity and compliance, making it easier to manage your business documents.

-

What are the pricing options for using airSlate SignNow for the 10ccd form?

airSlate SignNow offers flexible pricing plans to suit different business needs, whether you're a small startup or a large enterprise. Each plan includes features to manage the 10ccd form efficiently, with options for eSigning, team collaboration, and integrations. You can select a plan that provides the best value and support for your business.

-

Can I integrate other applications with airSlate SignNow for the 10ccd form?

Yes, airSlate SignNow allows seamless integration with various applications, which can enhance your workflow when dealing with the 10ccd form. You can connect tools like Google Drive, Dropbox, and various CRM systems to streamline document management processes. This integration capability can help centralize your operations and improve efficiency.

-

What are the benefits of using airSlate SignNow for the 10ccd form?

Using airSlate SignNow for the 10ccd form provides several benefits, such as enhanced security, speed, and ease of use. The platform ensures that your documents are safe with advanced encryption and compliant with industry standards. Additionally, the time saved through automation signNowly accelerates your business processes.

-

Are there any templates available for the 10ccd form in airSlate SignNow?

Absolutely! airSlate SignNow offers various templates for the 10ccd form, allowing you to customize your documents for specific needs. These templates help you save time while ensuring that all critical information is included. You can modify templates to fit your business requirements easily, making the process even smoother.

-

Is airSlate SignNow mobile-friendly for managing the 10ccd form?

Yes, airSlate SignNow is designed to be mobile-friendly, enabling you to manage the 10ccd form from any device. Whether you're in the office or on the go, you can send, sign, and track documents conveniently using your smartphone or tablet. This mobile capability ensures that you maintain productivity regardless of location.

Get more for Form 10ccd

- Assignment insurance funeral form

- Funeral agreement form

- Surrogate or surrogacy agreement for artificial insemination between husband wife and donor identity of donor known form

- Website subscription agreement form

- Rights grandparents form

- Agreement disputed form

- Letter offer employment form

- Sample letter opinion law form

Find out other Form 10ccd

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement