Oregon or Wr Form

What is the Oregon OR WR?

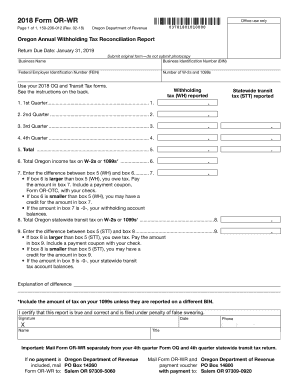

The Oregon OR WR, or Oregon Annual Withholding Tax Reconciliation Report, is a tax form used by employers in Oregon to report annual withholding tax amounts. This form is essential for reconciling the state income tax withheld from employees' wages throughout the year. It ensures that the correct amount of tax has been withheld and reported to the Oregon Department of Revenue.

How to use the Oregon OR WR

To use the Oregon OR WR, employers must gather all necessary information regarding the total wages paid and the tax withheld from employees during the year. This includes reviewing payroll records to ensure accuracy. The form must be completed with precise figures and submitted by the designated deadline to avoid penalties. Employers can fill out the form electronically, ensuring a streamlined process for submission.

Steps to complete the Oregon OR WR

Completing the Oregon OR WR involves several key steps:

- Collect payroll records for the year, including total wages and tax withheld.

- Access the Oregon OR WR form online or through authorized distribution channels.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form to the Oregon Department of Revenue by the deadline.

Legal use of the Oregon OR WR

The Oregon OR WR is legally binding when completed and submitted according to state regulations. It must be signed and dated by an authorized representative of the business. Compliance with the Oregon Department of Revenue's guidelines ensures that the form meets legal standards. Employers should keep a copy of the submitted form for their records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon OR WR are typically set for January 31 of the following year. Employers must ensure that the form is submitted by this date to avoid late fees or penalties. It is advisable to check the Oregon Department of Revenue's official announcements for any changes to deadlines or additional requirements that may arise.

Required Documents

When completing the Oregon OR WR, employers should have the following documents ready:

- Payroll records detailing employee wages and withheld taxes.

- Previous year's Oregon OR WR for reference.

- Any relevant correspondence from the Oregon Department of Revenue.

Form Submission Methods

The Oregon OR WR can be submitted through various methods. Employers have the option to file the form electronically via the Oregon Department of Revenue's online portal or submit a paper version by mail. Electronic filing is encouraged for its efficiency and quicker processing times. If mailing, ensure that the form is sent well before the deadline to allow for postal delays.

Quick guide on how to complete oregon or wr

Complete Oregon Or Wr effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to find the right form and securely store it on the internet. airSlate SignNow offers you all the tools necessary to create, modify, and eSign your documents efficiently without any delays. Handle Oregon Or Wr on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Oregon Or Wr with ease

- Find Oregon Or Wr and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Oregon Or Wr and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon or wr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon 2018 WR and how does it work?

The Oregon 2018 WR is a standardized form used for documenting witness statements. It can streamline the process of gathering and signing important documents, making it essential for businesses needing eSign capabilities.

-

How can I use airSlate SignNow with the Oregon 2018 WR?

You can easily upload the Oregon 2018 WR form to airSlate SignNow and utilize its eSigning features. This allows you to send the document for signature swiftly, ensuring compliance and convenience.

-

What are the pricing options for airSlate SignNow related to the Oregon 2018 WR?

airSlate SignNow offers various pricing plans tailored to suit different business needs. Whether you're a small business or a large corporation, you can find a cost-effective option that supports the use of the Oregon 2018 WR.

-

Are there any special features in airSlate SignNow that benefit users of the Oregon 2018 WR?

Yes, airSlate SignNow includes features like customizable templates, unlimited document sharing, and advanced signing options, all of which enhance the experience of using the Oregon 2018 WR.

-

Can I integrate airSlate SignNow with other tools when using the Oregon 2018 WR?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive and Salesforce, allowing for a smooth workflow when processing the Oregon 2018 WR.

-

What benefits does airSlate SignNow offer for businesses using the Oregon 2018 WR?

airSlate SignNow offers enhanced efficiency and security for businesses handling the Oregon 2018 WR. With features like audit trails and secure storage, you can ensure that your documents are safe and easily accessible.

-

Is technical support available for users of the Oregon 2018 WR on airSlate SignNow?

Yes, airSlate SignNow provides comprehensive technical support for all users, including those utilizing the Oregon 2018 WR. Whether you have questions about features or require assistance, dedicated support is readily available.

Get more for Oregon Or Wr

- Nj name change 497319562 form

- Nj minor name change form

- New jersey unsecured installment payment promissory note for fixed rate new jersey form

- New jersey note form

- New jersey note 497319566 form

- New jersey note 497319567 form

- Notice of option for recording new jersey form

- Interrogatories compensation form

Find out other Oregon Or Wr

- Certify Electronic signature Document Free

- Certify Electronic signature PPT Secure

- How Can I Certify Electronic signature Document

- Validate Electronic signature Word Secure

- Validate Electronic signature PDF Online

- Validate Electronic signature Document Online

- Validate Electronic signature Document Now

- Validate Electronic signature PDF iOS

- How To Validate Electronic signature Document

- How Do I Validate Electronic signature Document

- Validate Electronic signature Document Android

- Validate Electronic signature Form Online

- How To Validate Electronic signature PDF

- E-mail Electronic signature Form Online

- How To E-mail Electronic signature Word

- Install Electronic signature Word Free

- Can I Install Electronic signature Word

- Can I Install Electronic signature PDF

- How Can I Install Electronic signature Document

- Install Electronic signature Document Free