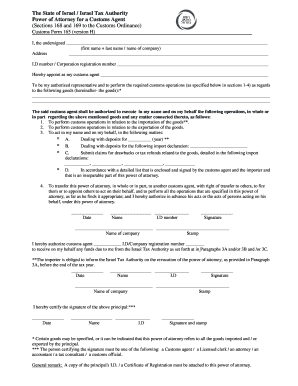

The State of Israel Israel Tax Authority Form

What is the State of Israel Israel Tax Authority

The State of Israel Israel Tax Authority is the government agency responsible for tax collection and enforcement in Israel. It oversees the implementation of tax laws, ensuring compliance and facilitating the collection of various taxes, including income tax, value-added tax (VAT), and property tax. The authority plays a crucial role in maintaining the country's economic stability by ensuring that all taxpayers fulfill their obligations.

How to use the State of Israel Israel Tax Authority

Utilizing the State of Israel Israel Tax Authority involves understanding the various services and resources it offers. Taxpayers can access information regarding tax regulations, filing procedures, and payment methods through their official website. Additionally, the authority provides online services for submitting tax returns and making payments, streamlining the process for individuals and businesses alike.

Steps to complete the State of Israel Israel Tax Authority

Completing the State of Israel Israel Tax Authority form requires several key steps. First, gather all necessary documentation, including income statements and identification. Next, access the online platform of the tax authority to fill out the required forms. Ensure all information is accurate and complete before submitting the form electronically. After submission, keep a copy for your records and monitor for any correspondence from the authority regarding your tax status.

Legal use of the State of Israel Israel Tax Authority

The legal use of the State of Israel Israel Tax Authority form is governed by specific regulations that ensure compliance with tax laws. To be considered valid, the form must be filled out truthfully and submitted within the designated deadlines. Failure to comply with these regulations can result in penalties or legal repercussions. It is essential for taxpayers to understand their rights and responsibilities when interacting with the tax authority.

Required Documents

When preparing to submit the State of Israel Israel Tax Authority form, certain documents are required. These typically include proof of income, identification documents, and any relevant tax deductions or credits. Having these documents ready can facilitate a smoother filing process and help ensure that all necessary information is provided to the tax authority.

Form Submission Methods

The State of Israel Israel Tax Authority offers various methods for form submission. Taxpayers can submit their forms online through the authority’s official website, which is the most efficient method. Alternatively, forms can be submitted by mail or in person at designated tax offices. Each method has its own guidelines and processing times, so it is important to choose the one that best suits the taxpayer's needs.

Penalties for Non-Compliance

Non-compliance with the State of Israel Israel Tax Authority regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to stay informed about their obligations and ensure timely and accurate submissions to avoid these consequences. Understanding the implications of non-compliance can help individuals and businesses maintain good standing with the tax authority.

Quick guide on how to complete the state of israel israel tax authority

Finish The State Of Israel Israel Tax Authority effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without holdups. Handle The State Of Israel Israel Tax Authority on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to alter and eSign The State Of Israel Israel Tax Authority without hassle

- Find The State Of Israel Israel Tax Authority and click on Get Form to initiate.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Alter and eSign The State Of Israel Israel Tax Authority and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the state of israel israel tax authority

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow, and how does it relate to The State Of Israel Israel Tax Authority?

airSlate SignNow is an eSignature solution that enables businesses to send and sign documents electronically. Utilizing this platform can help streamline interactions with The State Of Israel Israel Tax Authority by ensuring that all document submissions are timely and securely signed.

-

How can airSlate SignNow assist with compliance regarding The State Of Israel Israel Tax Authority?

Using airSlate SignNow can help businesses maintain compliance with various regulations enforced by The State Of Israel Israel Tax Authority. The platform offers features like audit trails and certified timestamps, ensuring that all eSigned documents are legally binding and compliant.

-

Is airSlate SignNow a cost-effective solution for businesses dealing with The State Of Israel Israel Tax Authority?

Yes, airSlate SignNow offers flexible pricing plans designed for businesses of all sizes, making it a cost-effective solution for managing documents related to The State Of Israel Israel Tax Authority. This enables companies to save on administrative costs while ensuring compliance.

-

What features does airSlate SignNow offer that are beneficial for The State Of Israel Israel Tax Authority interactions?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and automated workflows, making it easier to handle documents required by The State Of Israel Israel Tax Authority. These features enhance efficiency and reduce the time spent on paperwork.

-

Can airSlate SignNow integrate with other applications related to The State Of Israel Israel Tax Authority?

Absolutely! airSlate SignNow can integrate with various applications, including CRM and accounting software, simplifying the management of documents needed for The State Of Israel Israel Tax Authority. These integrations streamline processes and enhance productivity.

-

What are the benefits of using airSlate SignNow for interactions with The State Of Israel Israel Tax Authority?

The key benefits of using airSlate SignNow include increased efficiency, reduced errors, and enhanced security when dealing with The State Of Israel Israel Tax Authority. These advantages allow businesses to focus on core operations while ensuring compliance with regulations.

-

How secure is airSlate SignNow when managing documents for The State Of Israel Israel Tax Authority?

airSlate SignNow prioritizes security with features like data encryption and compliance with industry standards, ensuring that all documents related to The State Of Israel Israel Tax Authority are protected. This commitment to security instills confidence in the users.

Get more for The State Of Israel Israel Tax Authority

Find out other The State Of Israel Israel Tax Authority

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien