4506 T Form

What is the 4506 T Form

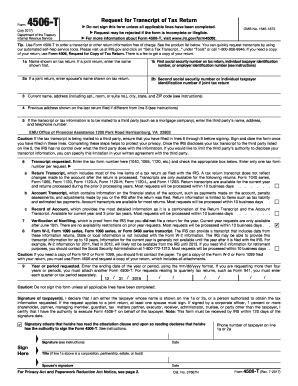

The 4506 T form, officially known as the Request for Transcript of Tax Return, is a document used by taxpayers in the United States to request a transcript of their tax return information from the Internal Revenue Service (IRS). This form is particularly useful for individuals who need to verify their income or tax filing status for various purposes, such as applying for loans, mortgages, or financial aid. The 4506 T form allows taxpayers to obtain a summary of their tax return information without having to request a full copy of their tax return, making it a streamlined option for accessing essential tax data.

How to use the 4506 T Form

To use the 4506 T form, taxpayers must first complete the form by providing their personal information, including name, Social Security number, and address. It is important to specify the type of transcript requested and the tax years needed. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on the options available. Taxpayers should ensure that they sign and date the form to validate their request. After submission, the IRS typically processes the request within five to ten business days, allowing taxpayers to receive their transcript efficiently.

Steps to complete the 4506 T Form

Completing the 4506 T form involves several key steps:

- Download the form: Obtain the latest version of the 4506 T form from the IRS website.

- Fill in personal details: Provide your name, Social Security number, and address accurately.

- Select transcript type: Indicate whether you need a tax return transcript, account transcript, or record of account.

- Specify tax years: Clearly state the tax years for which you are requesting the transcript.

- Sign and date: Ensure that you sign and date the form to authenticate your request.

- Submit the form: Send the completed form to the appropriate IRS address or submit electronically if applicable.

Legal use of the 4506 T Form

The 4506 T form is legally recognized as a valid request for tax return information under U.S. tax law. It is important for taxpayers to understand that the information obtained through this form can be used for various legal and financial purposes, such as verifying income for loan applications or compliance with financial regulations. The IRS maintains strict confidentiality regarding the information provided, ensuring that it is only shared with authorized parties. Proper use of the 4506 T form helps individuals maintain transparency in their financial dealings while adhering to legal requirements.

Who Issues the Form

The 4506 T form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement of tax laws. The IRS provides this form as a means for taxpayers to request their tax return transcripts, facilitating access to important tax information. By using the 4506 T form, taxpayers can efficiently obtain the necessary documentation required for various financial and legal processes, ensuring compliance with IRS regulations.

Required Documents

When submitting the 4506 T form, taxpayers should be aware of certain required documents to ensure a smooth processing experience. While the form itself does not require additional documents to be submitted, it is advisable to have the following information readily available:

- Identification: A valid Social Security number or Employer Identification Number (EIN).

- Tax information: Details of the tax years for which transcripts are requested.

- Signature: A handwritten signature is necessary to validate the request.

Having this information on hand can help expedite the process and ensure that the IRS can fulfill the request without delays.

Form Submission Methods

The 4506 T form can be submitted to the IRS through various methods, providing flexibility for taxpayers. The primary submission methods include:

- By Mail: Taxpayers can print the completed form and mail it to the appropriate IRS address indicated on the form.

- Electronically: Certain tax software programs and services may allow for electronic submission of the 4506 T form, streamlining the process.

Choosing the right submission method can help ensure timely processing of the request, allowing taxpayers to receive their transcripts efficiently.

Quick guide on how to complete 4506 t form

Prepare 4506 T Form effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Control 4506 T Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and electronically sign 4506 T Form without hassle

- Obtain 4506 T Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign 4506 T Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4506 t form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4506 T Form and why is it needed?

The 4506 T Form, also known as the Request for Transcript of Tax Return, is essential for obtaining tax information directly from the IRS. This form is often used by lenders and businesses to verify income during the loan application process. Understanding how to correctly fill out the 4506 T Form can streamline this verification and enhance your applications.

-

How does airSlate SignNow simplify the process of signing the 4506 T Form?

airSlate SignNow offers an intuitive platform to eSign the 4506 T Form quickly. With features like templates and automated workflows, sending and signing the form becomes more efficient. Additionally, users can ensure that their signature is legally binding and secure.

-

Are there any costs associated with using airSlate SignNow for the 4506 T Form?

airSlate SignNow provides various pricing plans tailored to meet different business needs. The costs for using the platform can vary, but they are generally cost-effective when considering the time saved on document management. You can choose a plan that best suits your requirements for handling the 4506 T Form and other documents.

-

Can I integrate airSlate SignNow with other software to manage the 4506 T Form?

Yes, airSlate SignNow offers seamless integrations with popular software like CRM systems and cloud storage solutions. This allows users to easily manage the 4506 T Form alongside other documents in their existing workflows. Streamlining your processes can enhance productivity and reduce the time spent managing forms.

-

What security features does airSlate SignNow offer for the 4506 T Form?

airSlate SignNow prioritizes document security, ensuring that your data, including the 4506 T Form, is protected. The platform uses advanced encryption and complies with industry standards to safeguard sensitive information. Users can trust that their signed documents are stored securely.

-

How quickly can I eSign the 4506 T Form using airSlate SignNow?

eSigning the 4506 T Form with airSlate SignNow is a quick process that can be completed in just a few minutes. The platform's user-friendly interface allows for fast navigation and signature placement. Once signed, the form can be sent off without delays, speeding up your overall process.

-

What are the benefits of using airSlate SignNow for my 4506 T Form?

Using airSlate SignNow for your 4506 T Form brings numerous benefits, including improved efficiency, reduced paperwork, and streamlined workflows. This platform eliminates the need for printing and physical signing, allowing for remote handling of documents. You can enhance collaboration within your team and simplify the submission processes.

Get more for 4506 T Form

Find out other 4506 T Form

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself