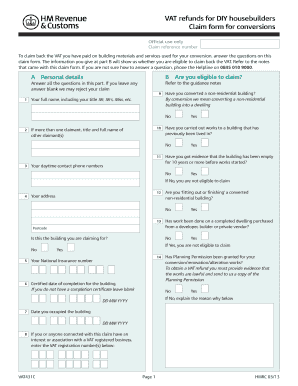

Vat431c 2022

What is the VAT431C?

The VAT431C is a specific form used for reporting value-added tax (VAT) obligations in the United States. This form is essential for businesses that are registered for VAT and need to report their sales and purchases accurately. It helps ensure compliance with state and federal tax regulations, allowing businesses to maintain proper records of their tax liabilities and transactions.

How to Use the VAT431C

Using the VAT431C involves several steps to ensure accurate reporting. First, gather all necessary documentation related to sales and purchases that are subject to VAT. Next, fill out the form with the required information, including total sales, total purchases, and any applicable tax rates. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. Proper use of the VAT431C can help avoid penalties and ensure compliance with tax laws.

Steps to Complete the VAT431C

Completing the VAT431C involves a systematic approach:

- Collect all relevant sales and purchase invoices.

- Determine the total sales and purchases that are subject to VAT.

- Fill in the VAT431C form with accurate figures.

- Double-check all entries for accuracy and completeness.

- Submit the completed form by the specified deadline.

Legal Use of the VAT431C

The VAT431C must be used in accordance with federal and state tax laws. Businesses are legally required to report their VAT obligations accurately. Failure to do so can result in penalties, fines, or legal action. It is crucial for businesses to understand the legal implications of using this form and to ensure that all information provided is truthful and complete.

Filing Deadlines / Important Dates

Timely filing of the VAT431C is critical to avoid penalties. The specific deadlines for submitting this form can vary by state and the type of business. Generally, businesses should be aware of quarterly or annual filing requirements. Keeping a calendar of important dates can help ensure compliance and prevent late submissions.

Required Documents

To complete the VAT431C, businesses must have several documents on hand, including:

- Sales invoices that detail taxable sales.

- Purchase invoices for items subject to VAT.

- Previous VAT returns for reference.

- Any correspondence with tax authorities regarding VAT matters.

Eligibility Criteria

Eligibility to file the VAT431C typically requires that a business is registered for VAT in its respective state. This includes meeting specific revenue thresholds and operational requirements. Understanding these criteria is essential for businesses to ensure they are compliant and eligible to file the form.

Create this form in 5 minutes or less

Find and fill out the correct vat431c

Create this form in 5 minutes!

How to create an eSignature for the vat431c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vat431c and how does it relate to airSlate SignNow?

Vat431c is a specific document type that can be efficiently managed using airSlate SignNow. Our platform allows users to easily create, send, and eSign vat431c documents, ensuring compliance and streamlining the process for businesses.

-

How much does airSlate SignNow cost for managing vat431c documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our plans are designed to provide cost-effective solutions for managing vat431c documents, with features that enhance productivity and reduce administrative burdens.

-

What features does airSlate SignNow offer for vat431c document management?

With airSlate SignNow, users can enjoy features such as customizable templates, secure eSigning, and real-time tracking for vat431c documents. These features help streamline workflows and ensure that all necessary steps are completed efficiently.

-

Can I integrate airSlate SignNow with other software for vat431c processing?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage vat431c documents alongside your existing tools. This flexibility enhances your workflow and ensures that all your document needs are met in one place.

-

What are the benefits of using airSlate SignNow for vat431c documents?

Using airSlate SignNow for vat431c documents provides numerous benefits, including increased efficiency, reduced processing time, and enhanced security. Our platform simplifies the eSigning process, allowing businesses to focus on their core operations.

-

Is airSlate SignNow user-friendly for handling vat431c documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage vat431c documents. Our intuitive interface ensures that users can quickly navigate the platform and complete their tasks without hassle.

-

How does airSlate SignNow ensure the security of vat431c documents?

airSlate SignNow prioritizes the security of your vat431c documents by implementing advanced encryption and compliance measures. Our platform adheres to industry standards, ensuring that your sensitive information remains protected throughout the signing process.

Get more for Vat431c

- Fa100 form

- Birth certificate form fill up

- Lloohttps support forms

- Small business identification questionnaire ds1152 form

- Lbbd voter registration form

- Personal injury intake form

- Getting affairs in order worksheet 216038046 form

- New york state department of labor division of safety and health license amp certification unit state office campus building 12 form

Find out other Vat431c

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement