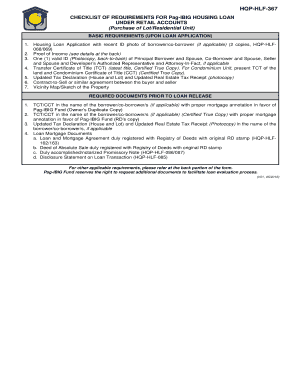

Checklist of Requirements for Pag Ibig Housing Loan Form

What is the checklist of requirements for pag ibig housing loan

The checklist of requirements for a pag ibig housing loan is a comprehensive list of documents and information needed to successfully apply for a housing loan through the Pag-IBIG Fund. This checklist ensures that applicants are prepared and have all necessary materials to facilitate the loan process. The requirements typically include:

- Completed Pag-IBIG housing loan application form

- Valid identification (government-issued ID)

- Proof of income (such as payslips, income tax return, or certificate of employment)

- Certificate of membership with Pag-IBIG

- Tax Identification Number (TIN)

- Proof of billing address

- Other documents as required based on the applicant's financial status

How to use the checklist of requirements for pag ibig housing loan

Using the checklist of requirements for a pag ibig housing loan involves a systematic approach to ensure all necessary documents are gathered and completed. Begin by reviewing the checklist thoroughly to understand each requirement. Next, collect the required documents, ensuring they are current and valid. It is helpful to organize them in a folder or digital format for easy access. As you gather each document, check it off the list to confirm you have everything needed before submitting your application.

Steps to complete the checklist of requirements for pag ibig housing loan

Completing the checklist for a pag ibig housing loan involves several key steps:

- Obtain the latest checklist of requirements from the Pag-IBIG Fund website or office.

- Fill out the Pag-IBIG housing loan application form accurately.

- Gather all necessary documents, such as valid IDs and proof of income.

- Ensure that all documents are properly signed and dated where required.

- Review the checklist to confirm that all items are complete before submission.

- Submit the completed application along with the checklist and supporting documents to the nearest Pag-IBIG office or through their online platform.

Required documents for the pag ibig housing loan

The required documents for a pag ibig housing loan are essential for verifying the applicant's identity and financial capability. Key documents typically include:

- Pag-IBIG housing loan application form

- Two valid IDs (government-issued)

- Proof of income, such as payslips or income tax returns

- Pag-IBIG membership certificate

- Tax Identification Number (TIN)

- Proof of billing address, like utility bills

Eligibility criteria for the pag ibig housing loan

Eligibility for a pag ibig housing loan is determined by several criteria set by the Pag-IBIG Fund. Generally, applicants must meet the following requirements:

- Must be a member of Pag-IBIG for at least 24 months.

- Must be at least 21 years old at the time of application.

- Must have a stable source of income.

- Must have a good credit history.

Application process and approval time for the pag ibig housing loan

The application process for a pag ibig housing loan involves submitting the completed checklist of requirements along with the application form and supporting documents. After submission, the Pag-IBIG Fund will review the application, which typically takes around five to ten working days for initial processing. If additional information is required, the applicant will be notified. Once approved, the loan amount will be disbursed according to the agreed terms.

Quick guide on how to complete checklist of requirements for pag ibig housing loan

Complete Checklist Of Requirements For Pag Ibig Housing Loan effortlessly on any gadget

Online document management has gained signNow traction among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can easily locate the correct form and store it securely online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without any holdups. Manage Checklist Of Requirements For Pag Ibig Housing Loan across any platform using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and electronically sign Checklist Of Requirements For Pag Ibig Housing Loan with ease

- Acquire Checklist Of Requirements For Pag Ibig Housing Loan and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure confidential information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Checklist Of Requirements For Pag Ibig Housing Loan to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the checklist of requirements for pag ibig housing loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pag ibig loan form and how is it used?

A pag ibig loan form is a document required when applying for a loan under the Pag-IBIG Fund. This form collects essential information about the borrower and the terms of the loan, allowing for a streamlined application process. By filling out this form accurately, applicants can ensure a smooth approval for their loan.

-

How can airSlate SignNow help in filling out a pag ibig loan form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your pag ibig loan form. With its intuitive interface, users can quickly fill out, review, and submit their forms without the hassle of printing and scanning. This not only saves time but also enhances efficiency throughout the loan application process.

-

What are the costs associated with using airSlate SignNow for pag ibig loan forms?

airSlate SignNow offers competitive pricing for its eSigning solutions, making it a cost-effective choice for handling pag ibig loan forms. The platform typically provides various subscription plans to fit different business needs, ensuring that you only pay for what you use while accessing premium features for your loan application processes.

-

Are there any integrations available for pag ibig loan form management?

Yes, airSlate SignNow integrates seamlessly with various applications that can enhance the management of your pag ibig loan form. This includes popular tools like Google Drive, Dropbox, and CRM systems, allowing users to easily store, share, and process forms within their preferred environments. These integrations streamline workflows and improve collaboration.

-

What are the benefits of using airSlate SignNow for pag ibig loan forms?

Using airSlate SignNow for pag ibig loan forms offers multiple benefits, including enhanced security for sensitive information, quicker turnaround times for document processing, and the convenience of signing documents anywhere, anytime. This flexibility helps clients and businesses expedite the loan approval process while maintaining compliance.

-

Is it safe to use airSlate SignNow for my pag ibig loan form?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to ensure that your pag ibig loan form and other documents are protected. With features like secure cloud storage and user authentication, you can confidently handle your sensitive information without worries.

-

Can I track the status of my pag ibig loan form when using airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities that allow you to monitor the status of your pag ibig loan form at every stage. You receive notifications when documents are opened, signed, or completed, which helps keep you informed and ensures that nothing falls through the cracks during the loan application process.

Get more for Checklist Of Requirements For Pag Ibig Housing Loan

- Dental screening form new beginnings schools foundation newbeginningsnola

- Doctor sheet form

- Gulf coast occ med medical authorization form

- Www coursehero comfile43954397dispute form pdf dispute form please complete the form in

- Ohio child medical statement form

- Ohio medicaid provider prior authorization request form

- West virginia berkeley county form

- Florida port st lucie form

Find out other Checklist Of Requirements For Pag Ibig Housing Loan

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate