Maryland Form El102

What is the Maryland Form EL102

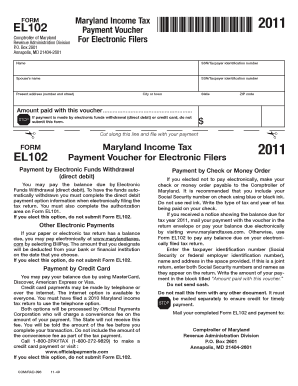

The Maryland Form EL102 is a crucial document used for reporting and remitting employee withholding taxes in the state of Maryland. This form is typically utilized by employers to report the state income tax withheld from employees' wages. It ensures compliance with state tax regulations and helps maintain accurate records of tax obligations. Understanding the purpose and requirements of the EL102 is essential for employers to avoid potential penalties and ensure proper tax management.

How to use the Maryland Form EL102

Using the Maryland Form EL102 involves a straightforward process. Employers must fill out the form accurately, including details such as the total wages paid, the amount of state income tax withheld, and the employer's identification information. After completing the form, it should be submitted to the Maryland Comptroller's Office. This can often be done electronically or via mail, depending on the employer's preference and the specific instructions provided by the state.

Steps to complete the Maryland Form EL102

To complete the Maryland Form EL102, follow these steps:

- Gather necessary information, including employee wages and withholding amounts.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form to the Maryland Comptroller's Office either electronically or by mail.

Taking these steps will help ensure that the form is filled out correctly and submitted on time, minimizing the risk of penalties.

Legal use of the Maryland Form EL102

The Maryland Form EL102 is legally binding when completed and submitted according to state regulations. Employers must ensure that the information provided is accurate and truthful, as any discrepancies may lead to legal consequences. Compliance with the state's tax laws is essential, and the EL102 serves as a formal declaration of the taxes withheld from employees' wages.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form EL102 are critical for compliance. Employers must submit the form by the specified due dates to avoid penalties. Typically, the form is due quarterly, with specific deadlines for each quarter. It is essential to stay informed about these dates to ensure timely submission and adherence to state tax regulations.

Who Issues the Form

The Maryland Form EL102 is issued by the Maryland Comptroller's Office. This office is responsible for overseeing tax collection and ensuring compliance with state tax laws. Employers can obtain the form directly from the Comptroller's website or through official state resources, ensuring they have the most current version available for use.

Quick guide on how to complete maryland form el102

Complete Maryland Form El102 effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features you require to create, modify, and electronically sign your documents swiftly without delays. Manage Maryland Form El102 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Maryland Form El102 without hassle

- Locate Maryland Form El102 and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal standing as a traditional ink signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of missing or lost files, tedious form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign Maryland Form El102 and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form el102

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form EL102?

The Maryland Form EL102 is an essential document used for tax-related purposes in Maryland. This form is vital for individuals and businesses to ensure compliance with state regulations. Utilizing airSlate SignNow can streamline the process of eSigning and submitting the Maryland Form EL102 efficiently.

-

How can airSlate SignNow help with Maryland Form EL102?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents, including the Maryland Form EL102. With its user-friendly interface, users can quickly complete and manage their forms without any hassle. This not only saves time but also ensures that the form is completed accurately.

-

Is there any cost associated with using airSlate SignNow for Maryland Form EL102?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While basic features are often available in free trials, certain advanced functionalities for the Maryland Form EL102 may require a subscription. It's advisable to check the pricing page for specific details related to your needs.

-

Can I integrate airSlate SignNow with other applications for Maryland Form EL102?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing for a seamless workflow when handling the Maryland Form EL102. Whether it's CRMs, cloud storage services, or project management tools, these integrations enhance efficiency and organization.

-

What are the benefits of using airSlate SignNow for Maryland Form EL102?

Using airSlate SignNow for the Maryland Form EL102 enhances document security and compliance. The platform provides features like digital signatures and audit trails, ensuring that your documents are legally binding. Additionally, it simplifies collaboration, making it easy to work with multiple parties.

-

Is eSigning the Maryland Form EL102 legally binding?

Yes, eSigning the Maryland Form EL102 through airSlate SignNow is legally binding. The platform complies with the ESIGN Act and UETA, ensuring that digital signatures hold the same legal weight as traditional handwritten signatures in Maryland.

-

How do I start using airSlate SignNow for my Maryland Form EL102 needs?

Getting started with airSlate SignNow is straightforward. Simply visit the website, create an account, and choose the appropriate pricing plan for your needs. Once registered, you can upload your Maryland Form EL102 and begin sending it for signatures right away!

Get more for Maryland Form El102

- Mississippi release lien form

- 497314094 form

- On this day of 20 the undersigned lienor in consideration of the final payment in the amount of hereby waives and releases his form

- Assignment of lien individual mississippi form

- Mississippi lien 497314097 form

- Mississippi lis pendens form

- Notice of lis pendens corporation or llc mississippi form

- Exclusive agency agreement mississippi form

Find out other Maryland Form El102

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online