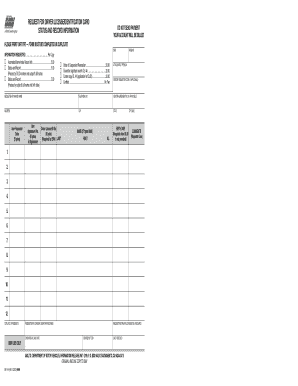

Inf 1119 Form

What is the Inf 1119

The Inf 1119 form is a crucial document used primarily for tax purposes in the United States. It is typically associated with reporting specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with federal tax regulations. Understanding the purpose and requirements of the Inf 1119 is vital for accurate tax reporting and avoiding potential penalties.

How to use the Inf 1119

Using the Inf 1119 involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents and information relevant to the reporting requirements. Next, accurately fill out the form, ensuring that all entries are correct and complete. Once completed, the Inf 1119 can be submitted electronically or via traditional mail, depending on the preferences and requirements set forth by the IRS. Familiarizing yourself with the specific instructions for the Inf 1119 will help streamline the process.

Steps to complete the Inf 1119

Completing the Inf 1119 requires careful attention to detail. Follow these steps for successful completion:

- Review the specific guidelines provided by the IRS for the Inf 1119.

- Collect all relevant financial documents, such as income statements and previous tax returns.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check all entries for accuracy to prevent errors.

- Submit the completed form electronically or by mail, as per IRS guidelines.

Legal use of the Inf 1119

The Inf 1119 must be used in compliance with federal tax laws to be considered legally valid. This includes adhering to the guidelines set forth by the IRS regarding submission methods and deadlines. Failure to comply with these regulations can result in penalties or other legal repercussions. Utilizing a reliable platform for e-signatures can enhance the legal standing of the completed form, ensuring that it meets all necessary requirements.

Filing Deadlines / Important Dates

Staying informed about filing deadlines for the Inf 1119 is crucial for compliance. Typically, the IRS outlines specific dates by which the form must be submitted. Missing these deadlines can lead to penalties or interest charges. It is advisable to regularly check the IRS website or consult a tax professional to ensure that you are aware of the most current deadlines associated with the Inf 1119.

Required Documents

To complete the Inf 1119 accurately, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Any supporting documentation that verifies financial claims made on the form.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete inf 1119

Prepare Inf 1119 effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed materials, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Inf 1119 on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The easiest method to modify and eSign Inf 1119 without hassle

- Locate Inf 1119 and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Verify the details and then select the Done button to retain your modifications.

- Choose how you wish to submit your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, cumbersome form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Inf 1119 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inf 1119

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the inf 1119 form and how does airSlate SignNow assist with it?

The inf 1119 form is a tax document used for reporting specific financial information. airSlate SignNow streamlines the process of completing and eSigning the inf 1119, making it easier for businesses to manage their documentation efficiently and securely.

-

How much does airSlate SignNow cost for handling inf 1119 forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including solutions for managing inf 1119 forms. Depending on your requirements, you can choose a plan that provides the right features at an affordable rate, ensuring you get the best value.

-

What features does airSlate SignNow provide for managing inf 1119 documents?

With airSlate SignNow, users can easily create, edit, and eSign inf 1119 documents. Key features include customizable templates, secure storage, and automated workflows, which simplify the management of important tax documentation.

-

Are there any integrations available with airSlate SignNow for inf 1119 processing?

Yes, airSlate SignNow integrates seamlessly with various applications commonly used for handling tax documents, including accounting and CRM systems. This ensures that your inf 1119 forms can be processed efficiently alongside your other business tools.

-

How does airSlate SignNow enhance the security of my inf 1119 documents?

Security is a top priority for airSlate SignNow, particularly for sensitive documents like the inf 1119. The platform employs encryption, secure user authentication, and compliance with industry standards to safeguard your information from unauthorized access.

-

Can I track the status of my inf 1119 forms with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking capabilities, allowing you to monitor the status of your inf 1119 forms at any stage of the signing process. This ensures transparency and helps you manage deadlines effectively.

-

What benefits does eSigning an inf 1119 form with airSlate SignNow offer?

eSigning your inf 1119 with airSlate SignNow offers several benefits, including faster turnaround times, reduced paperwork, and enhanced accessibility. It simplifies the signing process, making it convenient for all parties involved.

Get more for Inf 1119

Find out other Inf 1119

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form