Form 2203

What is the T2203 Form?

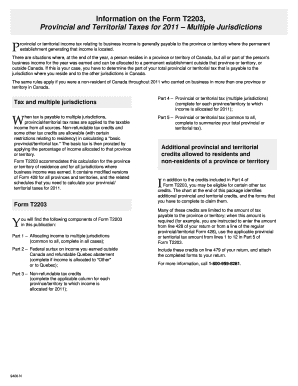

The T2203 form, also known as the Ontario tax form T2203, is primarily used by individuals and businesses to report income earned in more than one province or territory in Canada. This form is essential for calculating the correct amount of tax owed based on the income earned in different regions. The T2203 form helps ensure compliance with provincial tax laws and allows taxpayers to allocate their income accurately across jurisdictions.

How to Obtain the T2203 Form

The T2203 form can be obtained through the Canada Revenue Agency (CRA) website or by contacting their office directly. It is available in a PDF format, which can be downloaded and printed for completion. Additionally, many tax preparation software programs include the T2203 form, allowing users to fill it out digitally. This accessibility simplifies the process for taxpayers who need to report income from multiple provinces.

Steps to Complete the T2203 Form

Completing the T2203 form involves several key steps:

- Gather all relevant income documents from each province where income was earned.

- Fill in personal information, including your name, address, and Social Insurance Number (SIN).

- Report the total income earned in each province or territory during the tax year.

- Calculate the provincial tax credits and deductions applicable to your situation.

- Review the completed form for accuracy before submission.

Legal Use of the T2203 Form

The T2203 form is legally binding when filled out correctly and submitted to the CRA. It complies with Canadian tax laws and regulations, ensuring that taxpayers report their income accurately across provinces. Utilizing a reliable electronic signature solution, such as signNow, can enhance the legal validity of the form by providing a secure method for signing and submitting the document.

Key Elements of the T2203 Form

Understanding the key elements of the T2203 form is crucial for accurate completion. Important sections include:

- Identification Information: This includes personal details such as your name and SIN.

- Income Reporting: A breakdown of income earned in each province.

- Tax Calculations: This section outlines the calculations for provincial taxes owed.

- Signature Section: A place for your signature, verifying the accuracy of the information provided.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the T2203 form to avoid penalties. Typically, the deadline for submitting the T2203 aligns with the personal income tax return due date, which is usually April 30 for most individuals. However, if you are self-employed, the deadline extends to June 15, with any taxes owed still due by April 30. Staying informed about these dates can help ensure timely compliance.

Form Submission Methods

The T2203 form can be submitted through various methods:

- Online: If using tax software, the form can often be submitted electronically.

- By Mail: Completed forms can be printed and mailed to the appropriate CRA office.

- In-Person: Taxpayers may also visit a local CRA office to submit the form directly.

Quick guide on how to complete form 2203

Complete Form 2203 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, alter, and eSign your documents quickly without delays. Manage Form 2203 on any device with airSlate SignNow Android or iOS applications and simplify any document-related operations today.

How to modify and eSign Form 2203 without hassle

- Locate Form 2203 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for these tasks.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would prefer to share your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searching, or errors requiring new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Form 2203 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2203

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t2203 form and why is it important?

The t2203 form is a tax form used in Canada for individuals with income from multiple jurisdictions. It helps determine how much tax you owe based on your income sources, allowing you to claim credits or exemptions based on where your income is earned. Completing the t2203 form accurately ensures compliance with Canadian tax regulations.

-

How can airSlate SignNow assist in completing the t2203 form?

airSlate SignNow simplifies the process of completing the t2203 form by allowing users to fill out and eSign documents digitally. With an intuitive interface, you can ensure that all required fields are completed correctly and securely. Additionally, cloud storage options mean you'll have easy access to your completed forms anytime, anywhere.

-

Is airSlate SignNow cost-effective for filing the t2203 form?

Yes, airSlate SignNow offers a cost-effective solution for businesses and individuals needing to file the t2203 form. With competitive pricing plans, you can choose a package that fits your needs without breaking the bank. This affordability allows users to manage multiple document transactions seamlessly.

-

What features does airSlate SignNow offer for t2203 form preparation?

airSlate SignNow offers a variety of features perfect for t2203 form preparation, including customizable templates, reusable fields, and collaborative editing. Users can invite others to contribute to the form, ensuring everyone involved can provide the necessary information. The platform's eSignature functionality further streamlines the approval process.

-

Are there any integrations available for airSlate SignNow when preparing the t2203 form?

Yes, airSlate SignNow integrates with multiple popular applications, enhancing the t2203 form preparation experience. You can connect with platforms like Google Drive, Dropbox, and CRM tools, making it easy to import or export necessary information. These integrations save time and eliminate manual data entry.

-

Can I track the completion status of the t2203 form using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for the t2203 form, enabling you to see where each document stands in the signing process. You'll receive notifications once the form is viewed and signed, ensuring you stay informed and can take action when needed.

-

How secure is the data when using airSlate SignNow for the t2203 form?

Security is a top priority for airSlate SignNow. When completing the t2203 form, your data is protected with advanced encryption protocols and complies with international standards. You can trust that your personal tax information remains confidential and secure throughout the submission process.

Get more for Form 2203

Find out other Form 2203

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document