R 20128 Form

What is the R 20128

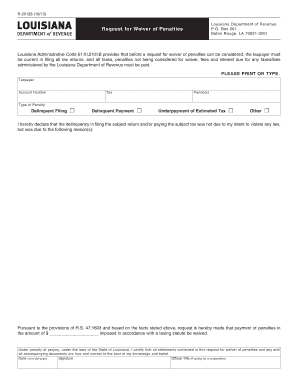

The R 20128 form is a specific document used in various administrative and legal contexts. It is essential for individuals and businesses to understand its purpose and requirements. This form typically serves to collect necessary information for compliance with regulatory standards or to fulfill specific obligations set forth by governing bodies. Understanding the R 20128 is crucial for ensuring that all required information is accurately provided.

How to use the R 20128

Using the R 20128 form involves several steps to ensure that it is completed correctly. First, gather all necessary information that the form requires. This may include personal identification details, financial information, or other relevant data. Next, carefully fill out the form, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors or omissions before submission. Utilizing digital tools can streamline this process, making it easier to fill out and sign the form securely.

Steps to complete the R 20128

Completing the R 20128 form requires a systematic approach. Follow these steps for successful completion:

- Gather Information: Collect all necessary documents and information needed to fill out the form.

- Fill Out the Form: Carefully enter the required information in each section of the form.

- Review: Double-check all entries for accuracy and completeness.

- Sign: Ensure that the form is signed appropriately, which may involve using a digital signature for electronic submissions.

- Submit: Choose your preferred method of submission, whether online, by mail, or in person.

Legal use of the R 20128

The R 20128 form holds legal significance and must be completed in accordance with applicable laws and regulations. To ensure its legal validity, the form must be filled out accurately, signed by the appropriate parties, and submitted within any specified deadlines. Compliance with legal requirements not only enhances the form's legitimacy but also protects the interests of all parties involved.

Key elements of the R 20128

Several key elements define the R 20128 form, making it essential for users to be aware of them. These elements typically include:

- Identification Information: Personal or business identification details that establish the identity of the filer.

- Financial Data: Relevant financial information that may be required for the purpose of the form.

- Signatures: Required signatures from all necessary parties to validate the document.

- Submission Details: Information regarding how and when the form should be submitted.

Form Submission Methods

Submitting the R 20128 form can be done through various methods, ensuring flexibility for users. Common submission methods include:

- Online Submission: Many users prefer to submit the form electronically, which can expedite processing times.

- Mail: Physical submission through the postal service is still a viable option for those who prefer traditional methods.

- In-Person: Some individuals may choose to deliver the form directly to the relevant office or agency.

Quick guide on how to complete r 20128

Complete R 20128 effortlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle R 20128 on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The most effective way to modify and eSign R 20128 effortlessly

- Locate R 20128 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign R 20128 to ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 20128

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to r 20128?

airSlate SignNow is a digital signature platform that allows businesses to send and eSign documents efficiently. The r 20128 aspect refers to a unique identifier for features or compliance that enhances productivity in document management. By implementing airSlate SignNow, users can ensure secure and legally binding signatures on their documents.

-

How much does airSlate SignNow cost for r 20128 features?

airSlate SignNow offers competitive pricing plans tailored to fit different business needs, including essential features for r 20128 compliance. The pricing depends on the scale of use, and businesses can opt for monthly or annual subscriptions to enjoy maximum savings. It's best to check the airSlate website for the most up-to-date pricing details.

-

What are the key features of airSlate SignNow related to r 20128?

The key features of airSlate SignNow that align with r 20128 include secure document storage, customizable workflows, and real-time tracking of signed documents. Additionally, user-friendly templates and mobile accessibility make it easy to manage documents on-the-go. These features streamline the signing process and enhance workflow efficiency.

-

Can airSlate SignNow help my business meet r 20128 compliance requirements?

Yes, airSlate SignNow is designed to aid businesses in meeting r 20128 compliance requirements by providing a secure platform for electronic signatures. With features like audit trails and secure encryption, businesses can ensure that their document handling adheres to legal standards. Adopting airSlate SignNow means you're taking steps towards compliance with ease.

-

What integrations does airSlate SignNow offer that support r 20128?

airSlate SignNow supports numerous integrations that facilitate document management processes related to r 20128. Popular tools include CRM systems, cloud storage solutions, and project management applications. These integrations allow businesses to streamline their operations and enhance productivity by centralizing document workflows.

-

Are there any benefits of using airSlate SignNow for r 20128 beyond eSigning?

Absolutely! In addition to the core eSigning capabilities, airSlate SignNow offers enhanced collaboration tools, the ability to create customizable templates, and options for automating workflows related to r 20128. These benefits result in time savings and increased efficiency for teams managing document processes.

-

Is airSlate SignNow user-friendly for individuals focusing on r 20128?

Yes, airSlate SignNow is designed with user experience in mind, making it accessible for individuals focusing on r 20128. The platform features an intuitive interface that requires minimal training to get started. Whether you're a small business owner or part of a larger organization, you can seamlessly navigate the system.

Get more for R 20128

Find out other R 20128

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement