Vat D1 Form No No Download Needed Needed

What is the D1 Form?

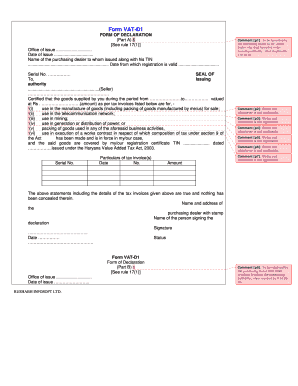

The D1 form, also known as the VAT D1 form, is a crucial document used primarily for reporting value-added tax (VAT) in the United States. It is essential for businesses that are registered for VAT and need to report their VAT liabilities and recoverable amounts. This form provides a structured way to detail sales, purchases, and the corresponding VAT amounts, ensuring compliance with tax regulations. Understanding the D1 form is vital for businesses to maintain accurate financial records and fulfill their tax obligations.

Steps to Complete the D1 Form

Completing the D1 form requires careful attention to detail to ensure accuracy and compliance with tax laws. Here are the key steps involved:

- Gather necessary information: Collect all relevant financial documents, including sales invoices, purchase receipts, and previous VAT returns.

- Fill in your business details: Include your business name, address, and VAT registration number at the top of the form.

- Report sales and purchases: Accurately list all taxable sales and purchases for the reporting period. Ensure to separate exempt and zero-rated transactions.

- Calculate VAT amounts: Determine the VAT due on sales and the VAT recoverable on purchases. This calculation is critical for ensuring correct reporting.

- Review and verify: Double-check all entries for accuracy, ensuring that calculations align with your financial records.

- Submit the form: Follow the appropriate submission method, whether online, by mail, or in person, based on your local regulations.

Legal Use of the D1 Form

The D1 form is legally binding when completed and submitted in accordance with the relevant tax laws. It must be filled out accurately to reflect your business's VAT transactions. Failure to comply with the legal requirements associated with the D1 form can result in penalties, including fines or audits. It is crucial for businesses to understand the legal implications of submitting this form and to ensure that all information reported is truthful and complete.

Key Elements of the D1 Form

The D1 form consists of several key elements that must be accurately completed to ensure compliance. These elements include:

- Business Information: This includes the business name, address, and VAT registration number.

- Sales and Purchases Sections: Detailed sections for reporting total sales and purchases, including taxable, exempt, and zero-rated transactions.

- VAT Calculations: Sections for calculating the total VAT due and recoverable amounts, which are essential for accurate reporting.

- Signature and Date: A section for the authorized person to sign and date the form, confirming the accuracy of the information provided.

Form Submission Methods

Submitting the D1 form can be done through various methods, depending on the specific requirements of your state or locality. Common submission methods include:

- Online Submission: Many states offer an online portal for businesses to submit their D1 forms electronically, which is often the fastest method.

- Mail: Businesses can print the completed form and send it via postal service to the designated tax authority.

- In-Person Submission: Some businesses may choose to submit the form in person at their local tax office, allowing for immediate confirmation of receipt.

Examples of Using the D1 Form

Understanding practical applications of the D1 form can help businesses navigate their VAT reporting obligations. Here are a few scenarios:

- Retail Business: A retail store must report all sales transactions, including VAT collected from customers, using the D1 form.

- Service Provider: A consulting firm providing taxable services must document the VAT charged on its invoices and report it on the D1 form.

- Import/Export Business: A business involved in importing goods must report VAT on both sales and purchases, ensuring compliance with international trade regulations.

Quick guide on how to complete vat d1 form no no download needed needed

Easily Prepare Vat D1 Form No No Download Needed Needed on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Vat D1 Form No No Download Needed Needed on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign Vat D1 Form No No Download Needed Needed Effortlessly

- Locate Vat D1 Form No No Download Needed Needed and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Vat D1 Form No No Download Needed Needed and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat d1 form no no download needed needed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a D1 form and who needs it?

The D1 form is a document utilized for various regulatory and compliance purposes in business transactions. Businesses, especially those in finance and logistics, often require a D1 form to ensure accurate record-keeping and compliance with industry standards.

-

How can airSlate SignNow help with creating a D1 form?

airSlate SignNow offers an intuitive platform that simplifies the process of creating and signing a D1 form. Our easy-to-use tools allow you to customize your D1 form, making it quick and efficient to gather the necessary approvals from stakeholders.

-

What are the pricing options for using airSlate SignNow to manage D1 forms?

airSlate SignNow provides flexible pricing plans tailored to fit the needs of businesses managing D1 forms. We offer different tiers, ensuring that you only pay for the features you need, whether you're a small business or a larger enterprise.

-

Can I integrate airSlate SignNow with other software for managing D1 forms?

Yes, airSlate SignNow seamlessly integrates with various software solutions, allowing you to efficiently manage your D1 forms. Connect with popular tools like CRM systems and project management software to streamline your document workflow.

-

What features does airSlate SignNow offer for D1 forms?

airSlate SignNow provides robust features for managing D1 forms, including eSignatures, templates, and document tracking. These features help ensure that your D1 forms are signed and stored securely, reducing turnaround times and improving efficiency.

-

How does airSlate SignNow ensure the security of my D1 forms?

airSlate SignNow prioritizes the security of your D1 forms by utilizing advanced encryption and authentication measures. Our platform adheres to strict compliance standards, ensuring that your documents are protected throughout the signing process.

-

Is it easy to share D1 forms with clients using airSlate SignNow?

Absolutely! Sharing D1 forms with clients through airSlate SignNow is straightforward. You can send documents via email or share a link, making it easy for clients to review and sign, enhancing your collaboration efforts.

Get more for Vat D1 Form No No Download Needed Needed

- Amendment of residential lease ohio form

- Agreement for payment of unpaid rent ohio form

- Ohio assignment 497322402 form

- Tenant consent to background and reference check ohio form

- Residential lease or rental agreement for month to month ohio form

- Residential rental lease agreement ohio form

- Tenant welcome letter ohio form

- Warning of default on commercial lease ohio form

Find out other Vat D1 Form No No Download Needed Needed

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation