Form N 200v 2013

What is the Form N-200V?

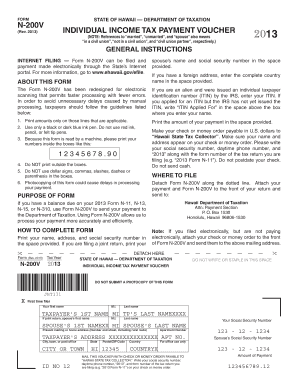

The Form N-200V is a Hawaii state tax payment voucher used by taxpayers to submit payments for their state income tax liabilities. This form is essential for individuals who owe taxes and prefer to make payments through the mail rather than electronically. It provides a structured way to ensure that payments are correctly applied to the taxpayer's account.

How to Obtain the Form N-200V

The Form N-200V can be easily obtained from the Hawaii Department of Taxation's official website. It is available as a printable document, allowing taxpayers to download, print, and fill it out at their convenience. Additionally, physical copies may be available at local tax offices or public libraries throughout Hawaii.

Steps to Complete the Form N-200V

Completing the Form N-200V involves several straightforward steps:

- Download the form from the Hawaii Department of Taxation website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you are paying and ensure it matches your tax liability.

- Sign and date the form to validate your payment.

- Mail the completed form along with your payment to the address specified on the form.

Legal Use of the Form N-200V

The Form N-200V serves as a legally recognized document for making tax payments in Hawaii. It must be completed accurately to ensure compliance with state tax laws. Submitting this form along with your payment helps maintain clear records of your tax obligations and can protect you in case of disputes with the tax authority.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines associated with the Form N-200V. Payments are typically due by the same date as the state income tax return, which is usually April 20 for individuals. Late payments may incur penalties and interest, so it is crucial to submit the form and payment on time to avoid additional charges.

Form Submission Methods

The Form N-200V can be submitted via mail. Taxpayers should ensure that they send it to the correct address provided on the form. While electronic payment options are available, using the N-200V allows for a traditional approach, which some taxpayers may prefer for record-keeping purposes.

Quick guide on how to complete form n 200v

Complete Form N 200v effortlessly on any device

Online document management has gained immense traction with businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage Form N 200v on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The most efficient way to modify and eSign Form N 200v without stress

- Obtain Form N 200v and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to preserve your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form N 200v and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 200v

Create this form in 5 minutes!

How to create an eSignature for the form n 200v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Hawaii state tax forms printable available through airSlate SignNow?

airSlate SignNow provides a comprehensive selection of Hawaii state tax forms printable, including common forms like the N-11 income tax return and N-1 exemptions. Whether you are an individual or a business, our platform makes it easy to access and complete all necessary tax documentation digitally.

-

How can I access the Hawaii state tax forms printable using airSlate SignNow?

To access Hawaii state tax forms printable, simply sign up for an airSlate SignNow account. Once you're logged in, you can search for and select the tax forms you need, fill them out online, and eSign them quickly and efficiently.

-

Are the Hawaii state tax forms printable user-friendly?

Yes, the Hawaii state tax forms printable available on airSlate SignNow are designed for maximum usability. The intuitive interface allows users to easily navigate through forms, providing tips and prompts to help complete each section accurately.

-

What is the cost of using airSlate SignNow for Hawaii state tax forms printable?

Pricing for airSlate SignNow's services varies based on the plan you choose, but it offers affordable solutions for accessing Hawaii state tax forms printable. With competitive pricing, you can select a plan that fits your budget and allows for unlimited eSigning and document management.

-

Can I integrate airSlate SignNow with other software for handling Hawaii state tax forms printable?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as Google Drive and Microsoft Office, enhancing your experience when managing Hawaii state tax forms printable. This integration allows for easy retrieval and storage of your documents across platforms.

-

What are the benefits of using airSlate SignNow for Hawaii state tax forms printable?

Using airSlate SignNow for Hawaii state tax forms printable offers several benefits, including increased efficiency in document management and the convenience of eSigning. You'll save time and reduce paperwork, ensuring your forms are completed accurately and submitted on time.

-

Is there customer support available for questions about Hawaii state tax forms printable?

Yes, airSlate SignNow provides robust customer support for all users, including assistance with Hawaii state tax forms printable. Whether you have questions about access, features, or troubleshooting, our support team is here to help you every step of the way.

Get more for Form N 200v

- Commercial contract for contractor vermont form

- Excavator contract for contractor vermont form

- Renovation contract for contractor vermont form

- Residential cleaning contract for contractor vermont form

- Concrete mason contract for contractor vermont form

- Demolition contract for contractor vermont form

- Framing contract for contractor vermont form

- Security contract for contractor vermont form

Find out other Form N 200v

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document