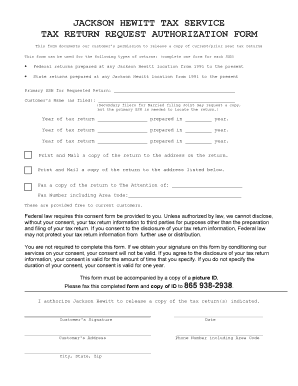

Jackson Hewitt Tax Service Tax Return Request Authorization Form

What is the Jackson Hewitt Tax Service Tax Return Request Authorization Form

The Jackson Hewitt Tax Service Tax Return Request Authorization Form is a crucial document that allows taxpayers to authorize Jackson Hewitt to request and obtain their tax return information from the IRS. This form is essential for individuals who wish to streamline their tax preparation process by enabling their tax preparer to access necessary documents directly. By signing this form, taxpayers grant Jackson Hewitt permission to act on their behalf, ensuring that all relevant tax data is gathered efficiently.

How to use the Jackson Hewitt Tax Service Tax Return Request Authorization Form

Using the Jackson Hewitt Tax Service Tax Return Request Authorization Form involves a few straightforward steps. First, you need to download the form from a reliable source. Once you have the form, fill in your personal information, including your name, Social Security number, and contact details. Next, provide the specific tax years for which you are granting authorization. Finally, sign and date the form to validate your request. After completing the form, submit it to Jackson Hewitt as instructed, either online or via mail.

Steps to complete the Jackson Hewitt Tax Service Tax Return Request Authorization Form

Completing the Jackson Hewitt Tax Service Tax Return Request Authorization Form requires careful attention to detail. Follow these steps to ensure accuracy:

- Download the form from a trusted source.

- Enter your full name and Social Security number in the designated fields.

- Specify the tax years you are authorizing Jackson Hewitt to access.

- Sign and date the form at the bottom to confirm your authorization.

- Submit the completed form to Jackson Hewitt, following their submission guidelines.

Legal use of the Jackson Hewitt Tax Service Tax Return Request Authorization Form

The Jackson Hewitt Tax Service Tax Return Request Authorization Form is legally binding once properly filled out and signed. It complies with IRS regulations, allowing Jackson Hewitt to request your tax information on your behalf. To ensure its legal validity, it is essential to provide accurate information and complete all required fields. Using a secure electronic signature platform can further enhance the form's legality, as it provides an audit trail and complies with eSignature laws.

Key elements of the Jackson Hewitt Tax Service Tax Return Request Authorization Form

Several key elements are essential for the Jackson Hewitt Tax Service Tax Return Request Authorization Form to be effective:

- Taxpayer Information: Full name, Social Security number, and contact details.

- Authorization Scope: Clearly defined tax years for which access is granted.

- Signature: The taxpayer's signature and date to validate the authorization.

- Submission Instructions: Guidance on how and where to submit the form.

Form Submission Methods

The Jackson Hewitt Tax Service Tax Return Request Authorization Form can be submitted through various methods, depending on your preference and Jackson Hewitt's guidelines. Common submission methods include:

- Online: Upload the completed form through Jackson Hewitt's secure portal.

- Mail: Send the signed form to the designated Jackson Hewitt office address.

- In-Person: Deliver the form directly to a local Jackson Hewitt office for processing.

Quick guide on how to complete jackson hewitt tax service tax return request authorization form

Complete Jackson Hewitt Tax Service Tax Return Request Authorization Form effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Jackson Hewitt Tax Service Tax Return Request Authorization Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Jackson Hewitt Tax Service Tax Return Request Authorization Form with ease

- Find Jackson Hewitt Tax Service Tax Return Request Authorization Form and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device you prefer. Edit and eSign Jackson Hewitt Tax Service Tax Return Request Authorization Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jackson hewitt tax service tax return request authorization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Jackson Hewitt Tax Service Tax Return Request Authorization Form?

The Jackson Hewitt Tax Service Tax Return Request Authorization Form is a document that allows Jackson Hewitt to obtain a copy of your prior tax returns from the IRS. This form is essential for clients who need to access past tax documents for various reasons, including loan applications and tax preparation.

-

How do I fill out the Jackson Hewitt Tax Service Tax Return Request Authorization Form?

Filling out the Jackson Hewitt Tax Service Tax Return Request Authorization Form is straightforward. You'll need to provide your personal information, such as your name, Social Security number, and the tax years for which you are requesting documents. Ensure that all information is current and accurately reflects your details to avoid delays.

-

Is there a fee for using the Jackson Hewitt Tax Service Tax Return Request Authorization Form?

Using the Jackson Hewitt Tax Service Tax Return Request Authorization Form itself does not typically incur a direct fee. However, some service charges may apply depending on the nature of your request or if you require additional services from Jackson Hewitt for your tax needs.

-

What are the benefits of using the Jackson Hewitt Tax Service Tax Return Request Authorization Form?

The primary benefit of the Jackson Hewitt Tax Service Tax Return Request Authorization Form is that it streamlines the process of obtaining past tax returns. This can save you time and effort, allowing you to focus on other important aspects of your financial planning and tax filing.

-

Can I submit the Jackson Hewitt Tax Service Tax Return Request Authorization Form online?

Yes, you can submit the Jackson Hewitt Tax Service Tax Return Request Authorization Form online through airSlate SignNow. Our platform allows you to eSign and send documents securely, making it a convenient option for accessing your tax records quickly.

-

How long does it take to process the Jackson Hewitt Tax Service Tax Return Request Authorization Form?

The processing time for the Jackson Hewitt Tax Service Tax Return Request Authorization Form can vary based on several factors. Generally, if the form is submitted correctly and all required information is provided, you can expect to receive your tax documents within a few weeks.

-

What should I do if I have questions about the Jackson Hewitt Tax Service Tax Return Request Authorization Form?

If you have questions regarding the Jackson Hewitt Tax Service Tax Return Request Authorization Form, it's best to contact Jackson Hewitt directly. Their customer service team can provide detailed guidance and assistance tailored to your specific concerns or needs.

Get more for Jackson Hewitt Tax Service Tax Return Request Authorization Form

Find out other Jackson Hewitt Tax Service Tax Return Request Authorization Form

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free