Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable 2019-2026

What is the Form N-200V, Rev, Individual Income Tax Payment Voucher?

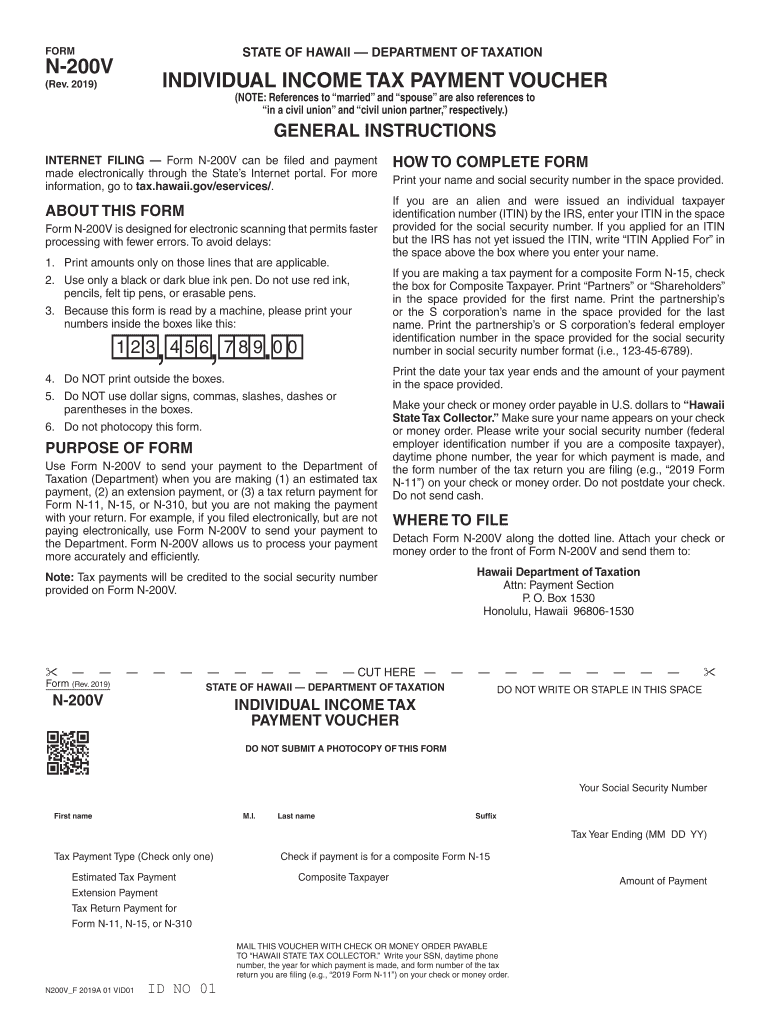

The Form N-200V, Rev, is an Individual Income Tax Payment Voucher specifically designed for taxpayers in the United States. This form serves as a means for individuals to submit payments for their state income taxes. It is particularly useful for those who owe taxes and prefer to make payments by mail rather than electronically. The form is fillable, allowing users to enter their information digitally before printing for submission.

How to Use the Form N-200V, Rev

To effectively use the Form N-200V, Rev, taxpayers should first ensure they have the correct version of the form, which can be obtained from state tax authority websites. After downloading or accessing the fillable form, individuals need to input their personal information, including name, address, and taxpayer identification number. The form also requires details about the tax payment, including the amount owed. Once completed, the form should be printed and mailed to the appropriate tax office along with the payment.

Steps to Complete the Form N-200V, Rev

Completing the Form N-200V, Rev involves several straightforward steps:

- Download the form from the state tax authority's website.

- Fill in your personal information, including your full name and address.

- Enter your taxpayer identification number accurately.

- Specify the amount of tax payment you are submitting.

- Review the form for any errors before printing.

- Sign and date the form where required.

- Mail the completed form along with your payment to the designated tax office.

Key Elements of the Form N-200V, Rev

The Form N-200V, Rev, contains several key elements that are essential for accurate tax payment processing. These include:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Payment Amount: Taxpayers must indicate the exact amount they are submitting for payment.

- Signature: A signature is often required to validate the submission.

- Submission Instructions: Clear guidelines on where to send the completed form and payment.

Legal Use of the Form N-200V, Rev

The Form N-200V, Rev, is legally recognized for the payment of state income taxes. It is important for taxpayers to use this form correctly to avoid penalties or delays in processing their payments. Using the form ensures compliance with state tax regulations and provides a clear record of payment for both the taxpayer and the tax authority.

Filing Deadlines / Important Dates

Taxpayers should be aware of the specific filing deadlines associated with the Form N-200V, Rev. Typically, payments are due on or before the state income tax filing deadline. It is advisable to check the state tax authority’s calendar for any updates or changes to deadlines, as timely submission is crucial to avoid late fees or penalties.

Create this form in 5 minutes or less

Find and fill out the correct form n 200v rev individual income tax payment voucher forms fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 200v rev individual income tax payment voucher forms fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable?

The Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable is a document used by individuals to submit their income tax payments to the state. This fillable form simplifies the payment process, allowing users to complete and submit their tax payments electronically. Utilizing airSlate SignNow, you can easily fill out and eSign this form for a seamless experience.

-

How can I access the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable?

You can access the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable directly through the airSlate SignNow platform. Our user-friendly interface allows you to find and fill out the form quickly. Once completed, you can eSign and send it directly to the appropriate tax authority.

-

Is there a cost associated with using the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable on airSlate SignNow?

Yes, there is a subscription fee for using airSlate SignNow, which provides access to the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable and other features. However, our pricing is competitive and designed to be cost-effective for individuals and businesses alike. You can choose a plan that best fits your needs.

-

What features does airSlate SignNow offer for the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable?

airSlate SignNow offers several features for the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable, including easy fillable fields, eSignature capabilities, and secure document storage. These features enhance the user experience, making it easier to manage your tax payments efficiently. Additionally, you can track the status of your submissions in real-time.

-

Can I integrate airSlate SignNow with other applications for the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable?

Yes, airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow when using the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable. You can connect with popular tools like Google Drive, Dropbox, and more. This integration helps you manage your documents and payments more effectively.

-

What are the benefits of using airSlate SignNow for the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable?

Using airSlate SignNow for the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable offers numerous benefits, including time savings, enhanced security, and ease of use. The platform allows you to complete and eSign your tax payment voucher quickly, reducing the hassle of traditional paper forms. Additionally, your data is securely stored and protected.

-

Is the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable compliant with state regulations?

Yes, the Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable available on airSlate SignNow is compliant with state regulations. We ensure that our forms are up-to-date with the latest requirements, so you can submit your tax payments confidently. Regular updates keep your documents compliant and ready for submission.

Get more for Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable

Find out other Form N 200V, Rev , Individual Income Tax Payment Voucher Forms Fillable

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure