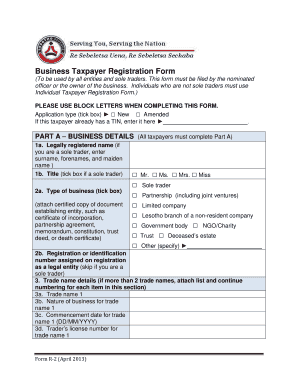

Business Taxpayer Registration Form Lesotho Revenue Authority

What is the Business Taxpayer Registration Form?

The Business Taxpayer Registration Form is a crucial document used by businesses in the United States to register for tax purposes. This form collects essential information about the business, including its legal name, address, and type of business entity. Completing this form is often a prerequisite for obtaining a business registration number, which is necessary for compliance with federal, state, and local tax regulations. Understanding the purpose and requirements of this form is vital for any business owner to ensure proper tax reporting and compliance.

Key Elements of the Business Taxpayer Registration Form

Several key elements are essential when filling out the Business Taxpayer Registration Form. These include:

- Business Name: The official name under which the business operates.

- Business Address: The physical location of the business.

- Employer Identification Number (EIN): A unique number assigned by the IRS for tax purposes.

- Type of Business Entity: Indicating whether the business is a sole proprietorship, partnership, corporation, or LLC.

- Owner Information: Details about the business owner(s), including their names and contact information.

Accurate completion of these elements is crucial for the successful processing of the form and for establishing the business's legal standing.

Steps to Complete the Business Taxpayer Registration Form

Completing the Business Taxpayer Registration Form involves several straightforward steps:

- Gather Required Information: Collect all necessary details about the business, including ownership structure and contact information.

- Access the Form: Obtain the latest version of the Business Taxpayer Registration Form from the appropriate tax authority.

- Fill Out the Form: Carefully enter all required information, ensuring accuracy and completeness.

- Review the Form: Double-check all entries for errors or omissions before submission.

- Submit the Form: Follow the specified submission method, whether online, by mail, or in person, as required by the tax authority.

By following these steps, businesses can ensure that their registration is processed smoothly and efficiently.

Required Documents for Submission

When submitting the Business Taxpayer Registration Form, certain documents may be required to support the application. These typically include:

- Proof of Identity: Such as a driver's license or state ID for the business owner.

- Business Formation Documents: Articles of incorporation, partnership agreements, or other relevant legal documents.

- Tax Identification Number: If applicable, provide the EIN or Social Security number of the business owner.

Having these documents ready can expedite the registration process and help avoid delays.

Penalties for Non-Compliance

Failure to complete and submit the Business Taxpayer Registration Form can lead to various penalties. Businesses may face:

- Fines: Monetary penalties imposed by tax authorities for late or non-filing.

- Legal Action: Potential legal consequences if the business operates without proper registration.

- Loss of Business Licenses: In some jurisdictions, non-compliance can result in the revocation of business licenses.

Understanding these penalties emphasizes the importance of timely and accurate registration to maintain compliance with tax laws.

Digital vs. Paper Version of the Form

The Business Taxpayer Registration Form is available in both digital and paper formats. The digital version offers several advantages, including:

- Convenience: Easily accessible online, allowing for quick completion and submission.

- Efficiency: Reduces processing time compared to mailing a paper form.

- Tracking: Digital submissions often provide confirmation and tracking capabilities.

While the paper version is still available, opting for the digital format can streamline the registration process and enhance overall efficiency.

Quick guide on how to complete business taxpayer registration form lesotho revenue authority

Complete Business Taxpayer Registration Form Lesotho Revenue Authority effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Business Taxpayer Registration Form Lesotho Revenue Authority on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to alter and eSign Business Taxpayer Registration Form Lesotho Revenue Authority with ease

- Find Business Taxpayer Registration Form Lesotho Revenue Authority and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

No more worries about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Business Taxpayer Registration Form Lesotho Revenue Authority and maintain excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business taxpayer registration form lesotho revenue authority

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business taxpayer registration form?

A business taxpayer registration form is an essential document that allows businesses to register with tax authorities. It typically collects information necessary for identifying the business and its tax obligations. Properly filling out this form is crucial to ensure compliance with tax regulations.

-

How can airSlate SignNow help with the business taxpayer registration form?

airSlate SignNow provides a seamless platform for businesses to create, send, and eSign their business taxpayer registration forms. Our easy-to-use interface simplifies the preparation of this important document while ensuring all necessary legal signatures are captured securely. This helps streamline your registration process.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs, starting with a free trial. Pricing includes features that cater to the management of business taxpayer registration forms and other essential documents. For detailed pricing information, visit our website or contact our sales team.

-

What features does airSlate SignNow offer for managing documents?

airSlate SignNow offers numerous features, including document templates, eSigning, and secure cloud storage. These tools specifically enhance the efficiency of handling business taxpayer registration forms and other administrative tasks. With user-friendly tools, collaboration becomes effortless and organized.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with various applications, such as CRM systems and cloud storage services. This allows businesses to automate workflows related to their business taxpayer registration forms and keep all documents in one place. Integrations enhance productivity and document accessibility.

-

Is airSlate SignNow safe for storing sensitive documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, including business taxpayer registration forms. We utilize advanced encryption protocols and comply with industry regulations to protect your data. Your sensitive information is secure as you eSign and manage documents on our platform.

-

How long does it take to complete a business taxpayer registration form using airSlate SignNow?

Using airSlate SignNow signNowly reduces the time needed to complete a business taxpayer registration form. Features like pre-filled templates and easy eSigning can help you finish the document in just a few minutes. This efficiency streamlines your registration and gets your business up and running faster.

Get more for Business Taxpayer Registration Form Lesotho Revenue Authority

- Tr 25 form

- Office supply list pdf form

- Mudra loan details malayalam form

- Compumed panel clinic form

- Auto repair shop standard operating procedures template form

- Oxford primary social studies 4 pdf download form

- Dittt formulaires

- Psc04 change of details of individual person with significant control you may use this form to change the details of an

Find out other Business Taxpayer Registration Form Lesotho Revenue Authority

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation