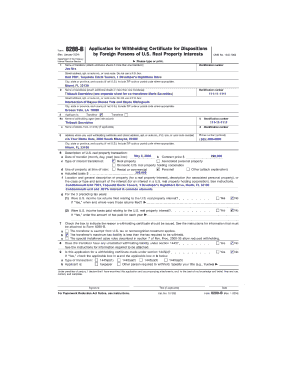

Form 8288 Example

What is the Form 8288 Example

The Form 8288 is a tax document used by the Internal Revenue Service (IRS) to report the sale or transfer of U.S. real property interests by foreign persons. This form is essential for ensuring compliance with U.S. tax laws regarding withholding taxes on such transactions. The form requires specific information about the seller, the property, and the transaction itself. Understanding the purpose of Form 8288 is crucial for both buyers and sellers involved in real estate transactions where foreign ownership is a factor.

Steps to Complete the Form 8288 Example

Completing the Form 8288 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the seller's details, property description, and transaction specifics. Next, fill out the form, ensuring that all sections are completed accurately. Pay special attention to the withholding amount, as this is a critical aspect of the form. After completing the form, review it for any errors or omissions before submission. Finally, submit the form to the IRS along with any required payments.

Legal Use of the Form 8288 Example

The legal use of Form 8288 is governed by IRS regulations that mandate its completion for certain real estate transactions involving foreign sellers. This form serves as a mechanism for the IRS to collect withholding taxes on the proceeds from the sale of U.S. real property interests. Properly completing and submitting this form helps ensure compliance with U.S. tax laws, thereby avoiding potential penalties or legal issues. It is essential for all parties involved in the transaction to understand their responsibilities regarding this form.

Filing Deadlines / Important Dates

Filing deadlines for Form 8288 are critical to avoid penalties. Generally, the form must be submitted to the IRS within twenty days of the sale or transfer of the property. It is important to note that this timeline is strict, and any delays can result in significant penalties for the withholding agent. Keeping track of these deadlines is essential for compliance and to ensure that all parties meet their tax obligations in a timely manner.

Required Documents

When completing Form 8288, several documents are typically required to support the information provided on the form. These may include a copy of the sales contract, proof of the seller's foreign status, and any relevant documentation regarding the property being sold. Having these documents readily available can facilitate the completion of the form and ensure that all necessary information is accurately reported to the IRS.

Form Submission Methods

Form 8288 can be submitted to the IRS through various methods. The most common methods include electronic submission via approved e-filing systems or mailing a paper copy to the appropriate IRS address. It is important to choose the method that best suits your needs and to ensure that the submission is completed within the required time frame. Each submission method may have different processing times, so planning ahead is advisable.

Quick guide on how to complete form 8288 example

Complete Form 8288 Example effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, adjust, and eSign your documents quickly without any delays. Handle Form 8288 Example on any platform with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The simplest way to modify and eSign Form 8288 Example with ease

- Obtain Form 8288 Example and click on Get Form to begin.

- Employ the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from a device of your choice. Edit and eSign Form 8288 Example and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8288 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 8288 example and why is it important?

A form 8288 example illustrates the U.S. tax withholding requirements for foreign sellers of U.S. real estate. Understanding this form is crucial for ensuring compliance with tax laws and avoiding penalties. Using a clear form 8288 example can simplify the filing process for both individuals and businesses.

-

How can airSlate SignNow help with form 8288 example submissions?

airSlate SignNow offers a streamlined platform for securely signing and sending documents, including your form 8288 example. With features like template creation and easy sharing, the platform simplifies the submission process. This ensures that your tax documentation is handled efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for form 8288 example transactions?

Yes, airSlate SignNow operates on a subscription model that offers various pricing plans. Depending on your needs, you can select a plan that fits your budget while having full access to features that simplify form 8288 example processes. There are options for try-outs or monthly subscriptions, making it flexible for all users.

-

Can I customize a form 8288 example using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your form 8288 example with pre-built templates and branded designs. This feature enables you to tailor the documents to fit your business style or specific requirements, enhancing the professional appearance of your submissions.

-

What integrations does airSlate SignNow offer for handling form 8288 examples?

airSlate SignNow integrates seamlessly with various platforms like Salesforce, Google Drive, and Microsoft Teams. These integrations make it easy for businesses to manage their form 8288 example documentation within the tools they already use. This creates a more efficient workflow and saves valuable time in document management.

-

How secure is the submission of form 8288 example through airSlate SignNow?

Security is a top priority for airSlate SignNow. All documents, including your form 8288 example, are encrypted and comply with industry standards to ensure confidentiality and data protection. This gives users peace of mind that their sensitive information is safe while being electronically signed and submitted.

-

What are the benefits of using airSlate SignNow for form 8288 examples?

Using airSlate SignNow for your form 8288 example provides numerous benefits, including increased efficiency and reduced processing time. The platform offers automated workflows that streamline document handling. Additionally, the ability to track document status in real-time enhances transparency throughout the signing process.

Get more for Form 8288 Example

- Franco collins form

- Kebs stickers application form

- Mad minute multiplication pdf form

- Building dna gizmo assessment answers form

- Illinois warranty deed form

- Oregon subpoena pdf form

- Good standing certificateinstructions to candidat form

- Application for liquor license retail nebraska liquor control lcc ne form

Find out other Form 8288 Example

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed