W 8ben Rev December Form

What is the W-8BEN Rev December Form

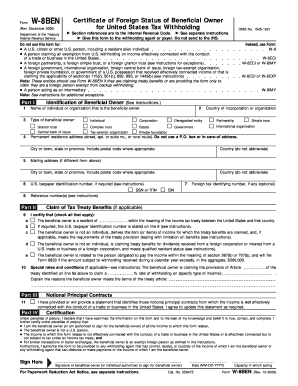

The W-8BEN Rev December Form is a tax document used by non-U.S. persons to certify their foreign status and claim beneficial ownership of income. This form is essential for individuals and entities receiving income from U.S. sources, such as dividends, interest, and royalties. By submitting the W-8BEN, foreign taxpayers can reduce or eliminate the withholding tax on certain types of income, as stipulated by tax treaties between the United States and their home countries. This form is particularly important for non-resident aliens and foreign entities engaged in business with U.S. companies.

How to Obtain the W-8BEN Rev December Form

To obtain the W-8BEN Rev December Form, individuals can visit the official IRS website, where the form is available for download in PDF format. It is crucial to ensure that you are using the most recent version of the form to comply with current regulations. Additionally, many financial institutions and tax professionals may provide copies of the form or assist in its completion. Always verify that you have the latest version before filling it out to avoid any compliance issues.

Steps to Complete the W-8BEN Rev December Form

Completing the W-8BEN Rev December Form involves several key steps:

- Part I: Identification of Beneficial Owner - Provide your name, country of citizenship, and address. This section identifies you as the beneficial owner of the income.

- Part II: Claim of Tax Treaty Benefits - Indicate your eligibility for tax treaty benefits by providing the necessary information regarding your country and the specific treaty provisions.

- Part III: Certification - Sign and date the form to certify that the information provided is accurate and that you are not a U.S. person.

Ensure that all information is complete and accurate to prevent delays in processing or issues with withholding tax.

Legal Use of the W-8BEN Rev December Form

The W-8BEN Rev December Form serves as a legal document that certifies the foreign status of the individual or entity completing it. By accurately completing and submitting this form, non-U.S. persons can claim benefits under applicable tax treaties, which may reduce the withholding tax rates on U.S. source income. It is important to maintain compliance with IRS regulations when using this form, as improper use can lead to penalties or increased tax liabilities.

Key Elements of the W-8BEN Rev December Form

Several key elements are essential to the W-8BEN Rev December Form:

- Identification Information: This includes the name, address, and country of citizenship of the beneficial owner.

- Tax Treaty Claim: Information regarding eligibility for benefits under a tax treaty, including the specific treaty article being claimed.

- Certification: The signature and date affirming that the information provided is true and correct.

Understanding these elements is crucial for accurate completion and compliance with U.S. tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the W-8BEN Rev December Form vary depending on the type of income being received. Generally, the form should be submitted before the first payment is made to ensure that the correct withholding tax rate is applied. It is advisable to keep track of any updates from the IRS regarding deadlines, especially during tax season, to avoid any potential penalties or issues with tax compliance.

Quick guide on how to complete w 8ben rev december form

Effortlessly prepare W 8ben Rev December Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle W 8ben Rev December Form seamlessly on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and electronically sign W 8ben Rev December Form with ease

- Locate W 8ben Rev December Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal force as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign W 8ben Rev December Form and maintain excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 8ben rev december form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 8ben Rev December Form?

The W 8ben Rev December Form is a tax form used by foreign individuals to signNow their foreign status and claim tax treaty benefits. It helps ensure that foreign taxpayers are not subjected to unnecessary withholding tax rates. Understanding the W 8ben Rev December Form is crucial for compliance and optimal tax management.

-

How does airSlate SignNow support the completion of the W 8ben Rev December Form?

airSlate SignNow offers an intuitive platform that simplifies the process of filling out the W 8ben Rev December Form. With its user-friendly interface, you can quickly input your information, and the platform provides step-by-step guidance for proper completion. This support reduces errors and enhances overall efficiency.

-

Is the W 8ben Rev December Form free to use with airSlate SignNow?

While the W 8ben Rev December Form itself is a free document provided by the IRS, using airSlate SignNow for eSigning and document management involves a subscription fee. However, airSlate SignNow offers competitive pricing plans, ensuring you receive excellent value for the ability to manage all your documents securely and effectively.

-

What features does airSlate SignNow provide for managing the W 8ben Rev December Form?

airSlate SignNow includes features like customizable templates, eSigning, secure storage, and easy sharing, all tailored to help users effectively manage the W 8ben Rev December Form. Additionally, the platform allows you to track the status of your documents and ensures that they are compliant with legal standards.

-

Can I integrate airSlate SignNow with other software for handling the W 8ben Rev December Form?

Yes, airSlate SignNow provides integrations with various software solutions such as CRM systems, email platforms, and cloud storage services to streamline the handling of the W 8ben Rev December Form. These integrations help automate workflows and make document management more efficient for businesses of all sizes.

-

How does using airSlate SignNow enhance the security of the W 8ben Rev December Form?

airSlate SignNow prioritizes the security of your documents, including the W 8ben Rev December Form, with features like encryption, audit trails, and compliance with regulations such as GDPR and HIPAA. This commitment to security ensures that sensitive information remains protected throughout the signing and storage processes.

-

What are the benefits of eSigning the W 8ben Rev December Form with airSlate SignNow?

eSigning the W 8ben Rev December Form with airSlate SignNow provides several benefits, including faster processing times, enhanced security, and the convenience of signing from anywhere. This digital approach eliminates the need for physical paperwork, streamlining your workflow and ensuring that documents are completed quickly and efficiently.

Get more for W 8ben Rev December Form

Find out other W 8ben Rev December Form

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online