Sa116a Form

What is the SA116A?

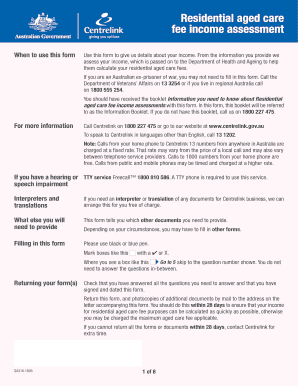

The SA116A form, also known as the Centrelink form SA116A, is a document used in Australia for reporting income and expenses related to business activities. This form is essential for individuals who are self-employed or running a business and need to provide accurate information to Centrelink for income support assessments. It helps determine eligibility for various benefits, ensuring that individuals receive the correct amount of support based on their financial situation.

How to Use the SA116A

Using the SA116A form involves several steps to ensure accurate completion. First, gather all necessary financial records, including income statements, receipts for expenses, and any other relevant documentation. Next, fill out the form by providing detailed information about your business income and expenses. It is important to be thorough and precise, as any discrepancies may affect your benefits. After completing the form, review it for accuracy before submission to ensure compliance with Centrelink requirements.

Steps to Complete the SA116A

Completing the SA116A form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, such as income statements and expense receipts.

- Fill in your personal details, including your name, address, and contact information.

- Report your business income, detailing all sources of income generated from your business activities.

- List your expenses, ensuring to categorize them accurately to reflect your business operations.

- Double-check all entries for accuracy and completeness.

- Submit the form to Centrelink through the preferred submission method.

Legal Use of the SA116A

The SA116A form must be filled out in accordance with legal guidelines to ensure its validity. It is crucial to provide truthful and accurate information, as any false statements can lead to penalties or loss of benefits. The form is legally binding, meaning that the information provided can be used in assessments by Centrelink and may be subject to audits. Understanding the legal implications of this form is essential for maintaining compliance and protecting your rights as a business owner.

Required Documents

When completing the SA116A form, several documents are necessary to support your claims. These include:

- Income statements from your business activities.

- Receipts for business-related expenses.

- Bank statements that reflect business transactions.

- Any additional documentation that verifies your income and expenses.

Having these documents ready will streamline the process and ensure that your submission is complete and accurate.

Form Submission Methods

The SA116A form can be submitted to Centrelink through various methods, including:

- Online submission via the Centrelink online account.

- Mailing a printed version of the form to the appropriate Centrelink office.

- In-person submission at a Centrelink service center.

Choosing the right submission method depends on your preferences and the resources available to you.

Quick guide on how to complete sa116a

Complete Sa116a seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files promptly without delays. Manage Sa116a on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign Sa116a effortlessly

- Find Sa116a and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for such purposes.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document-related needs in just a few clicks from any device you choose. Modify and eSign Sa116a and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sa116a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sa116a feature in airSlate SignNow?

The sa116a feature in airSlate SignNow allows users to streamline document signing processes through efficient eSignature capabilities. This feature ensures that documents are signed securely and quickly, enhancing operational efficiency. By utilizing sa116a, businesses can reduce turnaround times and increase productivity.

-

How much does the sa116a feature cost?

Pricing for the sa116a feature in airSlate SignNow varies based on the subscription plan chosen. We offer flexible pricing options that cater to businesses of all sizes, ensuring you pay only for what you need. Check our website for detailed pricing information and find the best plan that includes sa116a for your requirements.

-

Can I integrate sa116a with other applications?

Yes, airSlate SignNow, including its sa116a feature, can be integrated with various third-party applications such as CRM and document management systems. This integration capability enhances workflow efficiency by allowing seamless data sharing across platforms. Explore our integrations page for a list of compatible applications.

-

What are the benefits of using the sa116a feature?

The sa116a feature offers numerous benefits, including enhanced security, improved user experience, and reduced document processing time. By implementing sa116a in airSlate SignNow, businesses can ensure compliance while simplifying the eSigning process for all users. This leads to higher satisfaction rates among clients and employees alike.

-

Is the sa116a feature suitable for small businesses?

Absolutely! The sa116a feature in airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and competitive pricing make it an ideal choice for small teams looking to enhance their document signing capabilities.

-

What types of documents can I sign using sa116a?

With sa116a, you can sign a variety of documents, including contracts, agreements, and invoices. airSlate SignNow supports multiple document formats, ensuring you can handle any paperwork efficiently. This versatility allows businesses to manage all their signing needs in one easy-to-use platform.

-

How secure is the sa116a feature?

The sa116a feature in airSlate SignNow employs advanced security measures, including encryption and multi-factor authentication, to ensure your documents are safe. Compliance with industry standards is maintained, so you can trust that your sensitive information is protected. The robust security framework makes sa116a a reliable choice for businesses.

Get more for Sa116a

Find out other Sa116a

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online